Soulbound tokens, with their air of myth and legend, have very real applications that could significantly disrupt the finance sector, bringing decentralization to DeFi and creating a whole new way of thinking about society.

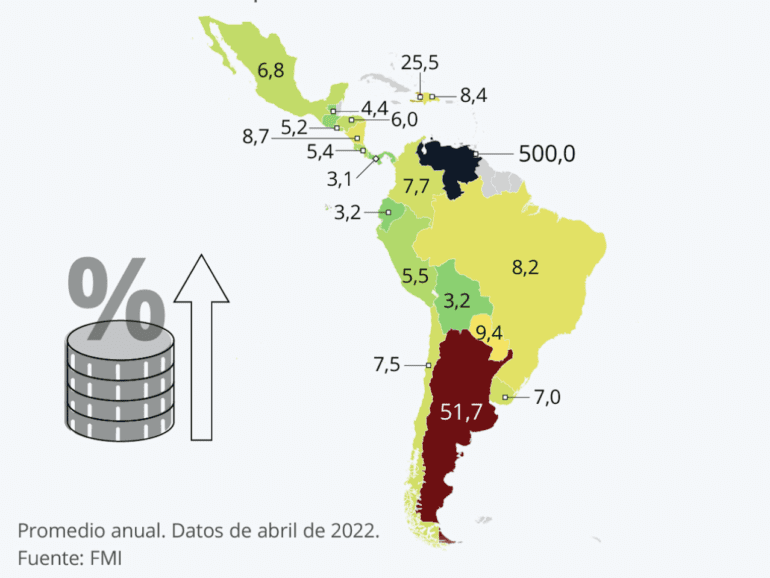

LatAm is seeing skyrocketing inflation and DeFi could mean survival for many citizens, but how can adoption be maximized?

With a message on Twitter and complaints of locked accounts, Crypto.com announced it was the first significant exchange hacked in 2022.

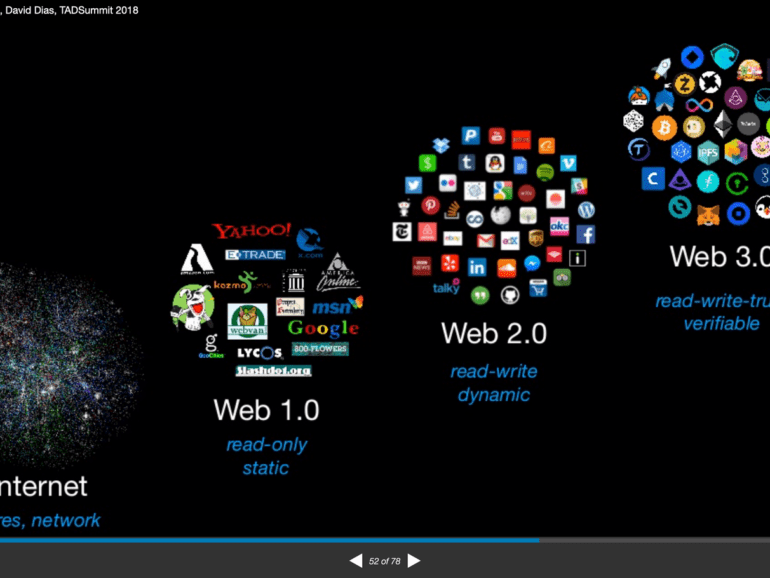

In this conversation, we chat with Gabriel Anderson – Managing Director at Tachyon, Head of Market Strategy & Business Intelligence at ConsenSys Labs. Former Head of VaynerMedia. Alumnus of Merrill Lynch.

More specifically, we touch on what Tachyon is, how it works, and who it’s for, the growth of crypto, and what needs to come next to allow the widespread adoption of crypto by mainstream society. Gabriel talks about the best projects he has seen so far that combine NFTs with other elements of DeFi and crypto, and what he’d like to see more of in the future.

