Avanti now needs FDIC insurance and acceptance into the Federal Reserve payments system to function as a bank and offer stable coin services.

Argentina has lagged behind the region in new fintech trends such as Open Finance. 2023 could be the year for regulating crypto instead.

Jacobo Toll-Messia’s mission is to scale Layer 2 solutions to the point where they become viable commercial uses and he wants Nahmii to take it there.

In the aftermath of 2022, Cogni launches non-custodial wallet. Founder calls for a shift in mentality in creating Web3 products.

Crypto exchange Genesis is seeking $1B handout after shutting down redemptions. Bloomberg reported that the firm might face bankruptcy.

As the crypto world stands on the precipice of ethereum's merge, we question, what are these "consensus mechanisms" and why does this shift even matter?

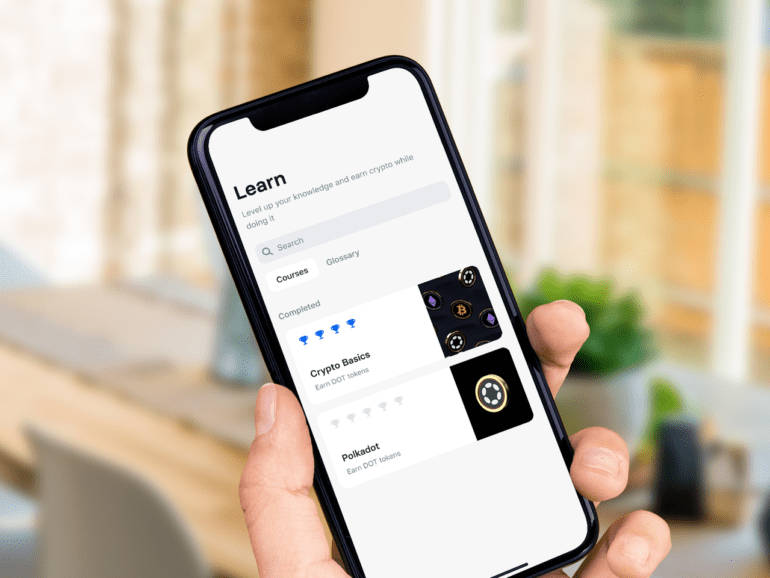

Crypto Basics covers how cryptocurrencies differ from fiat money, what a decentralized system is, how cryptography works, and the risks.

Crypto companies that choose to engage with traditional financial institutions must address risk management and compliance expectations.

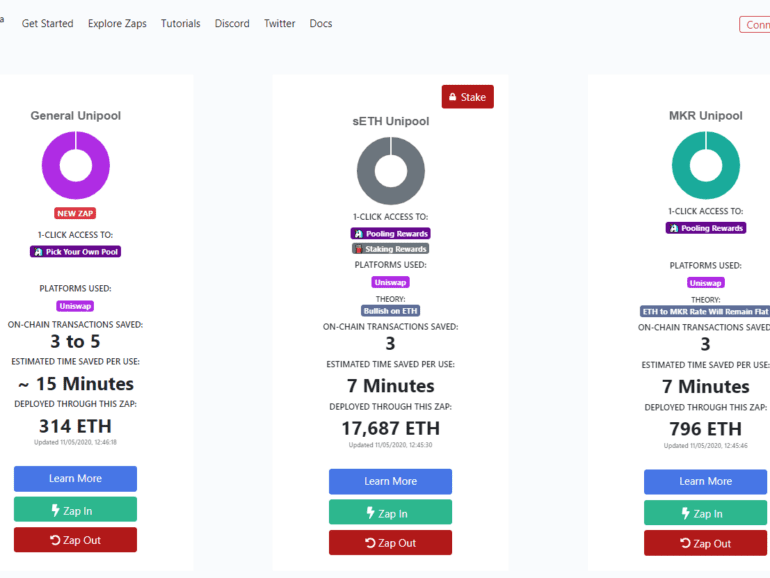

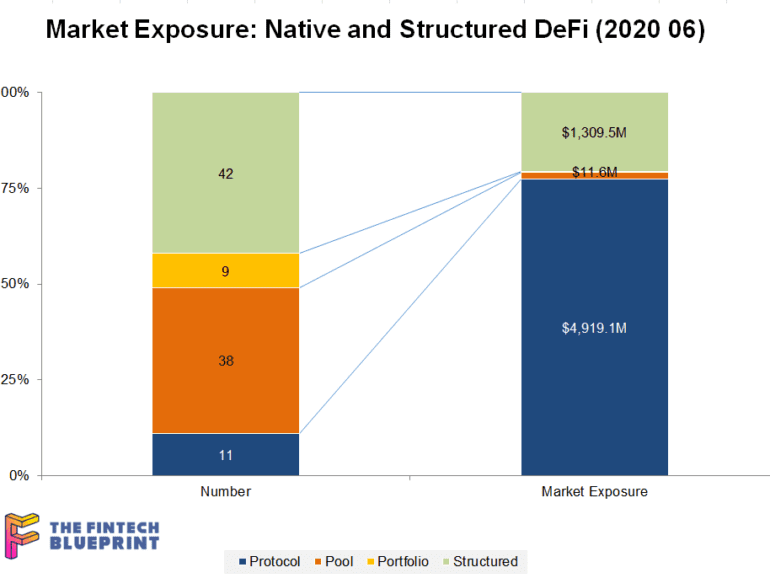

This week, I pause to reflect on the sales of (1) AdvisorEngine to Franklin Templeton and (2) the technology of Motif Investing to Schwab. Is all enterprise wealth tech destined to be acquired by financial incumbents? Has the roboadvisor innovation vector run dry? Not at all, I think. If anything, we are just getting started. Decentralized finance innovators like Zapper, Balancer, TokenSets, and PieDAO are re-imagining what wealth management looks like on Ethereum infrastructure. Their speed of iteration and deployment is both faster and cheaper, and I am more excited for the future of digital investing than ever before.

This week, I grapple with the concepts of financial centralization and decentralization, anchoring around custody, staking, and DeFi examples. On the centralized side, we look at BitGo's acquisition of Lumina, Coinbase Custody and its similarity to Schwab and Betterment Institutional. On the decentralized side, we examine the recent $500 million increase in value within the Compound protocol, as well as the recursive loops that could pose a broader financial risk to the ecosystem.