The FCA announced a customer duty legislation in July 2022, and the first deadline is now looming, much to the surprise of some business leaders.

According to a report conducted by Moneyhub and released today, 7% of all business leaders in the UK knew nothing at all of the impending legislation. A further 31% knew very little.

However, the Customer Duty rules are years in the making.

“What this represents is a number of past initiatives all being brought into one and significantly, moving from the status of guidance to regulation,” said Vaughan Jenkins, Director of Business Development at Moneyhub. “At the heart of it is the idea of treating customers fairly. And that was a concept which came out as far back as 2006, but it was, again, guidance and expectation.”

The regulation puts customers at the heart of business activity and demands products be designed to fit their needs and benefit.

“The way that they’ve been constructed, there are four key outcome areas that they’re looking for,” continued Jenkins. “One of them is that the price you pay is demonstrable, fair value. The other is that the product does what it says on the tin, so it’s functionally right and meets the need and the objective of the consumer.”

“It has to be communicated in a way which is understandable by the person that it’s intended to be used by, and that you provide the source of service as well but again, enables people to get the most out of it.”

“On top of that, it will also include that people can change their mind or get out of a product and counter what they call these “sludge practices,” which is stopping people from moving around and being penalized for changes in their circumstances.”

The regulation is comprehensive and far-reaching, applying to all sectors regulated by the FCA.

Noncompliance is rife

The report found that 56% of businesses are currently not compliant with the rules. Meanwhile, 22% of banks and building societies feel they will not meet the necessary standards by the original April 2023 deadline (this has since been pushed back to July 2023 but continues to cause issues).

These statistics may be shocking to some. The rules, although seemingly intuitive to a customer who would expect these standards to already apply to products on the market, could be the result of years of frustration from the FCA, explained Jenkins.

“I think, where the FCA come from, is that any, “good” business, you would think, would put customers at the center of what they’re doing, and build their business around those individuals.”

“I think the disparity between what we’re finding comes from whether firms feel that they comply with the rules they set out. There were a number of firms that did think that they were compliant. But the acid test is that when an FCA supervisor calls on you, it’s not about how many nice PowerPoint backgrounds you’ve got or that you’ve wonderfully kept minutes of all the meeting.”

“The fundamental question they’ll ask is, how do you know? How do you know that you’re actually delivering the outcomes that you want it to be delivered?”

This is where data comes in.

Data is critical for Customer Duty compliance

The favorable conditions within the UK for access to consumer-permissioned data could benefit businesses in their compliance.

“I think value exchange is very tightly coupled here to the trend towards open data and smart data, which sits alongside where the consumer duty regulation is coming from,” said Jenkins.

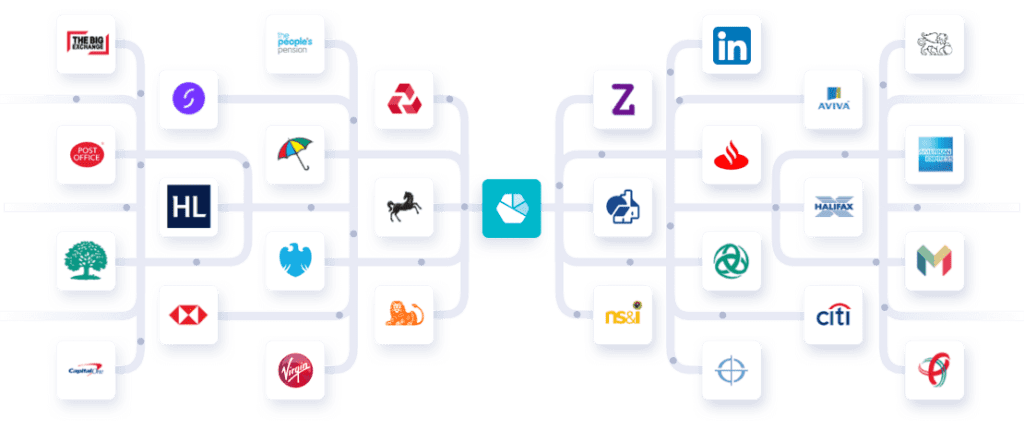

For some time, the FCA has supported open banking and continues to make steps towards a framework for open finance. The data available through this framework could enrich strategies for compliance with customer duty.

“There are no excuses left,” said Samantha Seaton, CEO of Moneyhub. “Businesses must ensure they understand their customer completely in order to offer products and services that fit their circumstances throughout the entire duration of their relationship. And the only way this is possible is with an ongoing holistic view of their customer’s financial universe.”

“Open Finance truly holds the key for firms to meet Consumer Duty. But to see Open Finance’s role as solely a solution to a problem is a mistake. It is also an opportunity.”

Jenkins explained that the regulation poses an opportunity for businesses to leverage this data to understand their client base better. In addition, technology could help firms create more personalized and targeted communications and create more customized products.

The Moneyhub report found that, despite the unfavorable macroeconomic conditions, firms were working on a compliance strategy that could involve over £5 million of investment. Two of every five firms felt the key to unlocking customer insights was the investment in technology.

Fintech could have a significant advantage

“Data” and “Technology” are two words that make up the core of fintech, meaning that they could be at a distinct advantage for compliance with the legislation.

For many, fintech is already the more customer-centric approach to financial services. In many cases, agile, digitally driven solutions build their products in response to a keen eye on customer data.

However, for the regulation, the customer awareness and benefit must be “demonstrable,” requiring additional data focused on the effect of the product. This, in itself, could be beneficial.

“There could be a real dividend in this,” said Jenkins. “It may be worth not just going down the rabbit hole of compliance.”

“If you do think about it, and you genuinely make customers the heart of what you do, and you may even beyond your own compliance support other firms, in a b2b sense, it may be that you’re providing services, data insights, and so on that will really help them to give a better service to customers.”

“So, you should see it as a business opportunity rather than just a compliance exercise for yourselves because you could see a lot of money in motion as people better understand what they have. Things are communicated more transparently; if you have a more educated, informed consumer, they can start voting with their feet.”

“That may be quite exciting for fintechs to think, hey, how could we capture that market in motion? If I was them, that’s what I would be doing. It’s one of those happy times when compliance and the business strategy could be aligned regarding what you want to do.”