At Fintech Nexus Merge, the panel discussion 'Creating On-Ramps and Off-Ramps Between DeFi and Traditional Finance' was a riveting discussion giving the audience a snapshot of how the convergence between DeFi and TradFi will happen

The evolution towards a financial metaverse is rapidly accelerating, with the growth in generative assets, profile picture avatars, the emerging derivative structures that build on their foundation, and DAOs that govern them. This article highlights the most novel developments, and builds the case for what a digital wallet / bank will need to be able to do in order to succeed on the way to this alien destination.

The sustainability of bitcoin is still an issue. Industry experts say a collaboration of all stakeholders is needed to make an impact.

On Monday, BlockFi agreed to pay $100 million to settle SEC allegations; a couple of hours after the Super bowl ran with so many crypto ads, media began calling it the 'crypto bowl.'

Despite the continuing bear market, consumer interest in crypto remains high. Plaid found that increased trust could be the key to adoption.

Last year will be known for a myriad of events. While the institutionalization of crypto might not make it to...

The regulatory landscape for US crypto companies continues to remain unclear so headquarters are moving. Tech talent may go with them.

Parfin's seed round was led by Framework Ventures, one of Silicon Valley's leading managers in the crypto ecosystem.

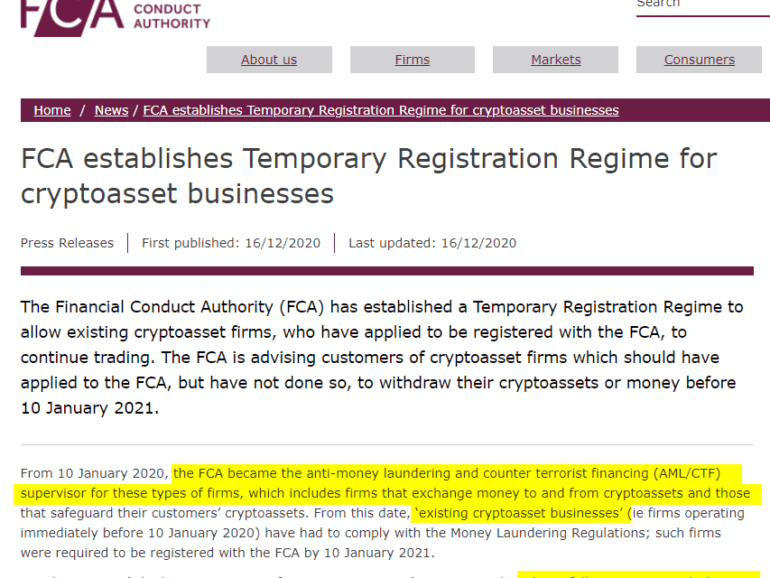

Cryptocurrency regulation has been embedded into broader financial technology regulation or postponed in a "wait and see" approach.

central bank / CBDCCryptodecentralized financeopen sourcephilosophyregulation & compliancestablecoins

·This week, we look at:

Proposed US regulation from FinCEN, legislation from the House of Representatives, and UK FCA registration requirements that would impact the crypto industry

The difference between competition for share within an established market, and competition between market paradigms (think MSFT vs. open source, finance vs. DeFi)

The crypto custodian moves from BBVA, Standard Charters, and Northern Trust

The bank license moves from Paxos and BitPay, as well as the planned launch of a new chain by Compound, in the context of the framework above

