Facebook announced last week that their digital payments platform, Novi, is nearly ready to launch across multiple states, having passed regulatory checks. Novi will use a stable cryptocurrency called Diem to launch payments across borders for the 2.7 billion users of the social network.

This week, we cover these ideas:

Crypto prices show increasing correlation in market swings, which hides the large substantive differences between projects

The core narrative of Bitcoin, and its fundamental indicators

The core narrative of Ethereum and Web3, and its fundamental indicators

A sanity check on potential market caps relative to gold, equities, and other assets

In the aftermath of stablecoin disaster, the institutionalization of crypto assets hangs in the balance, regulatory supervision is key.

·

The health-related benefits driving the move-to-earn economy are clear - but can it push past its 2022 crypto hype spike.

AllianceBlock Fundrs aims to take the best elements from venture capital, blockchain, and social media and combine them to create a more effective, 21st-century model to fund promising startups.

This week, we look at:

The Bitcoin money supply being worth as much as the M1 of several countries

The Visa/Plaid deal DOJ anti-trust filing and the PayPal integration of Bitcoin

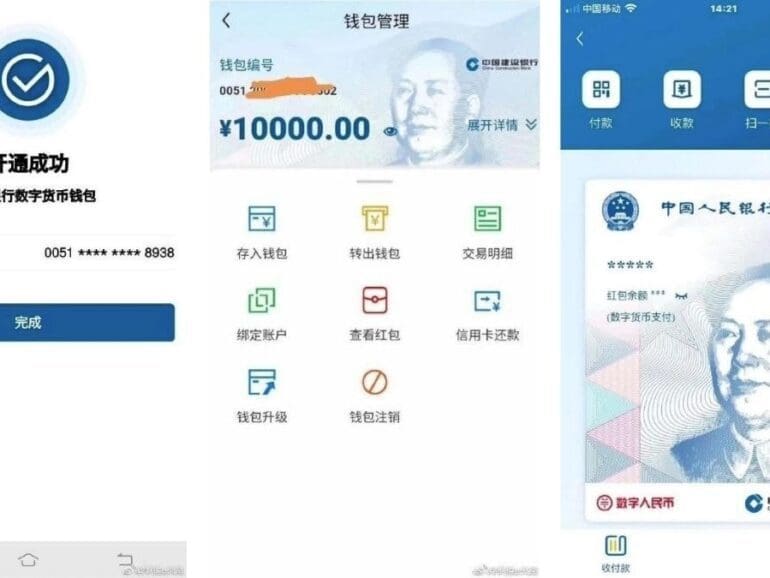

Understanding Central Bank Digital Currencies in the context of card networks, payment processors, and digital economies

Chinese CBDC and how it could relate to stopping the $34B Ant Financial IPO

How a CBDC ecosystem is like an operating system, rather than a payment rail

The correlation between stocks and crypto has increased over time as more institutional investors have invested in crypto.

In this week's LendIt TV session we learned about the state of central bank digital currencies (CBDCs) with experts from the USA, Europe, and China.

Since before bitcoin blew up in 2018, leading financial minds the world over have been researching the implications of institutionally created currencies for use as digital cash, to settle interbank deposits, and for monetary policy development.

Nikola Plecas from Visa Europe and Nick Charteris from Crypto.com discuss how web3 payments will go mainstream at Merge in London on October 18, 2022

Parfin's seed round was led by Framework Ventures, one of Silicon Valley's leading managers in the crypto ecosystem.