Despite coverage highlighting the environmental issues of certain cryptocurrencies, the crypto sector may be unexpectedly ESG aligned.

Grayscale's appeal of the SEC's decision to deny their application for a Bitcoin ETF has been upheld. The industry is considering it a win.

A basis for Web3 is the pursuit of the decentralisation dream. As 2022 sees even more "DeFi" entities fall, is a dream all it will ever be?

The whole of finance has felt SVB's ripples. Crypto is no exception. Some are evaluating DeFi as a influencer of changes to the system.

A week after halting customer withdrawals, BlockFi said it is filing for Chapter 11 Bankruptcy on Monday morning.

Blockchain, in all its incomprehensible glory, is likely here to stay. After two years of mayhem, the most recent bull run, where does that leave the industry?

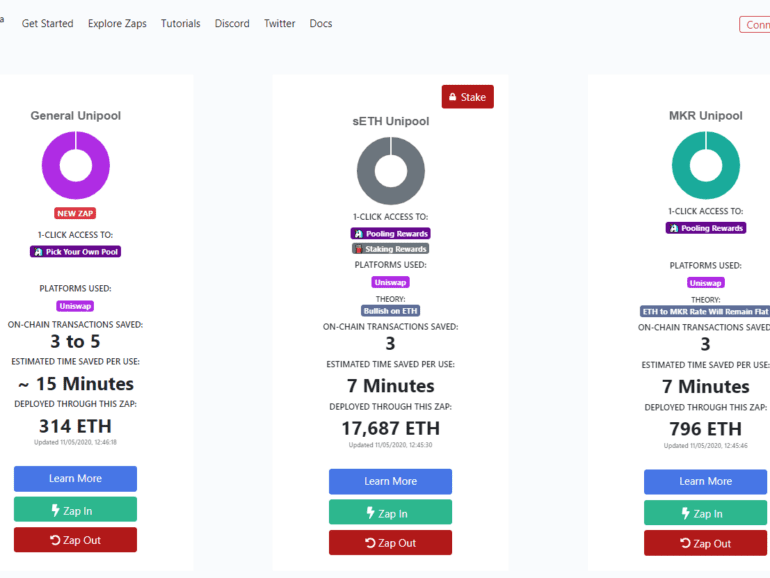

This week, I pause to reflect on the sales of (1) AdvisorEngine to Franklin Templeton and (2) the technology of Motif Investing to Schwab. Is all enterprise wealth tech destined to be acquired by financial incumbents? Has the roboadvisor innovation vector run dry? Not at all, I think. If anything, we are just getting started. Decentralized finance innovators like Zapper, Balancer, TokenSets, and PieDAO are re-imagining what wealth management looks like on Ethereum infrastructure. Their speed of iteration and deployment is both faster and cheaper, and I am more excited for the future of digital investing than ever before.

The Web3 space, famed for its "tech bros" could hold the key to widespread gender diversity. Support of female development in the space is critical.

As August comes to a close, Metaplex, a Solana NFT platform, announced it surpassed $1 billion in direct NFT sales after one year.

·

This week, we look at:

How banks and financial advisors have failed to deliver on $1 trillion in capital appreciation for their clients over the last 12 years

The role of bank regulators in the United States, and the tensions between state and federal agencies

How the OCC is laying the groundwork for national banks to custody crypto assets, bank stablecoin reserves, run blockchain nodes, and use crypto payment networks

And instead of financial advisors or other CFAs guiding the retail market in good decision making, a newsfeed of *what’s popular* has driven Apple, Google, Tesla and the other John Galt hallucinations to the stratosphere. Don’t get us wrong. We love the robot as much as the next Fintech commentator. But it is clear to us that “the masses” are not being “advised”. And that the capital appreciation that matters — cementing the next trillion dollar networks for global future generations in work yet to emerge — is misunderstood and misrepresented by most financial professionals to their clients.