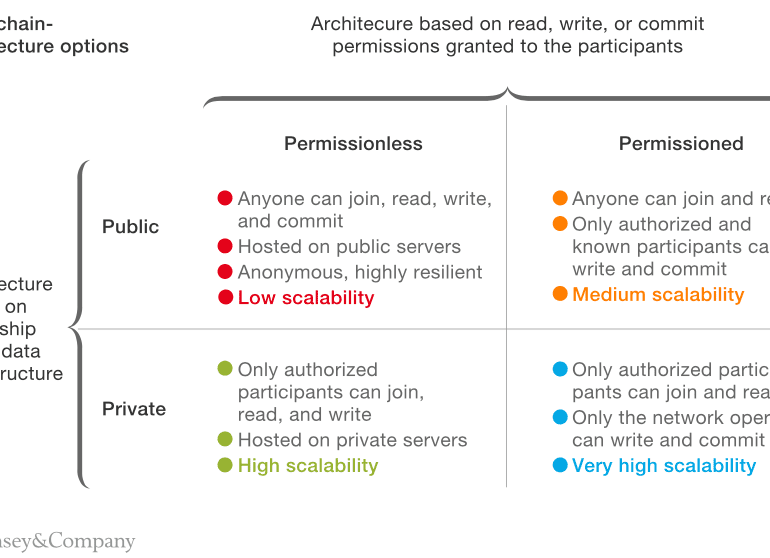

The web of investment bank technology, there are 20 or more core vendors on which systems run. Adding Blockchain to the mix merely adds a 21st system, which is by design incompatible with everything else. Thus enterprise chain projects have been focusing on integration and proofs of concepts, not re-engineering the core. But we know how this plays out -- as it has over and over again across Fintech. Digitizing "unimportant" channels and hoping for them to succeed simply doesn't work. See JP Morgan giving up on Finn, or Northern Trust capitulating its pioneering idea into Broadridge, or any other number of examples from Bloomberg to LPL Financial. Even the struggles of Digital Asset could be used as an example of the danger of working oneself into an existing web of solutions, and trying to preserve their dependencies.

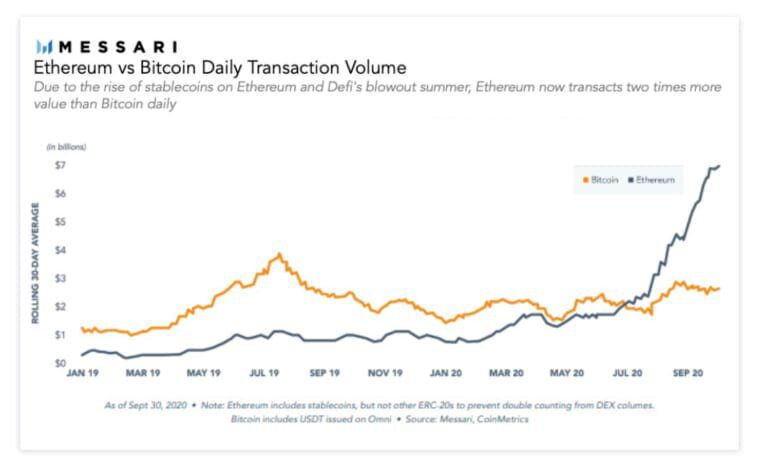

In this conversation, we talk with Patrick Berarducci of ConsenSys, about the valuations and multiples of capital markets protocols in Decentralized Finance on Ethereum, now making up over $60B in token value. Additionally, we explore the nuances of scaling Ethereum and its solutions, such as Metamask and the emerging Layer 2 protocols.

We also discuss law and regulation, including a fascinating story about Bernie Madoff from when Pat was a practicing attorney. This leads into a conversation about the embedded compliance nature of blockchain and crypto technology, the early days of ConsenSys, the path of crypto brokerages like Coinbase, and Metamask exhibiting emerging qualities of a neobank.

