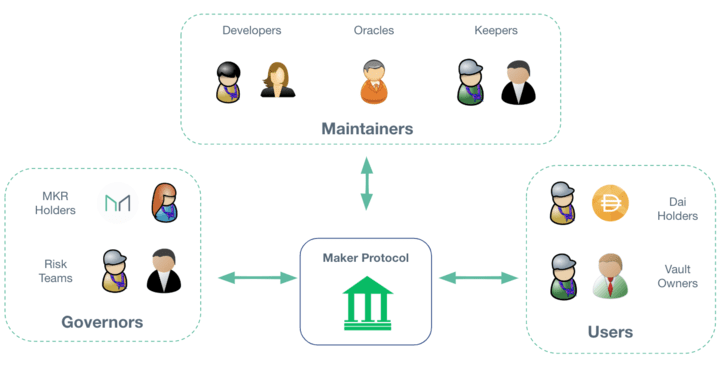

In this conversation, we talk with Rune Christensen of Maker Foundation about how he became one of the most influential builders in the DeFi ecosystem. Additionally, we explore the creation, experiences, and evolution of Decentralized Autonomous Organizations (DAOs), the nuances of stablecoins, the interaction between Maker and DeFi with traditional finance and traditional economies, and Maker’s approach to leveraging layer 2 solutions to aiding scalability and transaction throughput.

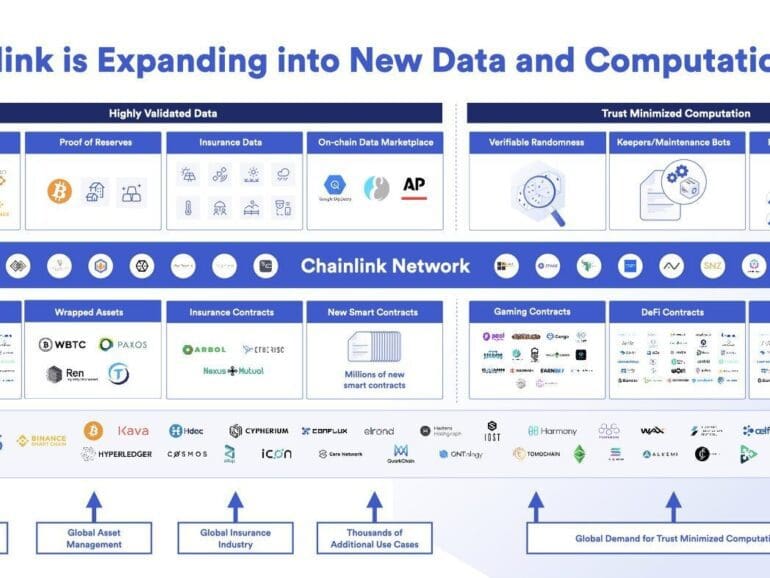

In this conversation, we chat with Sergey Nazarov. Sergey is Co-founder of Chainlink, the leading decentralized oracle network used by global enterprises & projects at the forefront of the blockchain space.

Chainlink is the industry standard oracle network for powering hybrid smart contracts. Chainlink Decentralized Oracle Networks provide developers with the largest collection of high-quality data sources and secure off-chain computations to expand the capabilities of smart contracts on any blockchain. Managed by a global, decentralized community, Chainlink currently secures billions of dollars in value for smart contracts across decentralized finance (DeFi), insurance, gaming, and other major industries.

More specifically, we touch on what it means to build in DeFi, what Oracles are like, what smart contracts are and what they enable, how all of this works and where the protocol is going, and so much more!

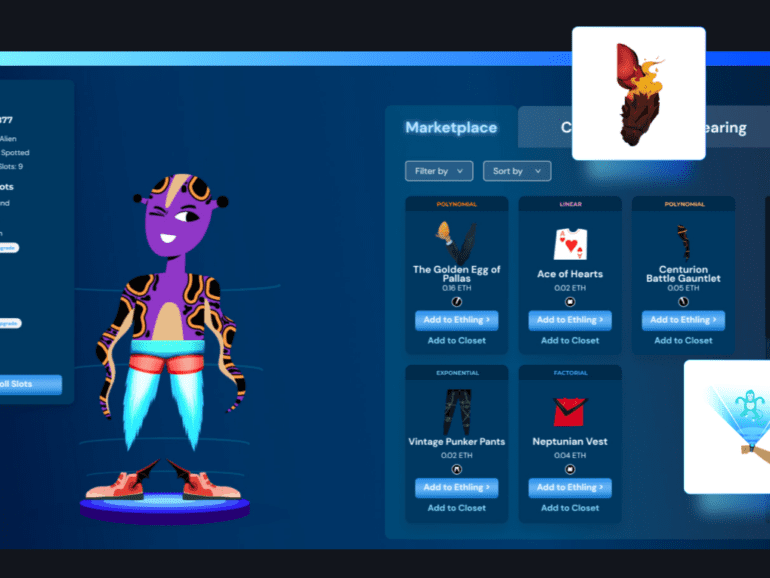

The evolution towards a financial metaverse is rapidly accelerating, with the growth in generative assets, profile picture avatars, the emerging derivative structures that build on their foundation, and DAOs that govern them. This article highlights the most novel developments, and builds the case for what a digital wallet / bank will need to be able to do in order to succeed on the way to this alien destination.

