Custodia bank's rejection could be a blow for the maturation of DeFi, but Caitlin Long says it is just the beginning.

Entry into the real estate market is challenging for younger generations. For those who are "crypto native" perhaps there are options.

The crypto world was buzzing with the news of ethereum's successful shift to PoS. But what actually is staking? And why is it significant?

Intain team ran an audit of their platform, a blockchain structured finance ledger, and found $3.75 billion in assets live on the database.

In this conversation, we talk all things capital markets and investing with Yoni Assia, the founder and CEO of eToro, one of the fastest-growing and largest global digital investing companies, brokerages, and applications out there.

More specifically, we discuss the eating habits of Warren Buffet, community-driven investment challenging incumbent investing practices, the purposes of investing and trading, of financial health, of investment education, of gamification of investment strategy, of capital markets and GameStop and the connection between capital, memes and fashion, and finally machine learning’s influence of investment behaviour.

Solidus Labs launches its financial risk assessment platform HALO, assisting in the integration of crypto and DeFi into the financial market.

Teana Baker Taylor, Circle's UK VP of Policy, advocates for careful cryptocurrency adoption on behalf of Circle's new Euro Coin.

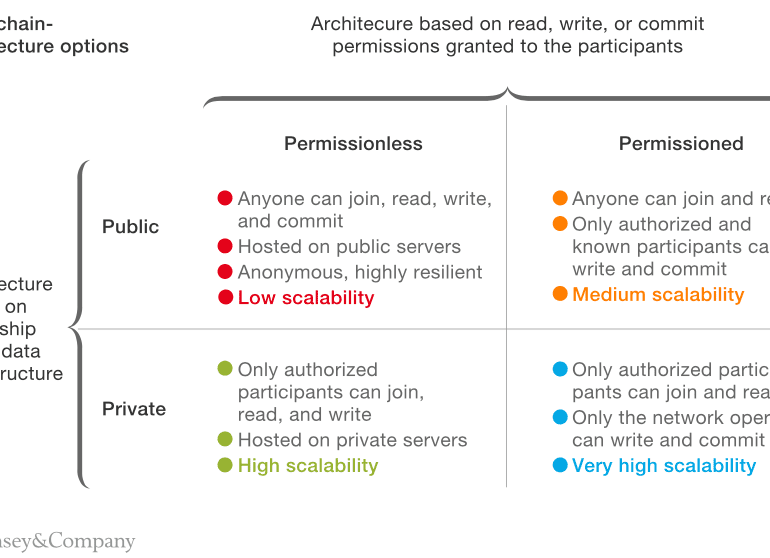

In this conversation, we talk with Patrick Berarducci of ConsenSys, about the valuations and multiples of capital markets protocols in Decentralized Finance on Ethereum, now making up over $60B in token value. Additionally, we explore the nuances of scaling Ethereum and its solutions, such as Metamask and the emerging Layer 2 protocols.

We also discuss law and regulation, including a fascinating story about Bernie Madoff from when Pat was a practicing attorney. This leads into a conversation about the embedded compliance nature of blockchain and crypto technology, the early days of ConsenSys, the path of crypto brokerages like Coinbase, and Metamask exhibiting emerging qualities of a neobank.

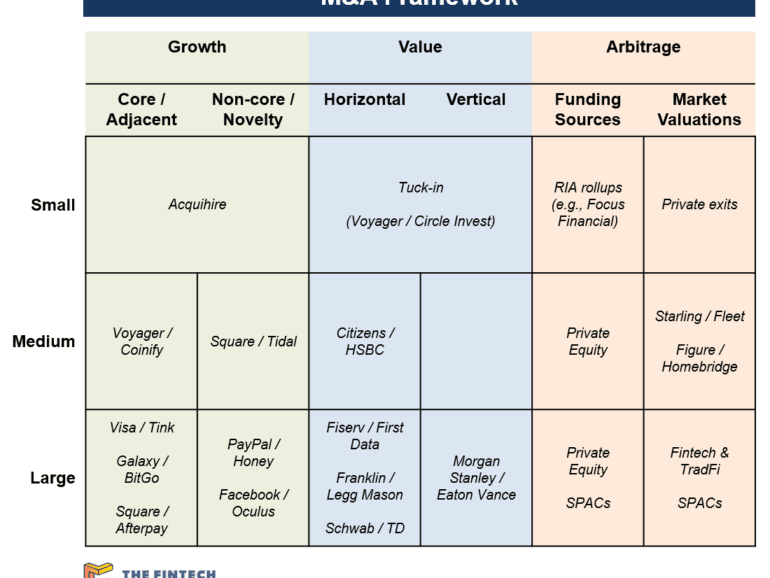

In this analysis, we explore an overarching framework for the M&A activity in the fintech, big tech, and crypto ecosystems. We discuss acquihiring, horizontal and vertical consolidation, as well as the differences between growth and value oriented acquisition rationales. The core insight, however, is about the arbitrage between the fintech and financial services capital markets, as evidenced by the recent transactions for Starling and Figure.

Gen Z ETF hopes to provide a vehicle for Gen Z, an actively managed fund that tracks the best and brightest firms 'born' after 1997.