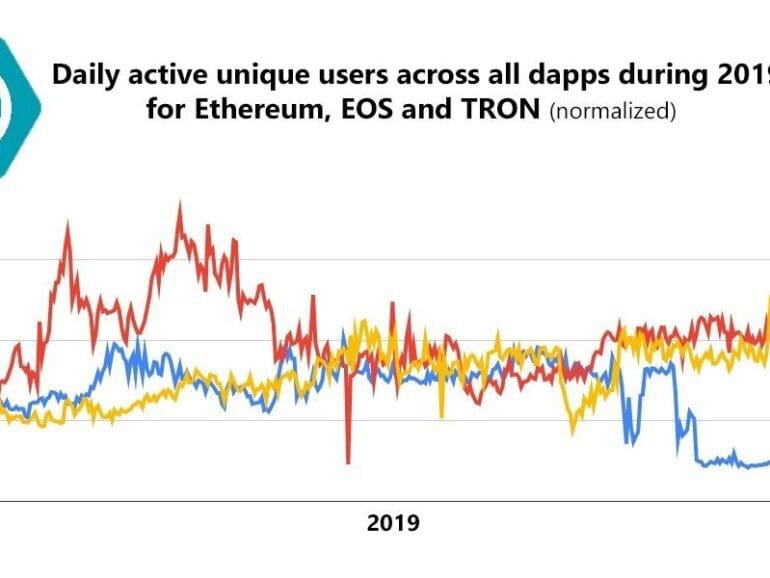

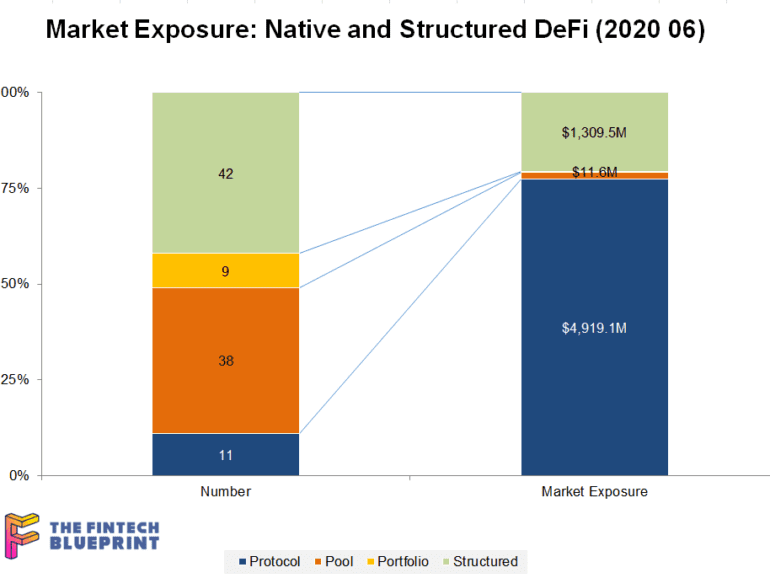

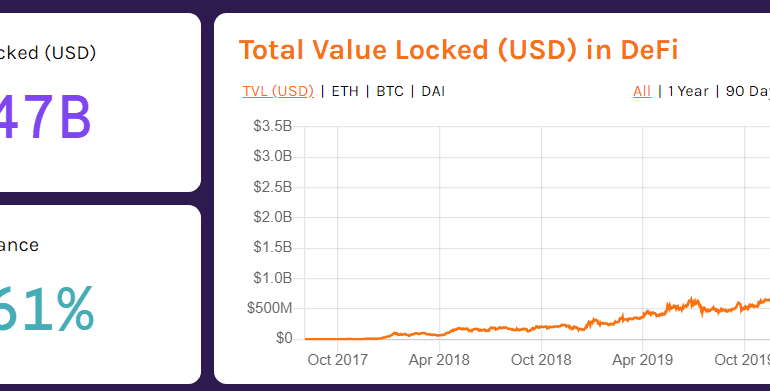

In the long take this week, I revisit decentralized finance, providing both an overview and 2019 update. The meat of the writing is the following long-range predictions for the space in the next decade -- (1) the role of Fintech champions like Revolut and Robinhood as it relates to DeFi, (2) increasing systemic correlation and self-reference in the space, which requires emerging metrics for risk and transparency, and (3) the potential for national services like Social Security and student lending to run on DeFi infrastucture, (4) the promise of pulling real assets into DeFi smart contracts and earning staking rewards, and (5) continued importance of trying to bridge into Bitcoin. Here's to an outlandish 2020!

Coinbase and Mastercard announced a partnership to offer users more "payment choices" on the upcoming Coinbase NFT platform.

Let’s do some math homework. It’s good for you:

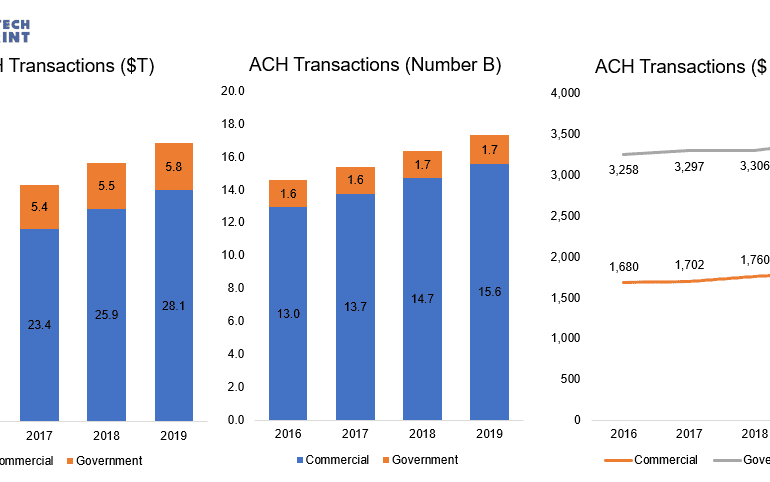

The Federal Reserve money movement system broke for several hours. We look deeply into its volumes and transactions, and value it like a Fintech unicorn.

The Ethereum ecosystem is throwing around as much volume in settlement as the Fed check processing system. We explore scalability barriers and solutions.

Can eCommerce fit into our emerging infrastructure? We anchor to the market numbers in China and the United States.

Things break.