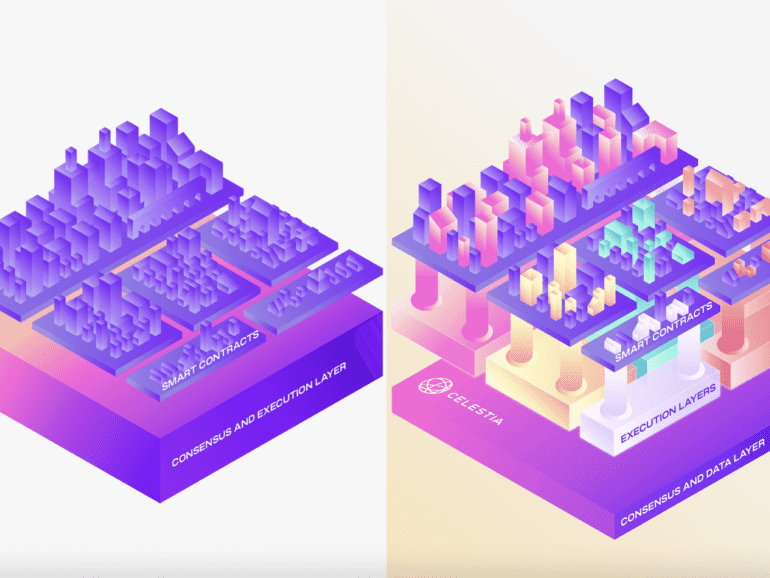

Just when you thought you had got a handle on blockchain, it turns out not all are equal. Modular could solve scalability and more.

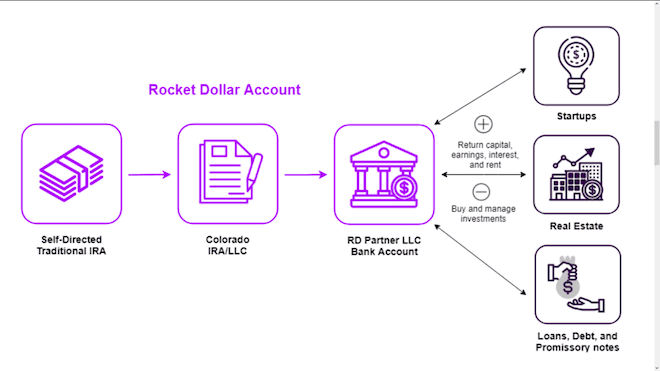

In this conversation, we chat with Henry Yoshida – Co-Founder & Chief Executive Officer, Rocket Dollar. Prior to Rocket Dollar, Yoshida was the co-founder of Honest Dollar, a robo-advisor retirement platform that was acquired by Goldman Sachs, as well as a founder of MY Group LLC, a $2.5-billion assets under management investment firm. Henry shares his industry expertise as a speaker at several industry conferences, as well as having been featured or quoted in the Wall Street Journal, TechCrunch, Bloomberg Businessweek, and Financial Times. Henry has a passion for helping people be the best that they can be and contributes as a member in several financial and technology industry organizations. He graduated from The University of Texas at Austin and has an MBA from Cornell University.

More specifically, we touch on Henry’s career at BoA Merrill Lynch, his role at building a multi-billion dollar RIA business, how he started a digital retirement account platform called Honest Dollar which was sold to Goldman Sach’s neobank Marcus, the inception of Rocket Dollar, we talk IRAs and 401ks and how important these are for the current Gen-Z market, and so so much more!

Nubank, the largest digital bank in Latin America, officially launched Nucoin. It is a free-of-charge token that rewards the most loyal users.

Attrace built a trustless word-of-mouth marketing system for Web3 that enables anyone with a marketing budget to automate affiliate results.

Continuing growth in the market cap of stablecoins shows increasing trust in the assets, but given recent events, could this be misplaced?

As the crypto industry waits for regulation in the U.S., CeFi has a trust dilemma. Increased transparency might be the way forward.