This week, we look at:

-

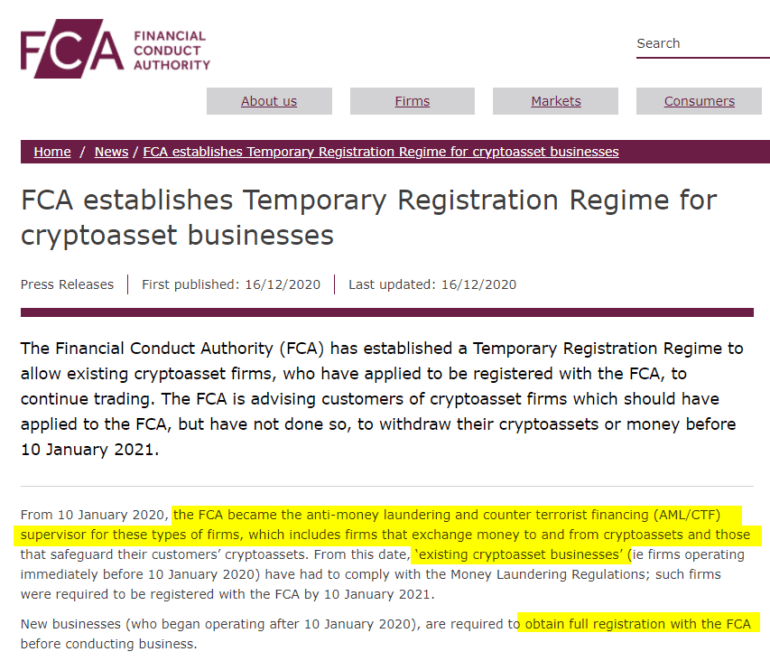

Proposed US regulation from FinCEN, legislation from the House of Representatives, and UK FCA registration requirements that would impact the crypto industry

-

The difference between competition for share within an established market, and competition between market paradigms (think MSFT vs. open source, finance vs. DeFi)

-

The crypto custodian moves from BBVA, Standard Charters, and Northern Trust

-

The bank license moves from Paxos and BitPay, as well as the planned launch of a new chain by Compound, in the context of the framework above

Permissionless finance is a paradigm breach. It pays no regard for the very nature of the incumbent financial market. Without banking, it creates its own banks. Without a sovereign, it bestows law on mathematics and consensus. Without broker/dealers, it creates decentralized robots. And so on. It tilts the world in such a way as to render the economic power of the incumbent financial market less important. Not powerless — the allure of institutional capital is a constant glimmer of greedy, opportunistic hope. But the hierarchy of traditional finance does not extend to DeFi, and thus has to be re-battled for the incumbent. This is cost, and annoying.