Crypto investment maintains the potential for wealth creation, despite the recent downturn, what will it take to push the market further?

Powered by their $300-million fundraise over the summer, Fireblocks is looking to drive infrastructure efforts of digital banking and crypto companies as the industry is poised for explosive growth.

DAOs have recently gained traction as more blockchain-powered projects look to go fully decentralized at all levels.

Ethereum is shifting to PoS and some think it's a mistake. Flux believes it could be the successor in the PoW space.

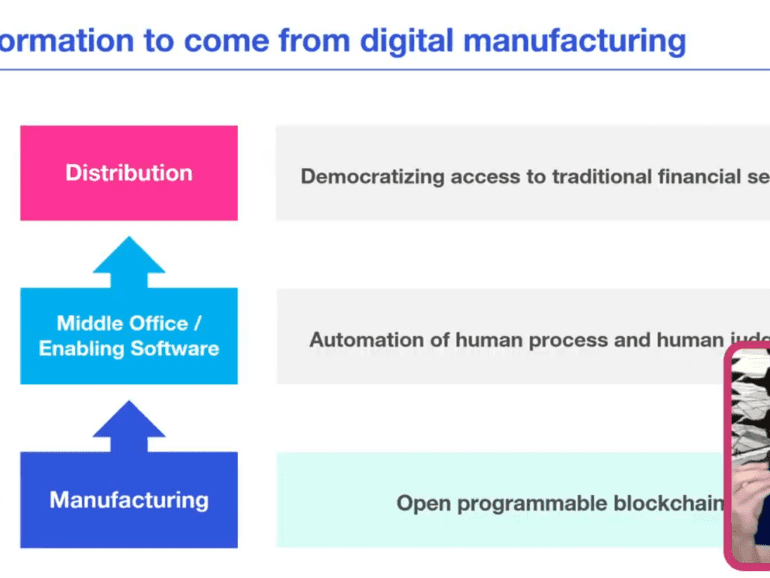

I presented earlier this week at the Ally Invest virtual conference, and the prompt asked for a description of what happens to finance from Fintech to Crypto / Blockchain to Augmented Reality / Virtual Worlds and finally to Artificial Intelligence.

Paradigm, a zero-fee liquidity network for crypto trading, launched one-click futures spread trading on FTX on Friday.

·

The FTX debacle continues- when you thought it was all over, things just get weirder.

Crypto exchange Genesis is seeking $1B handout after shutting down redemptions. Bloomberg reported that the firm might face bankruptcy.

This week, we look at:

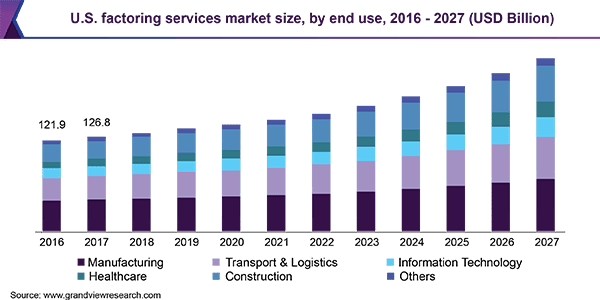

Pipe’s $150 million raise at a $2 billion valuation to turn annualized revenue run-rate into a new peer-to-peer asset class

BitClout’s $200 million of Bitcoin contributions and its mechanisms to turn social media profiles into digital assets

How both projects trade future performance for current monetization

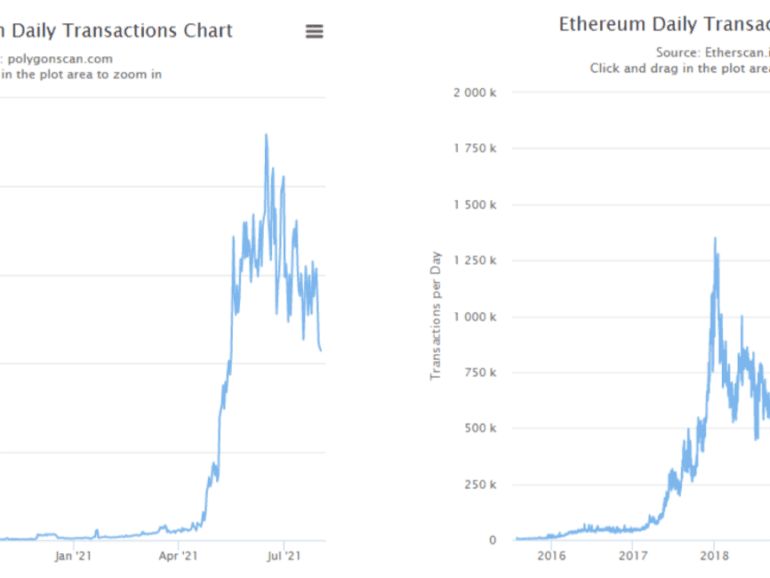

The macro and crypto economic thesis for 2021, building out the linkages between “Risk-On” assets, flows into and valuation of Bitcoin and Ethereum, and the interplay between value locked, the growth of decentralized application revenue, and the volumes around digital objects. We bring it all together.