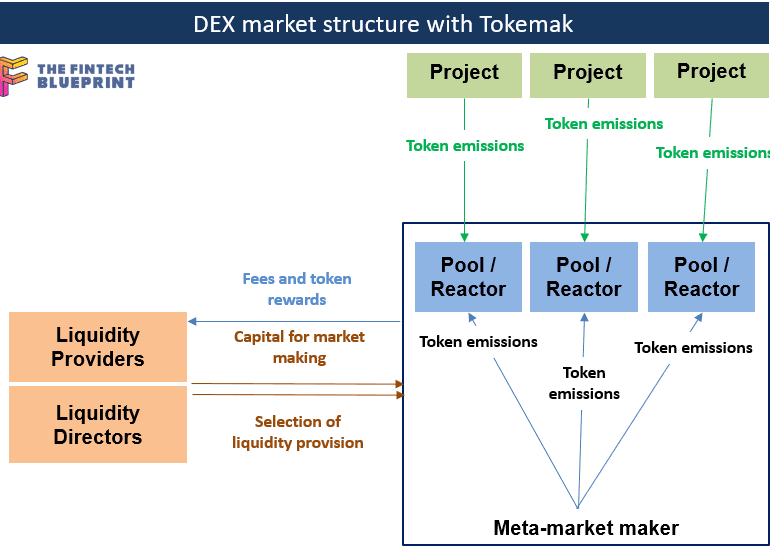

This week we continue the discussion of the shape of DeFi 2.0. We highlight Tokemak, a protocol that aims to aggregate and consolidate liquity across existing projects. Instead of having many different market makers and pools across the ecosystem, Tokemak could provide a clear meta-machine that optimizes rewards and rates across protocol emissions. This has interesting implications for overall industry structure, which we explore and compare to equities and asset management examples.

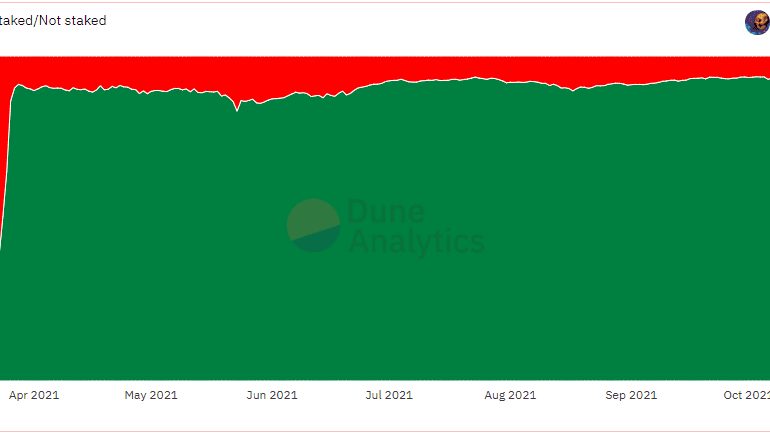

Decentralized finance is formulating new mechanisms to correct for the pitfalls of liquidity mining, yield farming, and other early token distribution approaches. This is happening both at the level of individual projects like Alchemix or Fei, and at the level of industry wide consolidation through Olympus DAO and Tokemak. We explore where this evolution is going, and potential outcomes. In this first part of the analysis, we look closely at Olympus DAO, the concept of Protocol Owned Liquidity, and whether the economics make sense.

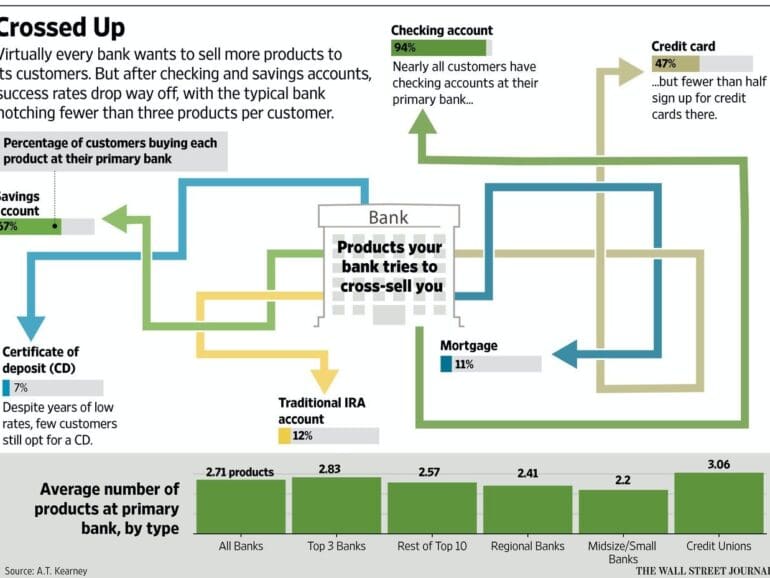

We focus on the law of unintended consequences, and how making rules often creates the opposite outcome from the desired results. The analysis starts with the Cobra effect, and then extends to a discussion of the Wells Fargo account scandal, dYdX trading farming, Divergence Ventures executing Sybil attacks, and Federal Reserve insider trading. We touch on the concepts of credit underwriting and token economies, and leave the reader with a question about rules vs. principles.

