In preparation for the London Fintech Nexus Merge event, Nexus launched a Crypto Winter podcast and webinar series to build momentum.

Tokenization has been set for some time to cause disruption but open finance incorporation may be key to realize its growth.

International cross-border banking system SWIFT announced it was building integration with Chainlink.

Paradigm, a zero-fee liquidity network for crypto trading, launched one-click futures spread trading on FTX on Friday.

Tribal Credit's Chief Product officer Arvind Nimbalker said the firm is enjoying a lot of demand for b2b crypto, and they aim to add Defi.

Solidus Labs launches its financial risk assessment platform HALO, assisting in the integration of crypto and DeFi into the financial market.

This week, we cover these ideas:

Crypto prices show increasing correlation in market swings, which hides the large substantive differences between projects

The core narrative of Bitcoin, and its fundamental indicators

The core narrative of Ethereum and Web3, and its fundamental indicators

A sanity check on potential market caps relative to gold, equities, and other assets

Wall Street backed EDX Markets launched two weeks ago making a critical shift in TradFi's approach to crypto. Will this change DeFi?

Prime Trust, a Las Vegas Based Crypto and fintech API company, announced a $100 million Series B to build crypto onramps and provide custody.

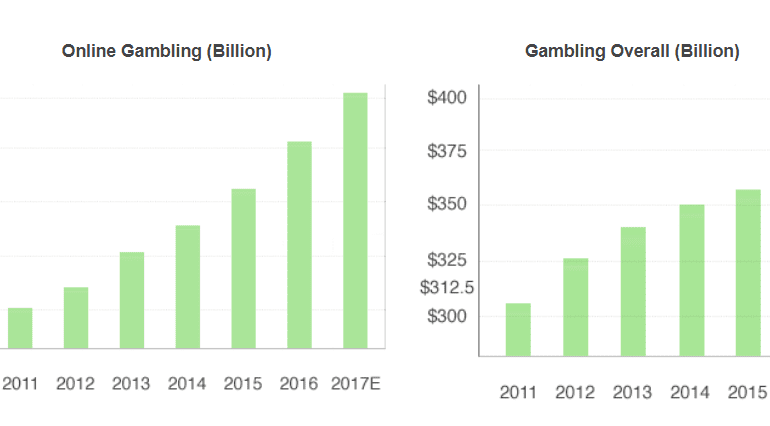

Looking into the statistics of gambling is illuminating and depressing. The UK, where gambling is more widely accepted than in the US, sees rates of 40-60% across all adults according to 2016 research. Revenues for casinos are over $100 billion annually, and global gambling revenues, including sports betting and the national lotteries, amount to over $400 billion. That's like the equivalent of the entire software cloud industry. And it asymmetrically addicts and disadvantages the already disadvantaged (see academic research here, here, and here).