Wall Street backed EDX Markets launched two weeks ago making a critical shift in TradFi's approach to crypto. Will this change DeFi?

The Bank of International Settlements sees tokenization in our future. Crypto, on the other hand, may not be.

The MiCA Bill was passed in April, bringing with it a possible end to the lack of clarity in European crypto but it's not all plain sailing.

Real-world asset tokenization was set to be a multi-trillion dollar market by 2030. It's still on track despite FTX setbacks.

The SEC's filing against Coinbase was expected, but might be the beginning of the end to their years of crypto regulation avoidance.

In the SEC's suit against Binance, the regulator goes far beyond the "unregistered securities" take - but still lack the community's trust.

TradFi's adoption of DeFi infrastructure is ongoing, despite its negative press. Could this mean mainstream integration is close?

Tokenization has been set for some time to cause disruption but open finance incorporation may be key to realize its growth.

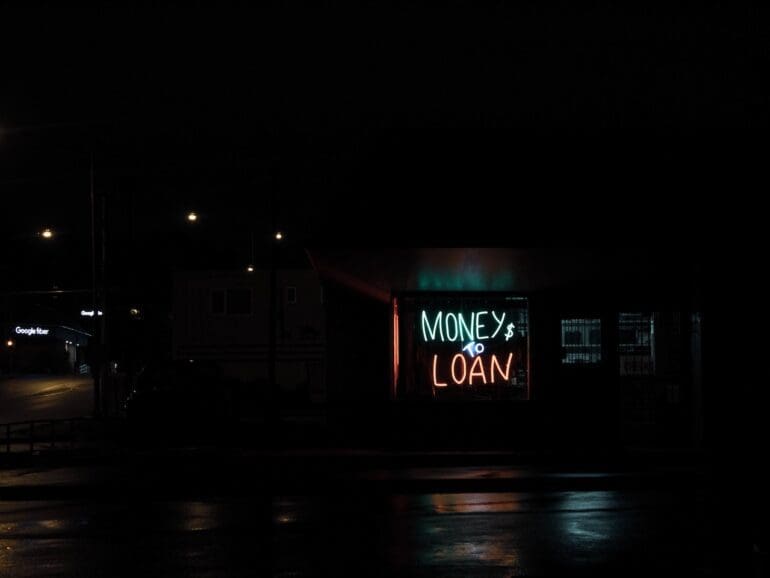

While DeFi, could be powerful in improving lending, it has collateral limitations that on-chain reputation could solve.

With an SEC lawsuit clouding the coverage of Ripple, their cross-border disruption seemed subdued. The company then launched a CBDC platform.