In this conversation, we chat with Tim Frost, CEO and Co-Founder of Yield App, a fintech app making DeFi accessible to everyone. Prior to founding Yield, Tim helped build 2 previous digital banks, Wirex and EQIBank. Tim has also helped accelerate early-stage blockchain startups QTUM, NEO, Paxful, Polymath, and many others.

More specifically, we touch on all things crypto banking and debit cards, crypto onramps, juristictions and regulation, defi banking, yield generation mechanisms, and so much more!

In this conversation, we chat with Gabriel Anderson – Managing Director at Tachyon, Head of Market Strategy & Business Intelligence at ConsenSys Labs. Former Head of VaynerMedia. Alumnus of Merrill Lynch.

More specifically, we touch on what Tachyon is, how it works, and who it’s for, the growth of crypto, and what needs to come next to allow the widespread adoption of crypto by mainstream society. Gabriel talks about the best projects he has seen so far that combine NFTs with other elements of DeFi and crypto, and what he’d like to see more of in the future.

In this conversation, we chat with Erick Calderon is the founder and CEO at Art Blocks, a platform for creating on-demand, generative art pieces. Since its launch a year ago, Art Blocks has garnered the attention of many, including auction house Sotheby’s, which recently sold 19 of the platform’s pieces in a deal totaling $81,000. Calderon, a native Houstonian, uses the online handle Snowfro, which stems from a snow cone stand he used to own.

More specifically, we touch on projection mapping, generative vs. algorithmic art, machine learning, smart contracts, the constructivist art movement, Artblocks’ unique approach to NFT algorithms and minting, NFT flipping vs. scalping, gas price wars, flashbots, dutch auctions, and the massive demand for anything Artblocks in the world today and the justifcations behind such demand.

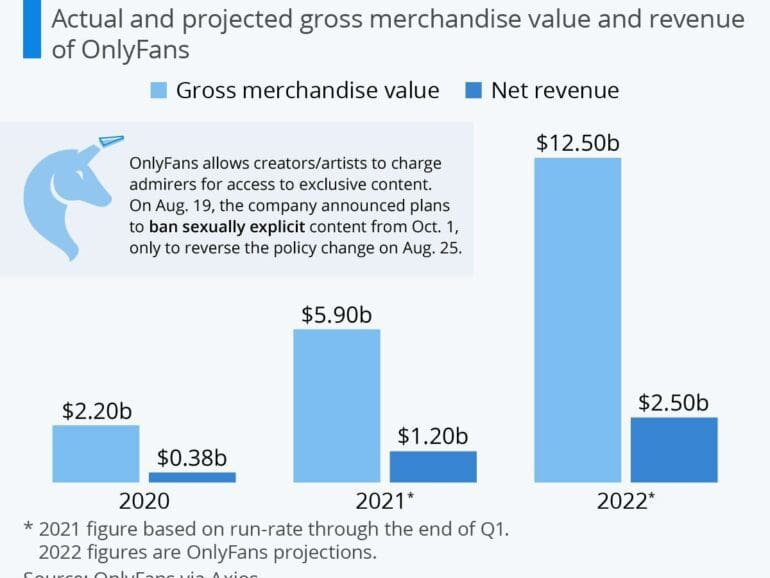

We talk about OnlyFans, and how its bank vendors pressured it to try to ban adult content, and how and why that failed. We also discuss the crypto tax provisions in the Senate version of the $1 trillion infrastructure bill, and their impracticality. These themes are tied together with a metaphysical hypothesis about the role of financial services, anchored in a discussion of the Platonic model of the mind. How are rationality, emotion, and social context involved to define the shape of our industry?

In this video conversation we feature a roundtable by The Defiant exploring how and if the gap between Fintech and DeFi will be bridged.

