Grayscale's appeal of the SEC's decision to deny their application for a Bitcoin ETF has been upheld. The industry is considering it a win.

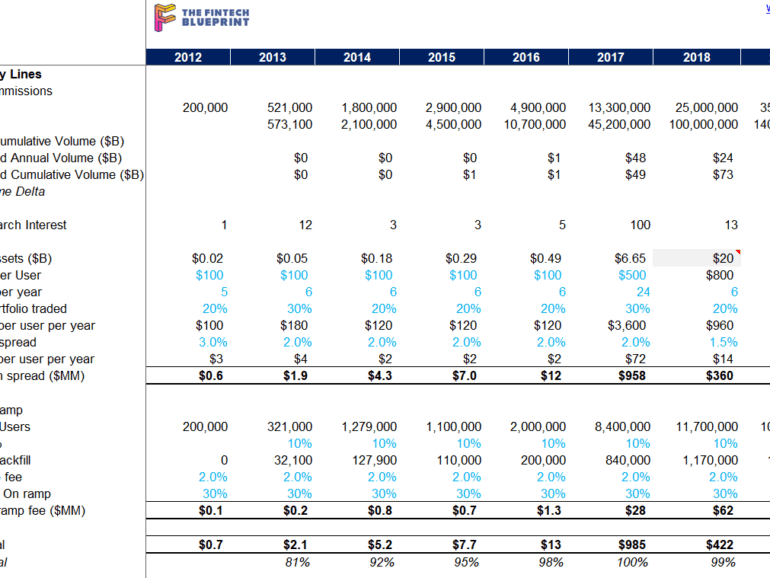

Being early on the scene and having a unique vision has helped GreenBox carve a solid niche for itself, with 2022 volume expected to surpass $3 billion.

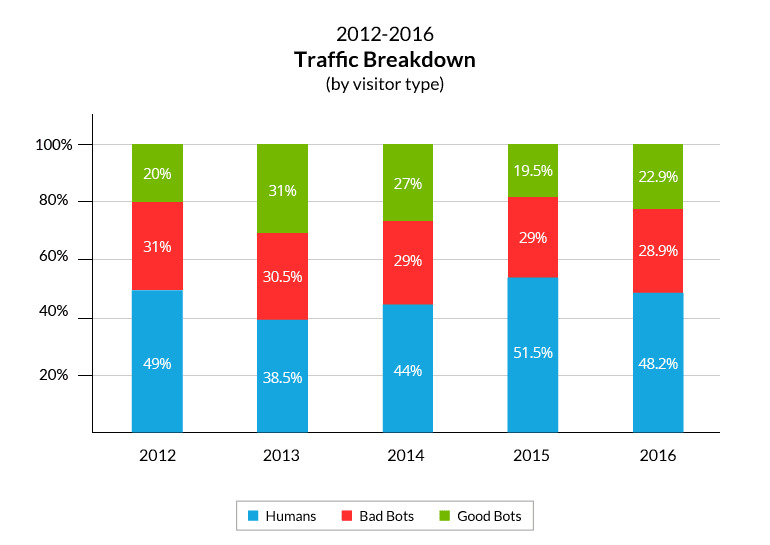

From an anti-money laundering perspective, organizations had significant increases in new customers and transactions over a short period.

Coinbase is going to go public.

The news hit Reuters, then Coindesk, and then the rest of the world. It feels like big news! The crypto broker is beating Robinhood, Acorns, Stash, Revolut, Betterment, and Wealthfront to the public markets. It's even beating SoFi, which is trying to get a national bank license (and who doesn't want to own a bank!).

Despite coverage highlighting the environmental issues of certain cryptocurrencies, the crypto sector may be unexpectedly ESG aligned.

Crypto companies that choose to engage with traditional financial institutions must address risk management and compliance expectations.