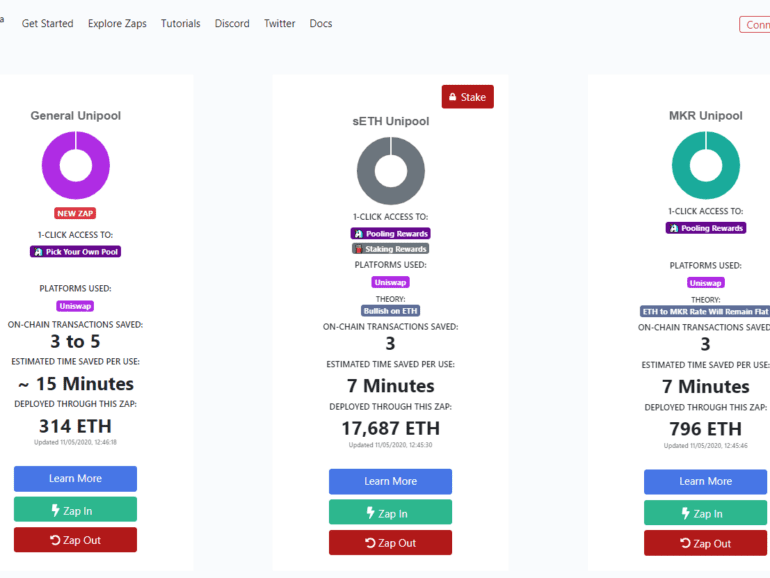

This week, I pause to reflect on the sales of (1) AdvisorEngine to Franklin Templeton and (2) the technology of Motif Investing to Schwab. Is all enterprise wealth tech destined to be acquired by financial incumbents? Has the roboadvisor innovation vector run dry? Not at all, I think. If anything, we are just getting started. Decentralized finance innovators like Zapper, Balancer, TokenSets, and PieDAO are re-imagining what wealth management looks like on Ethereum infrastructure. Their speed of iteration and deployment is both faster and cheaper, and I am more excited for the future of digital investing than ever before.

Sometimes more is more, and sometimes less is more.

In that spirit, we strongly urge you to check out Messari’s Crypto Theses for 2021. It is a mammoth work of 134 pages, covering each and every development in the ecosystem.

If you don’t want to fuss around with the email gate, the direct link is here.

We are going to pick out five things that are interesting to us substantively and provide a view below. By pick out, we mean screenshot and respond.

This week, we look at:

The fundraises of Jumio ($150MM), Feedzai ($200MM), and Chainalysis ($100MM) and the function they perform in the fintech industry

The nature of human competition and hierarchies, and why inequality is recreated across the various economic networks that exist

How the NFT markets have higher engagement than DeFi, which is more participatory than Fintech, which is more participatory than finance

The emergence of signalling in the crypto economy that resembles digital citizenship and social capital

In this conversation, we chat with Erick Calderon is the founder and CEO at Art Blocks, a platform for creating on-demand, generative art pieces. Since its launch a year ago, Art Blocks has garnered the attention of many, including auction house Sotheby’s, which recently sold 19 of the platform’s pieces in a deal totaling $81,000. Calderon, a native Houstonian, uses the online handle Snowfro, which stems from a snow cone stand he used to own.

More specifically, we touch on projection mapping, generative vs. algorithmic art, machine learning, smart contracts, the constructivist art movement, Artblocks’ unique approach to NFT algorithms and minting, NFT flipping vs. scalping, gas price wars, flashbots, dutch auctions, and the massive demand for anything Artblocks in the world today and the justifcations behind such demand.

