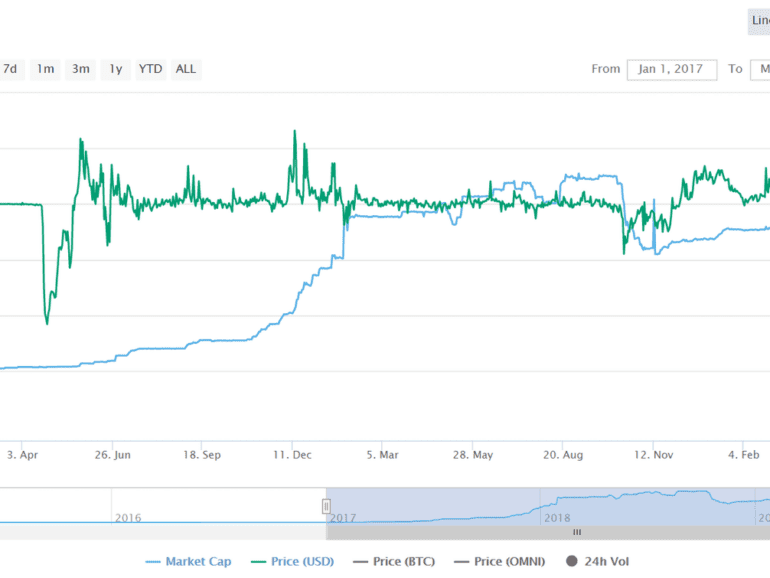

There is poetry in the symmetry of this situation. Bitfinex is looking to raise $1 billion in capital to support the most popular stablecoin Tether, which it controls. Facebook is reportedly looking to raise $1 billion in capital from First Data, Visa and Mastercard and other payments companies to shore up its own stablecoin asset. Poetry is where the similarities end, and all these devils are in the details.

Cryptocurrency regulation has been embedded into broader financial technology regulation or postponed in a "wait and see" approach.

Binance has announced a new $500 million lending facility to support struggling public and private bitcoin miners.

For more than a week, thousands of crypto devs and eth fanatics poured into Denver for the latest ETHDenver conference.

CFPB director Rohit Chopra lobbed a surprise grenade onto the expo floor Tuesday morning by announcing plans for an open banking rule.

In the aftermath of stablecoin disaster, the institutionalization of crypto assets hangs in the balance, regulatory supervision is key.

TradFi's adoption of DeFi infrastructure is ongoing, despite its negative press. Could this mean mainstream integration is close?

The law deals with various aspects of crypto assets, including their issuance and operations of tokenized financial products.

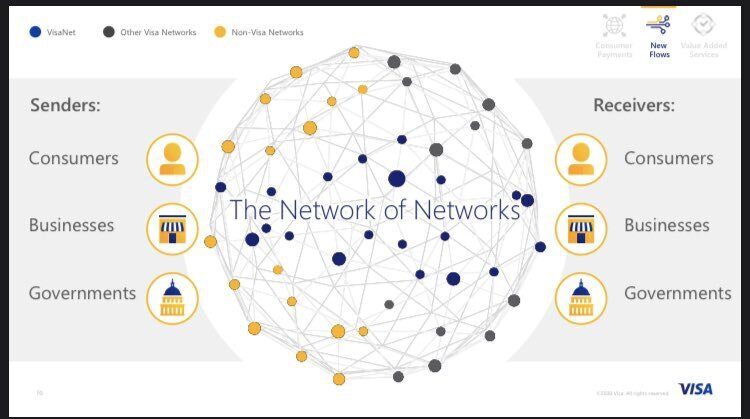

The principle behind Mastercard’s CipherTrace acquisition, L1 growth, and IRS getting your bank data

Paying attention is the path to seeing and doing. Mastercard has bought CipherTrace to see blockchain-based finance, to launch new businesses, and to plug in more networks into its nexus. The crypto networks proliferate at every layer, creating more computation on Ethereum, Polygon, Arbitrum, Optimism, Fantom, and Solana. The US executive seeks to see more too, asking the banks for their records of financial transactions to enforce taxation compliance.

Knowing how technologies work and the paths typical payments take has helped MyChargeBack develop an effective system to protect participants.