According to Ripio executives, this partnership will allow users of both fintechs to buy and sell cryptocurrencies directly in their respective apps.

Tokenization has been set for some time to cause disruption but open finance incorporation may be key to realize its growth.

The world watched as seemingly invincible giants in the ecosystem crashed and burned — each one filing for bankruptcy and facing endless lawsuits that rage on.

Since the FTX meltdown, centralized exchanges in the DeFi space are rushing to publish PoRs, but without liability data, are they relevant?

Blockchain, in all its incomprehensible glory, is likely here to stay. After two years of mayhem, the most recent bull run, where does that leave the industry?

Nikola Plecas from Visa Europe and Nick Charteris from Crypto.com discuss how web3 payments will go mainstream at Merge in London on October 18, 2022

The crypto firm enables users to buy and sell crypto, earn credit rewards on their accounts, and send money peer-to-peer: it will open up the Mastercard network to the cryptocurrency world.

Intain team ran an audit of their platform, a blockchain structured finance ledger, and found $3.75 billion in assets live on the database.

DAOs have recently gained traction as more blockchain-powered projects look to go fully decentralized at all levels.

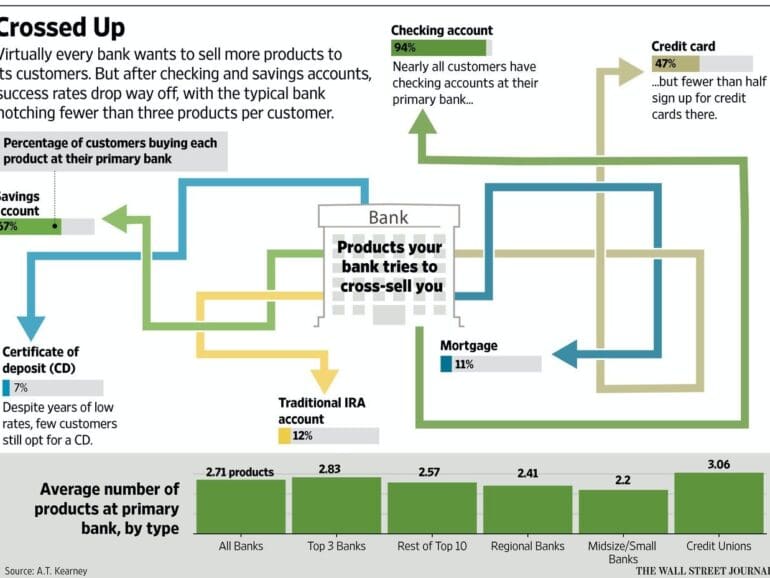

We focus on the law of unintended consequences, and how making rules often creates the opposite outcome from the desired results. The analysis starts with the Cobra effect, and then extends to a discussion of the Wells Fargo account scandal, dYdX trading farming, Divergence Ventures executing Sybil attacks, and Federal Reserve insider trading. We touch on the concepts of credit underwriting and token economies, and leave the reader with a question about rules vs. principles.