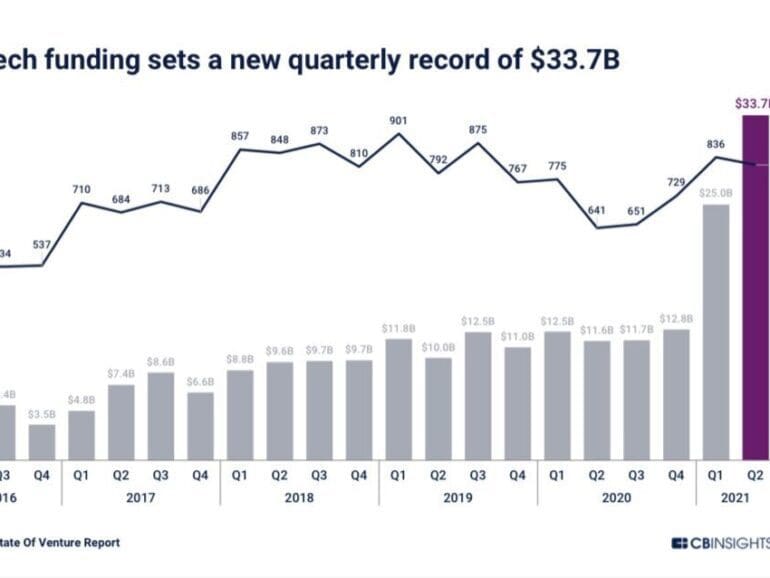

Last quarter, fintech funding rose to $30 billion, the highest on record. $14 billion of SPAC capital is waiting to take these companies public. Robinhood and Circle are about to float on the public markets, via SPAC and IPO. In this analysis, we explore the fundamentals of both companies, as well as the unifying thesis that explains their growth.

In this conversation, we have a really cool conversation on fintech, crypto assets, payments and all the things around it with Ivan Soto-Wright, the CEO and Co-founder of MoonPay.

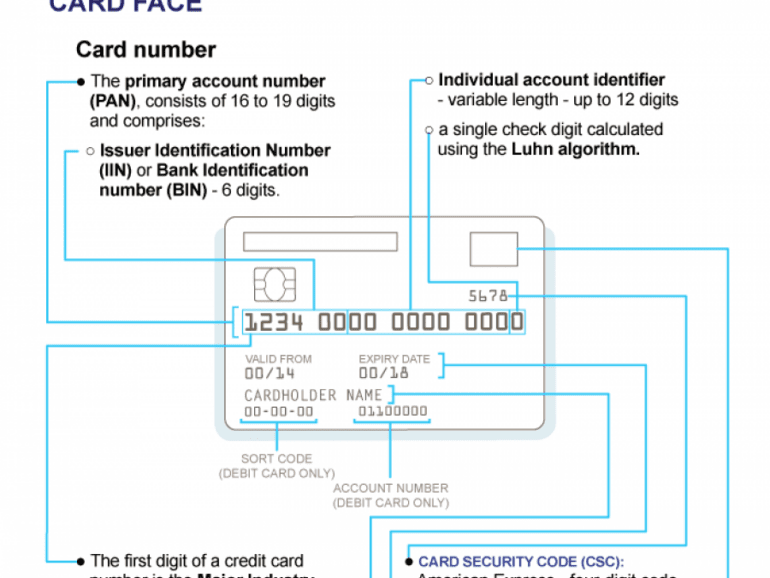

More specifically, we discuss Liability-driven Investment (LDI), the proliferation of AI in personal finance to drive sound decision-making, innovation in finance is following the same trajectory that resulted in VOIP for the telecommunication industry, the geographical maze of crypto KYC, payment networks, and crypto payment processing.