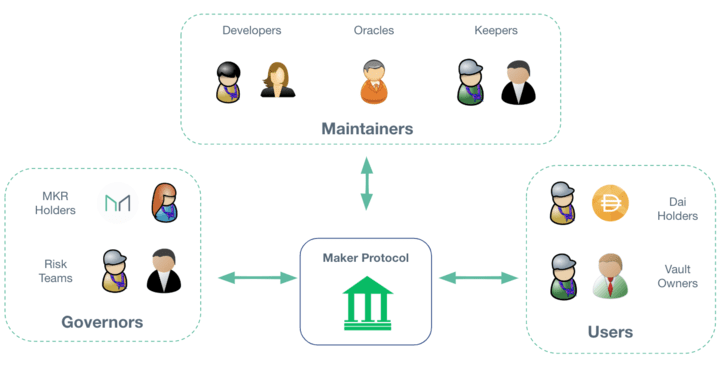

In this conversation, we talk with Rune Christensen of Maker Foundation about how he became one of the most influential builders in the DeFi ecosystem. Additionally, we explore the creation, experiences, and evolution of Decentralized Autonomous Organizations (DAOs), the nuances of stablecoins, the interaction between Maker and DeFi with traditional finance and traditional economies, and Maker’s approach to leveraging layer 2 solutions to aiding scalability and transaction throughput.

In this conversation, we talk with Camila Russo of The Defiant and author of The Infinite Machine, about her journey as a successful financial journalist was derailed by the Crypto boom and subsequent winter of 2017. Additionally, we explore the success behind her first book, the nuances of the NFT craze, and how The Defiant became one of the most popular crypto media brands to date.

In this conversation, we chat with Tim Frost, CEO and Co-Founder of Yield App, a fintech app making DeFi accessible to everyone. Prior to founding Yield, Tim helped build 2 previous digital banks, Wirex and EQIBank. Tim has also helped accelerate early-stage blockchain startups QTUM, NEO, Paxful, Polymath, and many others.

More specifically, we touch on all things crypto banking and debit cards, crypto onramps, juristictions and regulation, defi banking, yield generation mechanisms, and so much more!

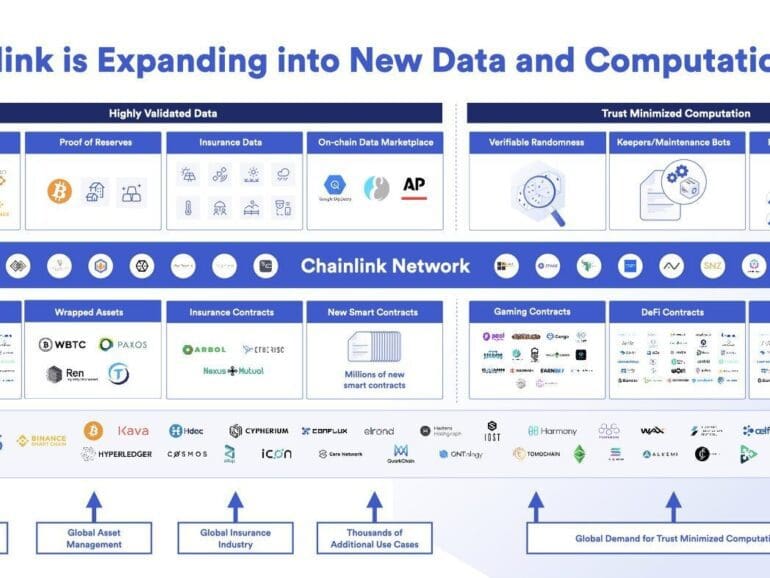

In this conversation, we chat with Sergey Nazarov. Sergey is Co-founder of Chainlink, the leading decentralized oracle network used by global enterprises & projects at the forefront of the blockchain space.

Chainlink is the industry standard oracle network for powering hybrid smart contracts. Chainlink Decentralized Oracle Networks provide developers with the largest collection of high-quality data sources and secure off-chain computations to expand the capabilities of smart contracts on any blockchain. Managed by a global, decentralized community, Chainlink currently secures billions of dollars in value for smart contracts across decentralized finance (DeFi), insurance, gaming, and other major industries.

More specifically, we touch on what it means to build in DeFi, what Oracles are like, what smart contracts are and what they enable, how all of this works and where the protocol is going, and so much more!