Silvergate, a US-based crypto bank that first partnered with the Facebook venture to create a stable coin last May, said in a release they paid $182 million for the operations infrastructure.

Coinbase and Mastercard announced a partnership to offer users more "payment choices" on the upcoming Coinbase NFT platform.

A fiat-to-payments-and-back app is needed for cryptocurrency to fulfill its original backers' vision and provide real-world utility.

With a message on Twitter and complaints of locked accounts, Crypto.com announced it was the first significant exchange hacked in 2022.

Cryptocurrency regulation has been embedded into broader financial technology regulation or postponed in a "wait and see" approach.

Like many interested in the crypto space, Crapo has asked for months about the stablecoin report.

Meet Islands of Cool, a blockchain-based carbon removal project out of New Zealand that wants to make carbon offsets cool.

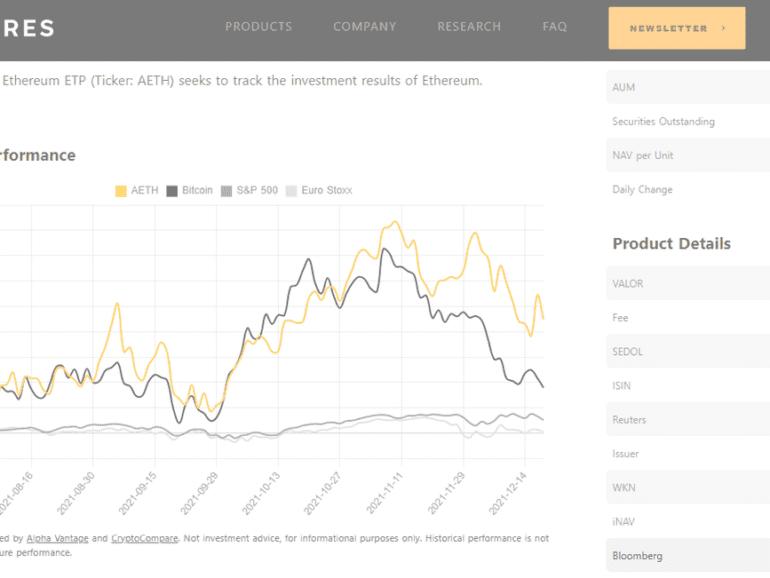

In this conversation, we chat with Hany Rashwan – the founder of Amun and 21Shares. Hany built the company that put out the first physically backed crypto Exchange Traded Product (ETP). In simpler terms, he created a vehicle for people to buy crypto assets, such as Bitcoin or Ethereum, on the stock market. Alongside Cathie Wood of ARK, 21Shares recently submitted a Bitcoin ETF to the SEC. While he waits for the US to get on board, Hany's products are already offered all over Europe, with more than $3 billion under management.

More specifically, we touch on his early entrepreneurial mindset which lead him to building successful businesses, how currency devaluation in Egypt pushed him to create 21Shares, what an Exchange Traded Product (ETP) is and how it related to Exchange Traded Funds (ETFs), the regulatory landscape for crypto-backed ETPs, and so so much more!

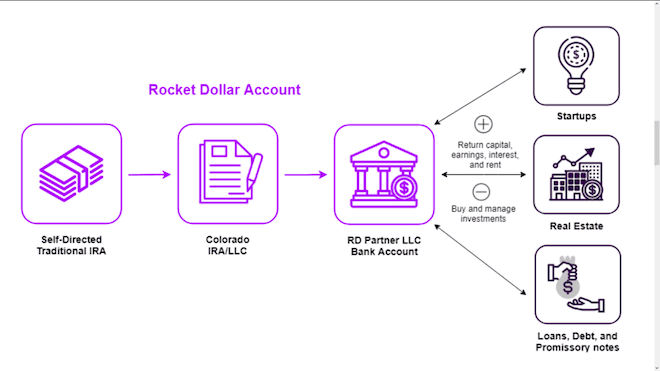

In this conversation, we chat with Henry Yoshida – Co-Founder & Chief Executive Officer, Rocket Dollar. Prior to Rocket Dollar, Yoshida was the co-founder of Honest Dollar, a robo-advisor retirement platform that was acquired by Goldman Sachs, as well as a founder of MY Group LLC, a $2.5-billion assets under management investment firm. Henry shares his industry expertise as a speaker at several industry conferences, as well as having been featured or quoted in the Wall Street Journal, TechCrunch, Bloomberg Businessweek, and Financial Times. Henry has a passion for helping people be the best that they can be and contributes as a member in several financial and technology industry organizations. He graduated from The University of Texas at Austin and has an MBA from Cornell University.

More specifically, we touch on Henry’s career at BoA Merrill Lynch, his role at building a multi-billion dollar RIA business, how he started a digital retirement account platform called Honest Dollar which was sold to Goldman Sach’s neobank Marcus, the inception of Rocket Dollar, we talk IRAs and 401ks and how important these are for the current Gen-Z market, and so so much more!

While there will likely be a change in how organizations use sanctions as a tool, their increased use looks to continue.