This week, we cover these ideas:

Crypto prices show increasing correlation in market swings, which hides the large substantive differences between projects

The core narrative of Bitcoin, and its fundamental indicators

The core narrative of Ethereum and Web3, and its fundamental indicators

A sanity check on potential market caps relative to gold, equities, and other assets

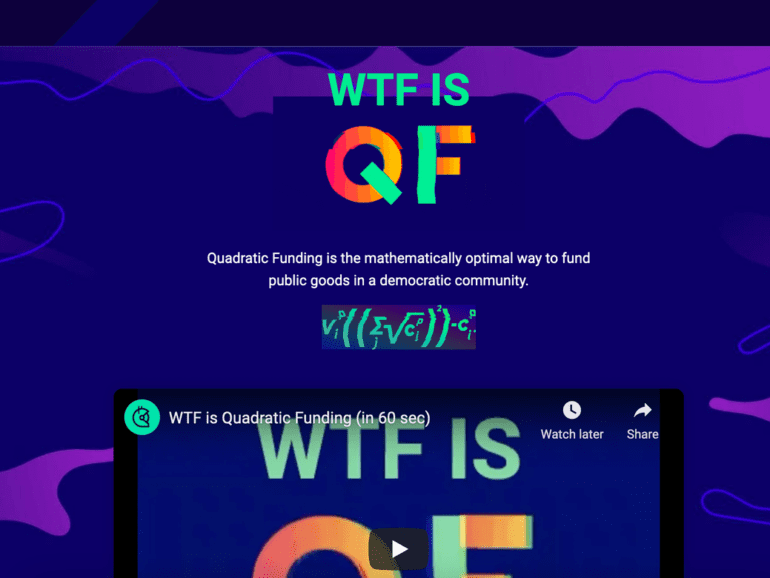

In this conversation, we talk with Kevin Owocki, who serves as the CEO & Chief Roboticist at Gitcoin, about the evolution of the programmable blockchain space, how open software gets made, where value comes from and all sorts of other really cool futuristic things.

Additionally, we explore the nuances of being an early developer in shifting markets, idea mazes, the founding of and philosophy behind Gitcoin, the deep work being done towards the Open Internet, the building of community-driven grant mechanisms, early work on quadratic-funding, and the idea behind memes powering DeFi.

This week, we cover these ideas:

That absurd Paul Krugman article about Bitcoin. Also Jim Cramer has things to say about financial regulation.

If all the prices are down, which they are, does that mean that everything is bad and wrong?

How timing is a personal financial planning problem, not a market value problem

I have had crypto investments since I first dabbled in bitcoin in 2015. Since then, I have expanded my investments...

In this conversation, we talk with Michael Sena of uPort, 3Box Labs, and The Ceramic Network about web3.0, decentralized identity, and the various standards that he has been implicit in creating. Additionally, we explore the nuances around data ownership and identity, the journey from founding uPort to now 3Box and the Ceramic network and how the practical implementation of these ideas has changed as the decentralized web has changed from Web2.0 to Web3.0, and conclude on how the metaverse will be composed of decentralized identity and the protocols on which it travels.

Crypto isn’t magic. It’s math. Two trillion dollars worth of math.

We are still, often, asked incorrect questions about the crypto currency markets. Questions like — “but what is the fundamental value?”

You have to unpack the word “fundamental”. That word signals a Warren Buffet view of the world: there are companies out there, they have equity shares well specified by corporate law in a particular jurisdiction, some are expensive while some are cheap, and that bargain shopping can be determined by a spreadsheet analysis of their cashflows relative to others. It’s so fundamental!

The story of such fundamental truth is anchored in our cultural and social history. We can point to the intellectual tradition of rationalism and classical economics, and talk about the theory of the firm, and its production function. We can point to how these things grew out of governance by religion, and natural rights as granted by a deity, and all sorts of other non-empirical hand waving.

This week, we look at:

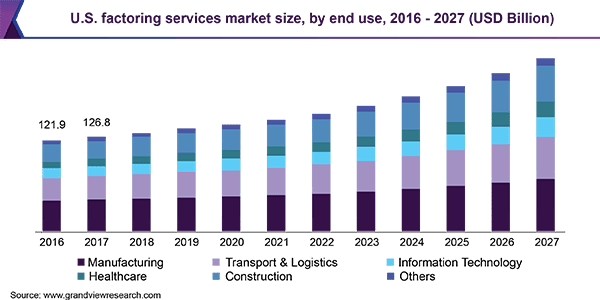

Pipe’s $150 million raise at a $2 billion valuation to turn annualized revenue run-rate into a new peer-to-peer asset class

BitClout’s $200 million of Bitcoin contributions and its mechanisms to turn social media profiles into digital assets

How both projects trade future performance for current monetization

[Editor’s Note: This is an article by Devin Partida, the Editor-in-Chief of ReHack.com. Devin is a Fintech and crypto writer...