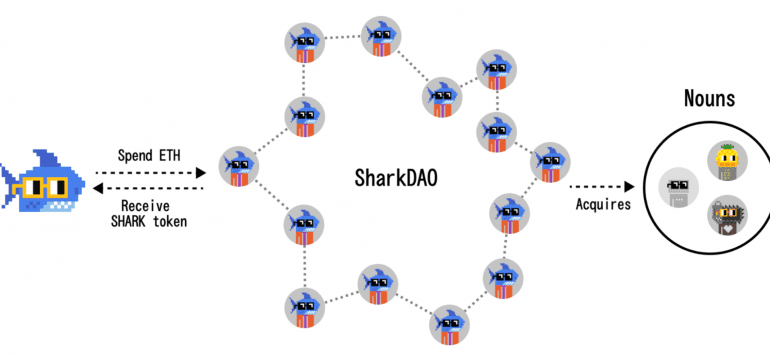

In this conversation, we chat with Nicholas – an NFT developer and a contributor to Juicebox, which is an awesome DAO enablement software, as well as SharkDAO and PartyDAO. He is very active in the ecosystems, got a solidity podcast called Solidity Galaxy Brain, a collaborator with multiple NFT artists, but I could go on and on. Let me welcome Nicholas to the podcast.

More specifically, we touch on the philosophy behind programming and coding, what a decentralized autonomous organization (DAO) truly is and what it is comprised of, various successful examples of DAOs that Nicholas has been involved in, the concept of community and the value that DAOs serve in this respect, how DAOs leverage tools to achieve their purpose, and so so much more!

Decentralized finance is formulating new mechanisms to correct for the pitfalls of liquidity mining, yield farming, and other early token distribution approaches. This is happening both at the level of individual projects like Alchemix or Fei, and at the level of industry wide consolidation through Olympus DAO and Tokemak. We explore where this evolution is going, and potential outcomes. In this first part of the analysis, we look closely at Olympus DAO, the concept of Protocol Owned Liquidity, and whether the economics make sense.

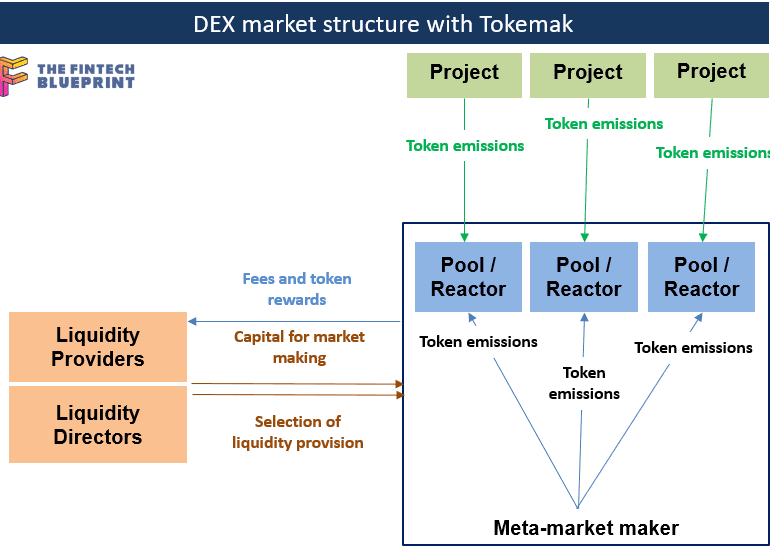

This week we continue the discussion of the shape of DeFi 2.0. We highlight Tokemak, a protocol that aims to aggregate and consolidate liquity across existing projects. Instead of having many different market makers and pools across the ecosystem, Tokemak could provide a clear meta-machine that optimizes rewards and rates across protocol emissions. This has interesting implications for overall industry structure, which we explore and compare to equities and asset management examples.