Sometimes the things that break are the US Federal Reserve ACH service, Check 21, FedCash, Fedwire, and the national settlement service. They were down for a few hours — discovered at 11AM on Feb 24th and still in trouble at 3PM that day. Everything is now up and running again.

As more applications turn digital, the threat of hacks become ever present. Crypto has become a weak point for theft.

This week, I grapple with the concepts of financial centralization and decentralization, anchoring around custody, staking, and DeFi examples. On the centralized side, we look at BitGo's acquisition of Lumina, Coinbase Custody and its similarity to Schwab and Betterment Institutional. On the decentralized side, we examine the recent $500 million increase in value within the Compound protocol, as well as the recursive loops that could pose a broader financial risk to the ecosystem.

Welcome back to the Fintech Blueprint podcast. Today we share a panel recording that Lex moderated with Steven Becker, President and COO of MakerDAO, and Lucas Vogelsang, CEO and Co-Founder of Centrifuge.

The session was hosted at LendIt Fintech Digital, a vibrant community of Fintech and banking leaders.

With a message on Twitter and complaints of locked accounts, Crypto.com announced it was the first significant exchange hacked in 2022.

Argentina's inflationary economy has reached new highs leading more people to crypto. Binance hopes to serve them with a seamless solution.

The proper definition of cryptocurrencies has stumped US regulators, many believe it has affected development. This year could bring clarity.

Continuing growth in the market cap of stablecoins shows increasing trust in the assets, but given recent events, could this be misplaced?