We focus on the law of unintended consequences, and how making rules often creates the opposite outcome from the desired results. The analysis starts with the Cobra effect, and then extends to a discussion of the Wells Fargo account scandal, dYdX trading farming, Divergence Ventures executing Sybil attacks, and Federal Reserve insider trading. We touch on the concepts of credit underwriting and token economies, and leave the reader with a question about rules vs. principles.

In this conversation, we chat with Tim Frost, CEO and Co-Founder of Yield App, a fintech app making DeFi accessible to everyone. Prior to founding Yield, Tim helped build 2 previous digital banks, Wirex and EQIBank. Tim has also helped accelerate early-stage blockchain startups QTUM, NEO, Paxful, Polymath, and many others.

More specifically, we touch on all things crypto banking and debit cards, crypto onramps, juristictions and regulation, defi banking, yield generation mechanisms, and so much more!

Agreena has partnered with ZTLment to facilitate increased incentives for carbon sequestration in the agricultural sector

Binance has announced a new $500 million lending facility to support struggling public and private bitcoin miners.

Sometimes more is more, and sometimes less is more.

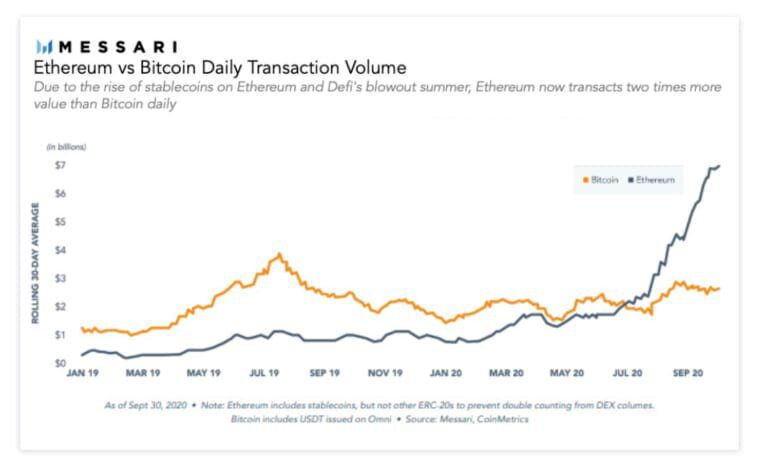

In that spirit, we strongly urge you to check out Messari’s Crypto Theses for 2021. It is a mammoth work of 134 pages, covering each and every development in the ecosystem.

If you don’t want to fuss around with the email gate, the direct link is here.

We are going to pick out five things that are interesting to us substantively and provide a view below. By pick out, we mean screenshot and respond.

On Tuesday, Paris-based Web3 payments startup Request Finance launched "Salaries" to help Web3 enterprises automate payroll in crypto.

Despite the crypto-winter, Mexican cryptocurrency unicorn Bitso is expanding its reach in Latin America, and they added a QR code feature.

Last year was the year of CeFi collapses. While detrimental, investigations are shedding a light on CeFi's (not DeFi's) lack of transparency.

The sustainability of bitcoin is still an issue. Industry experts say a collaboration of all stakeholders is needed to make an impact.

·

This week, we look at:

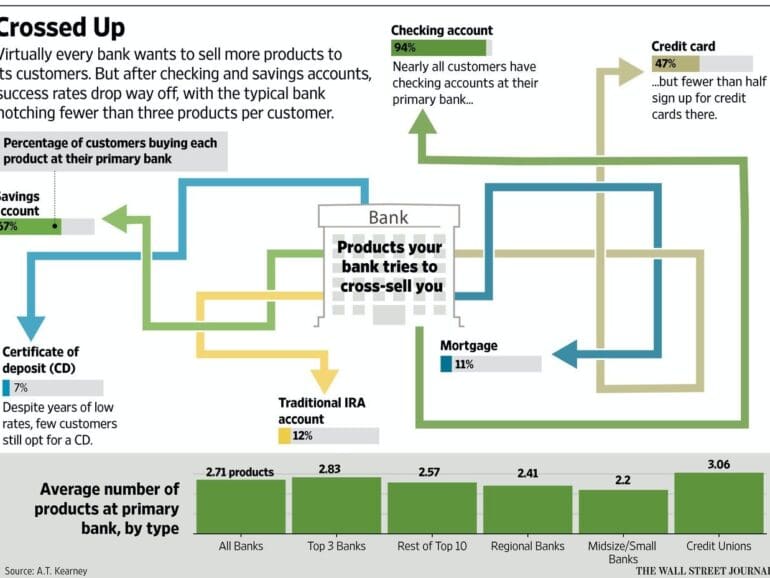

How banks and financial advisors have failed to deliver on $1 trillion in capital appreciation for their clients over the last 12 years

The role of bank regulators in the United States, and the tensions between state and federal agencies

How the OCC is laying the groundwork for national banks to custody crypto assets, bank stablecoin reserves, run blockchain nodes, and use crypto payment networks

And instead of financial advisors or other CFAs guiding the retail market in good decision making, a newsfeed of *what’s popular* has driven Apple, Google, Tesla and the other John Galt hallucinations to the stratosphere. Don’t get us wrong. We love the robot as much as the next Fintech commentator. But it is clear to us that “the masses” are not being “advised”. And that the capital appreciation that matters — cementing the next trillion dollar networks for global future generations in work yet to emerge — is misunderstood and misrepresented by most financial professionals to their clients.