On Monday, Changpeng Zhao, Founder and CEO of Binance took to Twitter to talk about the failed FTX bailout and what the crypto industry can expect next.

Zhao said that crypto could expect a push toward auditing and cleansing the pallet as leveraged exchanges wipe out, with stablecoins leading the way. He said that proof of reserves has been coming for a long time, and the tech is already there.

“Proof of reserve is a mathematical way to prove that your balance is included in the final balance, and it uses a Merkel tree algorithm. It ensures that funds are included in the grand total, and we ensure that the total is there.”

He said typically, the third-party auditor is used to ensure the information is accurate, but FTX already employed the auditor they were going to use.

“On an exchange today, in a bear market, if their assets do not include a large percentage of stablecoins, that is a risky sign,” Zhao said.

Central figure

Zhao became a central figure in the FTX explosion early on. He was an original investor in the Sam Bankman-Fried exchange in 2019. After Binance sold shares in the FTX a year later for over $2b, cracks in the relationship started to form. By 2022, Bankman-Fied and co. took to Twitter to chirp Zhao and Binance, their main competitor in the top five crypto exchanges.

No amount of marketing could replace Binance as the industry leader, and by the time FTX began to melt under the pressure of mishandled and levered funds, Binance almost came in to save them. In a personal call between Zhao and Bankman-Fried, Zhao agreed in principle to bail out FTX.

A day later, after hearing more about the legal, regulatory, and financial mess FTX was in, Zhao said he was pulling out of the deal: he would not bail out a bankrupt firm just to keep the scheme going for a couple of months like Bankman-Fried did.

When Zhao gave FTX a zero-confidence vote, the air left the tires, and the caravan halted. In all, $6 billion left the FTX exchange in hours; it was over fast.

Started with high-frequency trading

Zhao, a Chinese-Canadian founder, began his career building high-frequency trading systems in Tokyo and futures software and went on to launch Binance in 2017.

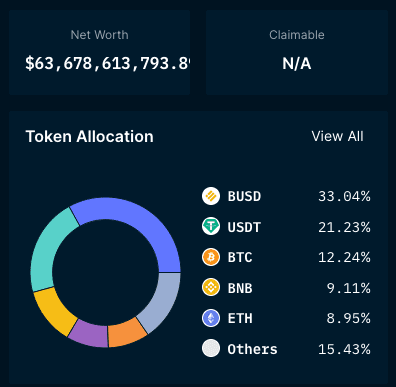

Zhao is worth upwards of $17 billion, according to Bloomberg Billionaires. Binance is the largest exchange by volume, and according to crypto wallets posted last Thursday, it holds $74 billion of crypto.

But do they? For years, reserves have been the common thread in the crypto industry that has clouded the concept of safety, contributing to stirred-up volatility and fraud.

Over the years, exchanges like Mt. Gox collapsed under the weight of hacks and missing funds, and stablecoins like Tether saw inquiries into their backing long before the collapse of Terra Luna this spring.

Binance posted addresses that say they have cryptocurrency, and Zhao said he and ethereum Founder Vitalik Buterin would work on a proof of reserves protocol to solve everything. During the call, he said it would be a couple of weeks away, a common concept in the crypto world.

A Merkle tree is another name for the data structure blockchains use, where one ledger update leads back to another: it is not a magic algorithm that can prove how much crypto a firm holds. Zhao described a system that still relies on a central entity to choose which data points to submit to a third-party auditor, even if the third party is an objective protocol.

Showing a wallet with a big pile of coins tells the public nothing about the holdings of an international digital asset empire. In the case of FTX, there was nothing fishy about their centralized processes until the lights suddenly turned off.

Hindsight is 2022

Zhao said his firm has never traded on margin, handed out tokens, or paid back venture capitalists with their tokens. Zhao referenced FTX and other exchanges when he said this to 40,000 Twitter listeners.

“We have not taken from other people, we have not taken VC investments, we especially have not taken a VC investment and then given the money back to them through a loan or a reversing investment,” Zhao said. “And we just have never done that; we don’t have loans; we don’t have debt. We don’t owe anybody any money.”

Binance showed a backing made up of its coins, 40% of the total heald in a token called BNB and BUSD, a stablecoin created by partner firm Paxos. Another 21% of Binance’s posted reserves were in Tether, a USD-backed stablecoin. Binance said the posted addresses were just a “snapshot,” not total reserves.

Though FTX partner Alameda Research had massive backing from in-house coin FTT, Zhao said it is not a problem for Binance.

“BUSD is the most Fiat-backed stablecoin, fully auditable and transparent. They publish their monthly holdings report, whereas other stablecoins use a lot more corporate treasury bonds,” Zhao said. “Other stablecoins are black boxes that do not provide audit reports.”

Paxos, founded as itBit on the Bitcoin Exchange in 2012, offers tokenization and crypto exchange services in the US. Paxos was the first crypto company to receive a New York State Department of Financial Services trust company charter, and PayPal uses the firm for crypto trading.

According to the Paxos October 2022 BUSD backing report, Paxos has about $20 billion in reserves stored by U.S. treasury bonds that mature periodically every three months. The firm also has about $869 million in cash, held almost entirely with “Private Insurance Coverage” that appears non-FDIC insured.

On Monday, Paxos said U.S. law enforcement told the firm to shut down $19 million in funds tied to FTX after a hack.

What about money laundering?

Jason Brett, a former FDIC regulator and analyst for Forbes got his chance to ask a question about the Binance U.S. strategy after media reports claimed Binance processed money for Iran and Russia despite sanctions.

“The first thing is, we have a global operational standard; we use a different remote working model the only thing we need for our work is a laptop and a phone,” Zhao said. “The second is that we just want to provide tools for people who need crypto access.”

Zhao said Binance is antiwar and anti-dictator.

“Anything that helps people access crypto, we want to either help, invest, or do it ourselves. I think it is unethical for businesses to decide to sanction the entire country, I’m not sure if that’s even legal, but again legal has to do with each country. What’s legal in Russia may not be legal in the United States.”

He called the Iran article inaccurate because Binance relies on the same anti-money laundering tech as the intelligence community. He said Reuters was fed the wrong information from a small FTX-funded exchange called currency.com.

Association for open Industry books

A viewer of the conversation took the mic to ask Zhao why they can’t open their books completely, posting all wallet addresses and letting consumers see transactions themselves.

Zhao said if firms did that, other companies could use the data to front run the exchanges, giving away the valuable data they need to do business.

Another viewer asked Zhao if he felt he hurt FTX by announcing Binance would cancel the takeover deal.

“That would have hurt our customers; we have customers to think about,” Zhao said.

Binance and Zhao have said in updates on Twitter that their funds were caught up in the FTX crash alongside other consumers, losing a large portion of the more than $800 million they had on exchange at the time.

“As much as some people blame me for whistleblowing, or opening the bubble, etc. I apologize for that,” Zhao said.

Zhao also expressed interest in an industry recovery fund for companies battered by the FTX crash that was otherwise on the right track.

“For a various number of reasons, they may be negatively affected. But other than the FTX liquidity crisis, short of money in the short term, they are good projects with good products and community: we want to help those projects survive this turmoil,” Zhao said. “The best way is to help them with investments. This is a very good time to do this because most of these projects’ valuations are much more reasonable than a year ago.”

On Wednesday, Zhao announced support from the industry and investors for an industry bailout fund with an undetermined size or scope. He said four or five names from the global industry are interested in creating an Industry association worldwide, communicating with regulators, and focusing on proof of reserves.

“A lot of positive things are happening in the industry. I am very confident about the future of our industry.”