As ethereum's merge looms closer we asked the digital asset community what they felt about the shift from PoW to PoS.

Blockchain, in all its incomprehensible glory, is likely here to stay. After two years of mayhem, the most recent bull run, where does that leave the industry?

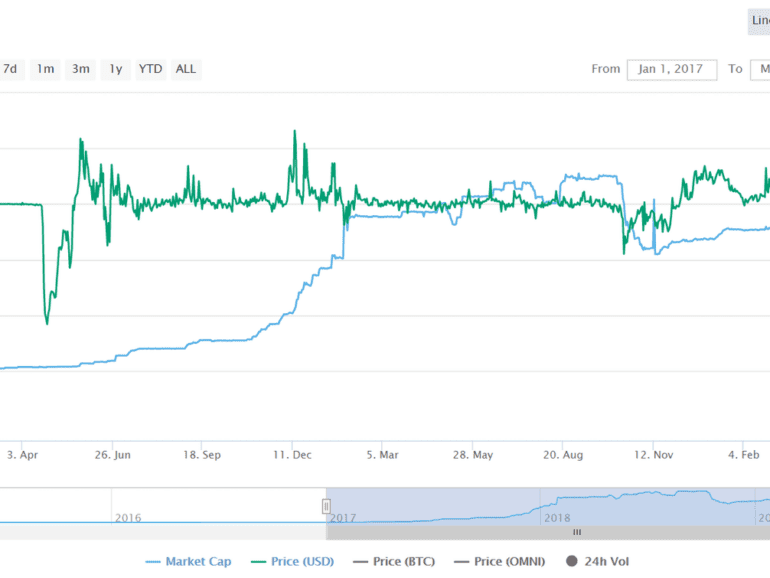

There is poetry in the symmetry of this situation. Bitfinex is looking to raise $1 billion in capital to support the most popular stablecoin Tether, which it controls. Facebook is reportedly looking to raise $1 billion in capital from First Data, Visa and Mastercard and other payments companies to shore up its own stablecoin asset. Poetry is where the similarities end, and all these devils are in the details.

Facebook announced last week that their digital payments platform, Novi, is nearly ready to launch across multiple states, having passed regulatory checks. Novi will use a stable cryptocurrency called Diem to launch payments across borders for the 2.7 billion users of the social network.

"We're aware that some people are having trouble accessing our apps and products," Facebook said in its first public comment on Twitter. "We're working to get things back to normal as quickly as possible, and we apologize for any inconvenience."

Silvergate, a US-based crypto bank that first partnered with the Facebook venture to create a stable coin last May, said in a release they paid $182 million for the operations infrastructure.

Cryptodecentralized financedigital lendingenterprise blockchainentrepreneurshipfixed incomeneobankroboadvisor

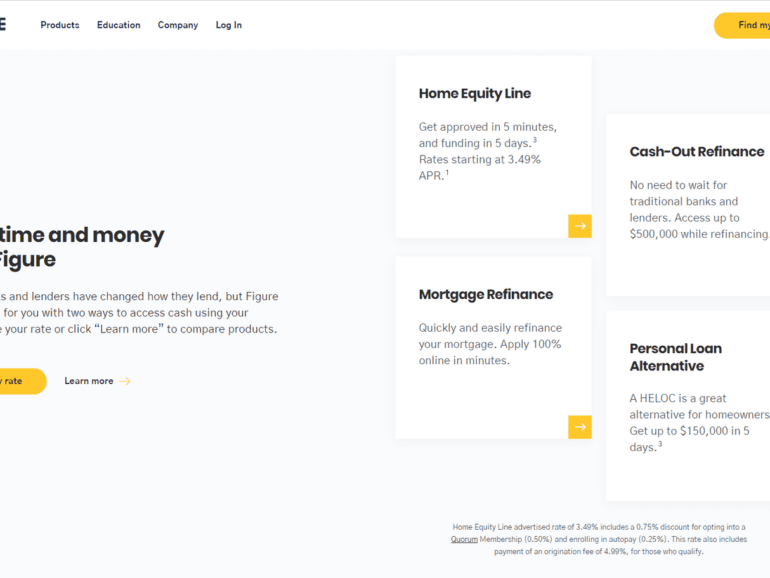

·Mike Cagney is the Co-Founder and CEO of Figure, a full stack financial services blockchain company with consumer offerings in market or on the way in lending, banking and more. In late-2019, Figure raised $103 million at a $1.2 billion valuation and continues to grow.

Prior to starting Figure, Mike co-founded and ran SoFi, one of the most successful consumer fintech companies ever.

In this conversation, we discuss Figure’s routes to asset origination and capital markets disruption, Figure’s previously unannounced consumer banking and payments offering, lessons learned building and scaling multiple billion dollar companies and more.

Companies face more pressure to detail the environmental footprints of their investments, thanks to regulations and the ESG trends.

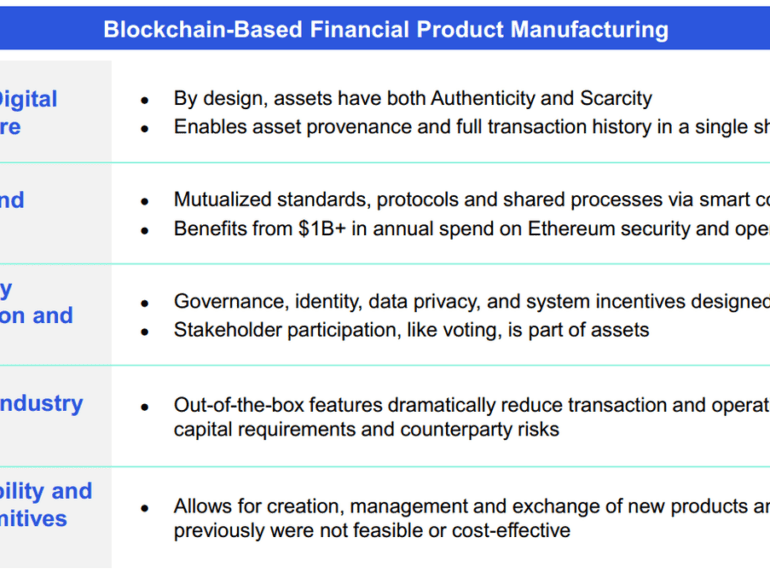

But nothing feels fundamentally different. Yes, we have some new brands that live on our phones. But when sliced across deposits, volume, or assets under management, the public companies still do the lion's share of the financial work. With open banking, incumbents are likely to win even more, powering Apple's credit card for example. The core reason for this, I think, is that Fintech has democratized access to existing financial products. It has not really changed how those products are manufactured. Only by transforming how things are made and the value chains to deliver them can you build the Google, Netflix, Spotify, or Uber of the next generation.

Financial arm of the major Brazilian retailer now facilitates cryptocurrency trading for millions of users of its digital wallet, MagaluPay.