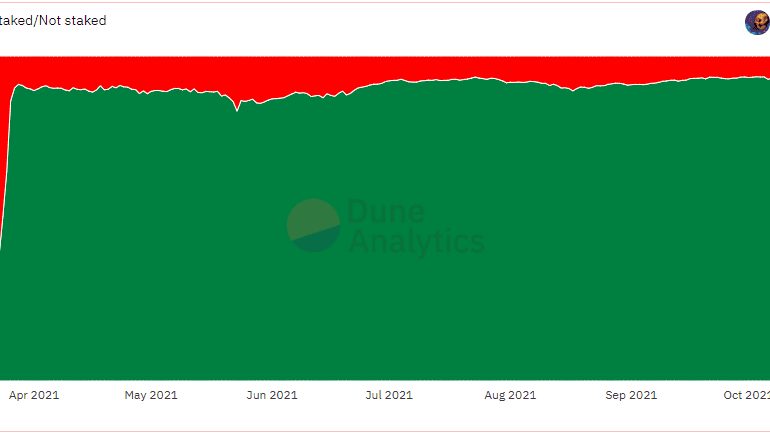

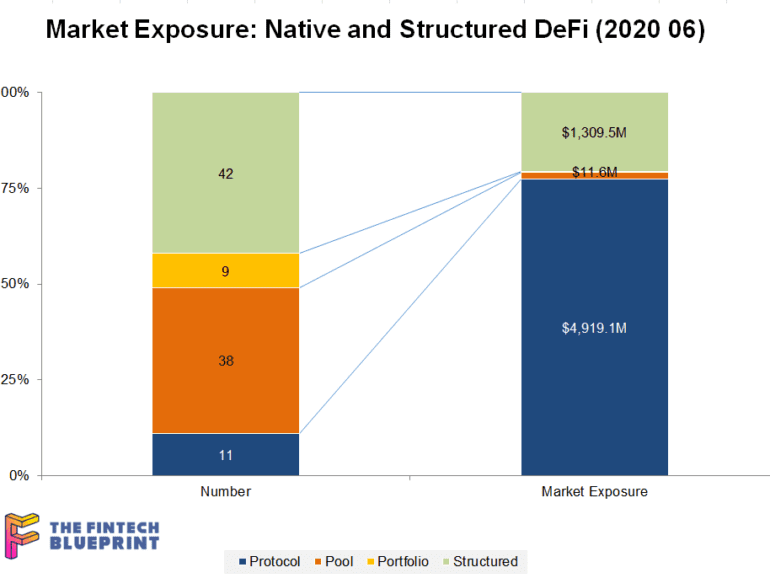

This week, I grapple with the concepts of financial centralization and decentralization, anchoring around custody, staking, and DeFi examples. On the centralized side, we look at BitGo's acquisition of Lumina, Coinbase Custody and its similarity to Schwab and Betterment Institutional. On the decentralized side, we examine the recent $500 million increase in value within the Compound protocol, as well as the recursive loops that could pose a broader financial risk to the ecosystem.

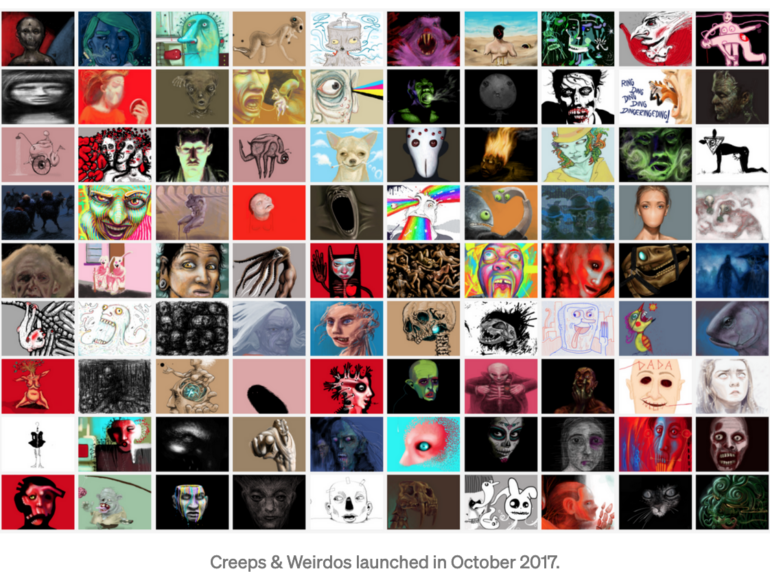

In this conversation, we talk with Beatriz Helena Ramos – artist, entrepreneur, film director, producer and illustrator – the mind behind DADA.art. DADA is “a space where everything is about cooperation and solidarity, which are amazing ways to allow self-expression, as well as constant inspiration. Additionally, we provide simple tools to encourage creativity, and erase intimidation.”

More specifically, we discuss Beatriz’s journey to creating DADA, decentralized power structures, community-inspired creative collaboration, assymetric rewards in NFT markets driving new value distribution methodologies, DADA’s latest project called “The Invisible Economy”, and technology-inspired and centric approaches to empower artists in the future.

This week, we cover these ideas:

The difference between building a Fintech company, and building an empire to transform the world

How Warren Buffett is the best in the world at getting leverage through third party capital to grow

How Elon Musk is the best in the world at re-investing capital into his own judgment and view of the future

The $1.2B BitGo acquisition by Galaxy Digital, and the growing footprint of Alameda Research

DAOs as a way for all of us to participate

Luxury and fashion markets are structurally different from finance or commodity markets in that they seek to limit supply in order to generate value. This increases price and social status. We can analogize these brand dynamics to what is happening in NFT digital object markets and better understand their function as a result.

We’re not cool. That’s why we’re in finance.

But people want to be cool. As highly social and intelligent animals, we want and need to belong, differentiate against each other, and negotiate for status. We create signals and hierarchies to create pockets of relational capital, which we then cash in for real world benefits.

Such mammalian realities are contrary to the economic rendering of the homo economicus, the abstracted rational agent making choices in financial models. In 2021, our financial models are waking up and instantiating themselves, becoming Decentralized Autonomous Organizations (DAOs), spun up by DeFi and NFT industry insiders, and implemented into commercial actions onchain.