At Fintech Nexus Merge, the panel discussion 'Creating On-Ramps and Off-Ramps Between DeFi and Traditional Finance' was a riveting discussion giving the audience a snapshot of how the convergence between DeFi and TradFi will happen

Despite the continuing bear market, consumer interest in crypto remains high. Plaid found that increased trust could be the key to adoption.

Thursday afternoon, the Boston Federal Reserve and MIT Digital Currency Initiative (DCI) released Phase 1 of Project Hamilton.

As August comes to a close, Metaplex, a Solana NFT platform, announced it surpassed $1 billion in direct NFT sales after one year.

·

BAYC has 10% of the total market cap of NFTs, this project has been at the center of the conversations about copycats.

LTG Bank is the latest traditional institution making the step towards crypto integration. Partnering with SEBA Bank, their roll-out is symptomatic of increasing global demand for crypto assets.

In this conversation, we talk all things capital markets and investing with Yoni Assia, the founder and CEO of eToro, one of the fastest-growing and largest global digital investing companies, brokerages, and applications out there.

More specifically, we discuss the eating habits of Warren Buffet, community-driven investment challenging incumbent investing practices, the purposes of investing and trading, of financial health, of investment education, of gamification of investment strategy, of capital markets and GameStop and the connection between capital, memes and fashion, and finally machine learning’s influence of investment behaviour.

As more applications turn digital, the threat of hacks become ever present. Crypto has become a weak point for theft.

·

The health-related benefits driving the move-to-earn economy are clear - but can it push past its 2022 crypto hype spike.

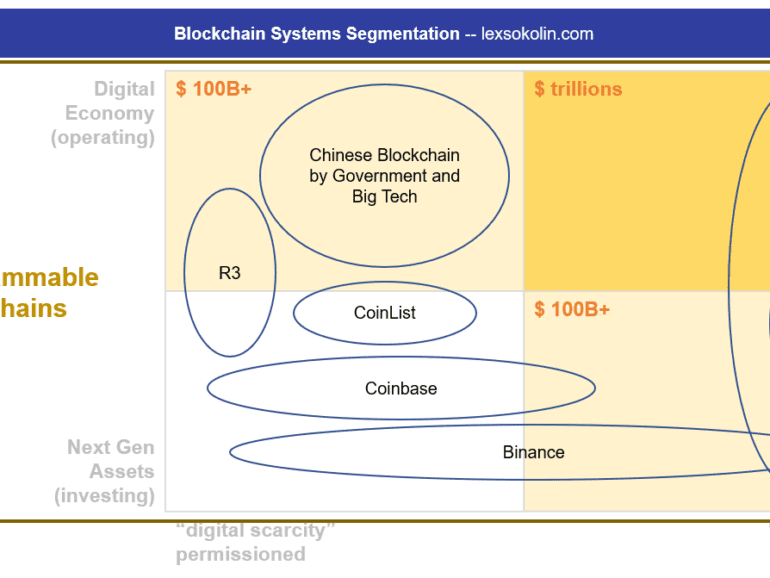

Blockchain progress through the lens of Binance’s $180MM profit and Greensill’s $1.5B SoftBank raise

Look at the difference between (1) building out the crypto asset class, and (2) operating infrastruture for a blockchain-based digital economy. There are so many little logic pot holes into which you could fall! There are so many things one could believe that make the whole thing make no sense at all! I am anchoring around two primary data points -- a Multicoin report about Binance's financial progress and its massive (though unaudited) $180 million profit in Q3 of 2019, and a post by supply chain company Centrifuge about marrying cashflow financing with the decentralized web.