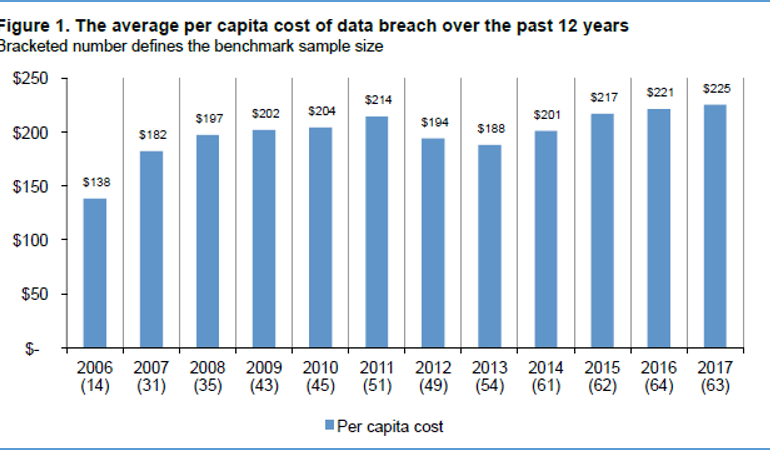

Capital One recently suffered a data breach resulting from poor security practices that exposed 100 million credit card applications and accounts. They expect the breach to cost the company $150 million. Two years back, Equifax lost 140 million identities, again from poor security practices. At the time, I said that according to GDPR this should cost them $150 million. They have since settled for about $600 million -- though some of that seems to be in-kind services coverage like free credit monitoring (lol!). Separately, Facebook has settled for a $5 billion fine associated with the Cambridge Analytica privacy "breach".

Fraud is rising, and with real-time payments taking an ever greater hold of the financial system, faster ways to combat are needed.

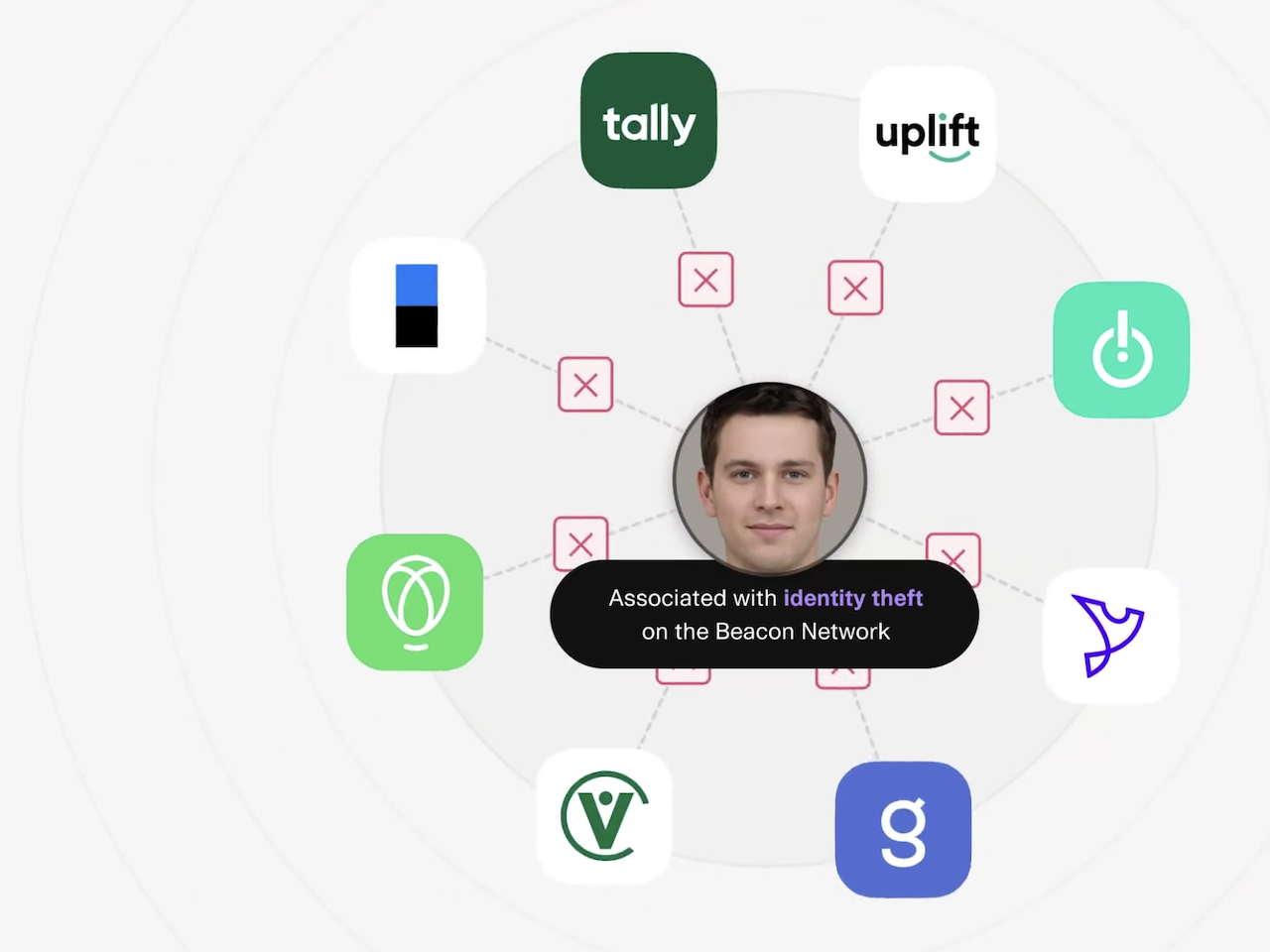

Sardine, a leader in the fraud prevention and compliance space has upped its game against widespread fraud.

APIs drive much of financial services' digital revolution, but studies have shown they could also pose a significant security weakness.

A new report from Trustwave SpiderLabs provides a rich description of the myriad of threats facing financial services companies. 2023 Financial Services Sector Threat Landscape covers prominent threat actors and tactics, breaks down the financial services attack flow into steps, and covers several common hacker entry points.

·

While more people are shopping online, they are increasingly concerned about their digital security. Might passkeys be the answer? Quintin Stephen believes they will help.

Instead of modifying decades-old transaction infrastructure, Spade provides better fraud protection by creating a new system. Customers like Sardine, Mercury, Unit and Ramp have improved their fraud models by more than 15% using Spade's real-time merchant intelligence for the card ecosystem.

The SEC’s new cybersecurity rule can protect investors and ensure companies take security seriously. But it creates as many questions as it answers.

Cybersecurity needs to be a focus for fintech companies right now. Here are the most important factors to consider to ensure strong cybersecurity governance.

Financial institutions are grappling with increasing cybersecurity threats due to heightened cloud adoption and technological sophistication. To combat these challenges, financial institutions must take proactive measures to protect themselves. Red Hat’s Dr. Richard Harmon provides insight on three key measures that can mitigate risk: collaboration, automation and standardization.