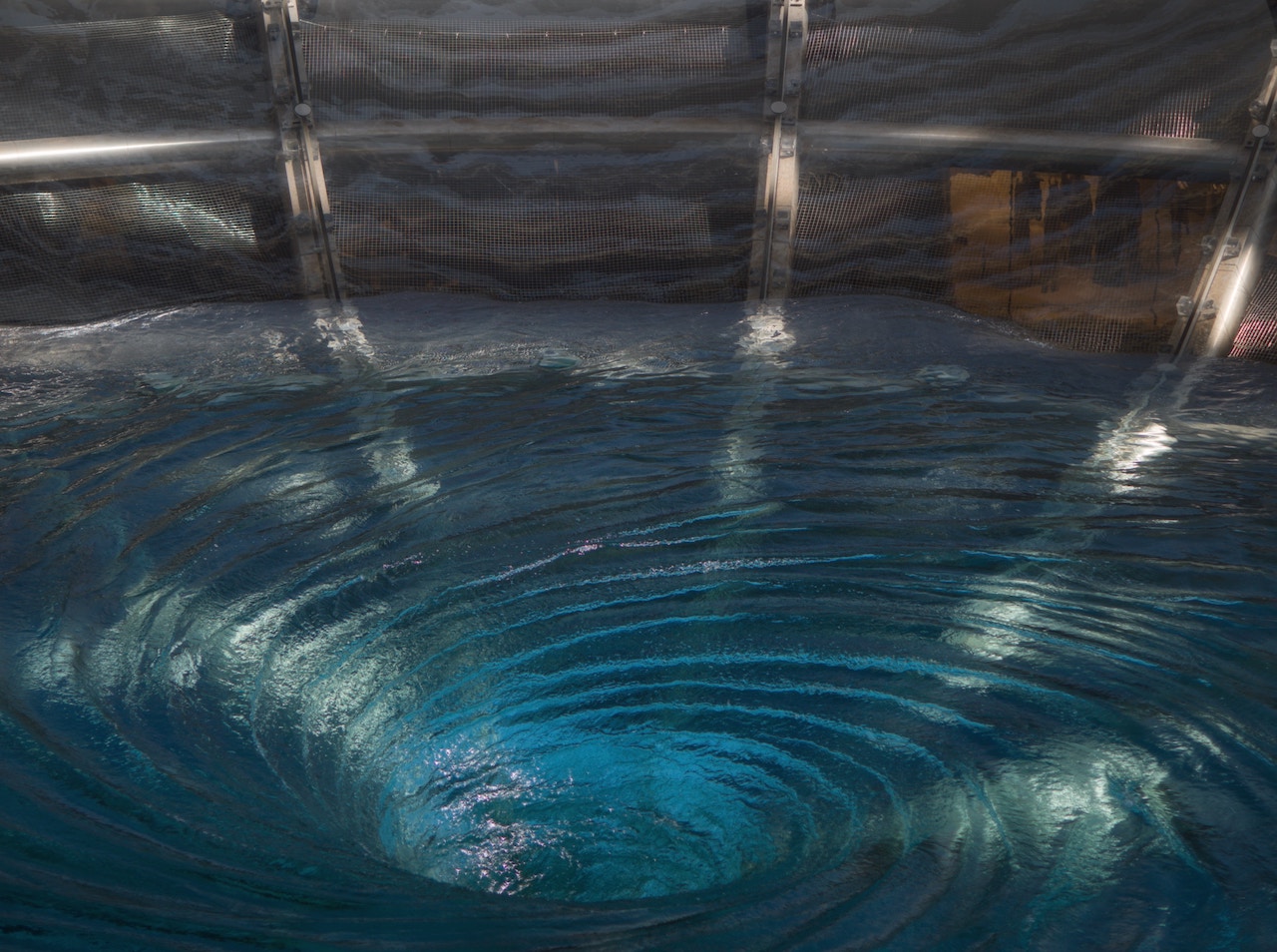

Permissionless finance is a paradigm breach. It pays no regard for the very nature of the incumbent financial market. Without banking, it creates its own banks. Without a sovereign, it bestows law on mathematics and consensus. Without broker/dealers, it creates decentralized robots. And so on. It tilts the world in such a way as to render the economic power of the incumbent financial market less important. Not powerless -- the allure of institutional capital is a constant glimmer of greedy, opportunistic hope. But the hierarchy of traditional finance does not extend to DeFi, and thus has to be re-battled for the incumbent. This is cost, and annoying.