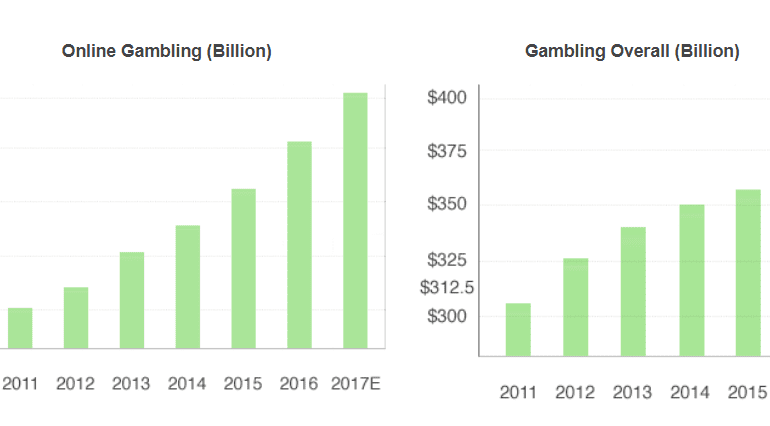

Looking into the statistics of gambling is illuminating and depressing. The UK, where gambling is more widely accepted than in the US, sees rates of 40-60% across all adults according to 2016 research. Revenues for casinos are over $100 billion annually, and global gambling revenues, including sports betting and the national lotteries, amount to over $400 billion. That's like the equivalent of the entire software cloud industry. And it asymmetrically addicts and disadvantages the already disadvantaged (see academic research here, here, and here).

·

This week, we look at:

How banks and financial advisors have failed to deliver on $1 trillion in capital appreciation for their clients over the last 12 years

The role of bank regulators in the United States, and the tensions between state and federal agencies

How the OCC is laying the groundwork for national banks to custody crypto assets, bank stablecoin reserves, run blockchain nodes, and use crypto payment networks

And instead of financial advisors or other CFAs guiding the retail market in good decision making, a newsfeed of *what’s popular* has driven Apple, Google, Tesla and the other John Galt hallucinations to the stratosphere. Don’t get us wrong. We love the robot as much as the next Fintech commentator. But it is clear to us that “the masses” are not being “advised”. And that the capital appreciation that matters — cementing the next trillion dollar networks for global future generations in work yet to emerge — is misunderstood and misrepresented by most financial professionals to their clients.

The Securities and Exchange Comission punted again on allowing a passive Bitcoin ETF to enter the market. It failed to approve the VanEck SolidX Bitcoin Trust, instead opting to open a commentary period to address several questions around Bitcoin price formation and the health of the exchanges. A similar outcome faces the Bitwise Bitcoin ETF. You can tell I am not a fan of this waffling, and there are two core reasons: (1) the years-long delay and uncertainty is responsible for financial damage to both traditional and crypto investors, and (2) the premise of the objections misunderstand the environment of the Internet and the way our world is shaping up in the 21st century.

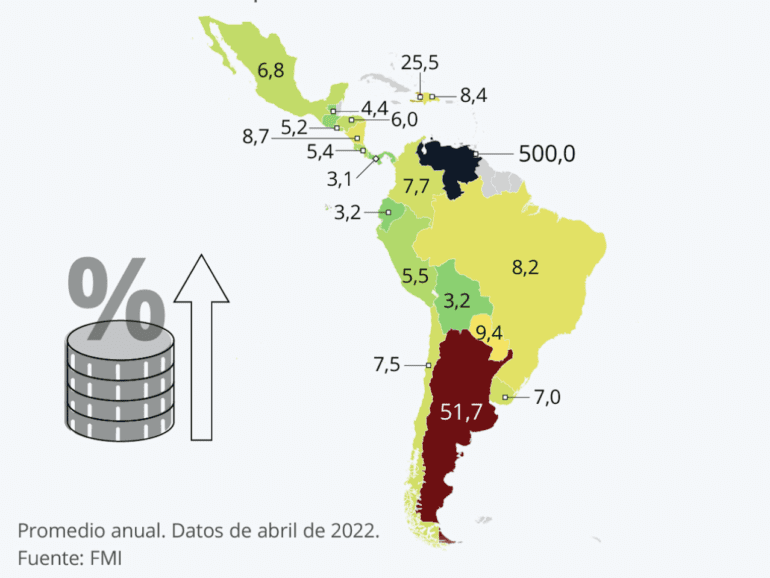

LatAm is seeing skyrocketing inflation and DeFi could mean survival for many citizens, but how can adoption be maximized?