DeFi Panelists

Lex Sokolin, head economist at ConsenSys

Santiago Roel Santos, angel investor

Spencer Noon, Investor at Variant

Vance Spencer, co founder at Framework Ventures

Fintech Panelists

Keith Grose, head of Plaid international

Nik Milanovi?, founder of This Week in Fintech

Simon Taylor, co-founder of 11:FS

Bruno Werneck, Business & Corporate Development at Plaid

Moderator

Camila Russo, Founder of The Defiant

central bank / CBDCChinacivilization and politicsCryptoDAOsdecentralized financegovernanceIndiamacroeconomicsMetaverse / xRregulation & compliance

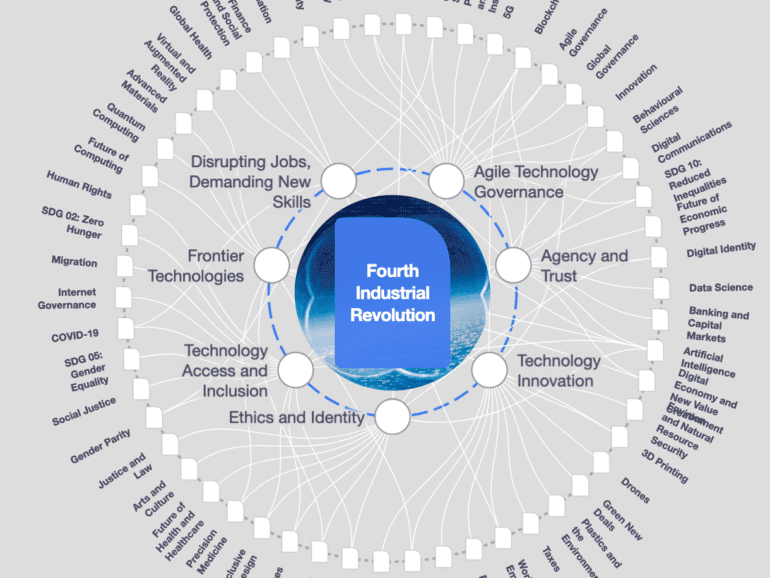

·In this conversation, we are so lucky to tap into the brilliant mind of none other than Sheila Warren who sits on the Executive Committee of the World Economic Forum and is a key member in the executive leadership of the Forum’s Centre for the Fourth Industrial Revolution (C4IR), in which she oversees strategy across the entire C4IR Network, consisting of centers in 13 countries. Sheila also holds board member and advisory positions at multiple institutions and organizations including The MIT Press (Cryptoeconomic Systems), The Organisation for Economic Co-operation and Development (OECD), NGO network TechSoup and she is a Member of The Bretton Woods Committee.

More specifically, we discuss her professional journey from small claims court to NGO Aid to refugees to corporate law to The WEF, touching on rational choice theory, corporate personhood and its correlation to the growth around ESG, new substrates, DAOs and protocols, artificial intelligence, the purpose of The World Economic Forum and its impact on governments and society alike, and just so much more!

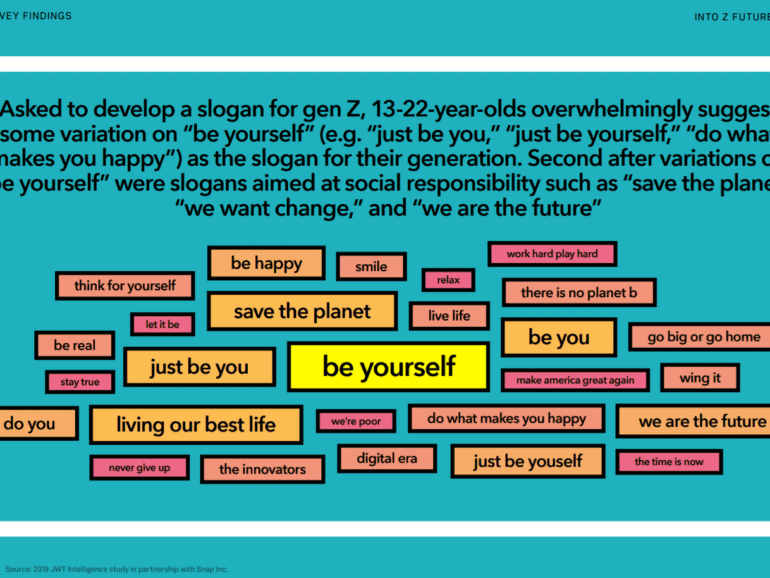

Gen Z is becoming a cultural force, reshaping culture and online society. This is starting to echo in fintech startups and crypto protocols. We explore how financial communities are beginning to congeal into DAOs, their nature and structure, and potential longer terms outcomes. The analysis identifies the differences in Millennial and Gen Z approaches — however imperfectly — to explain the frontier of social tokens and why ShapeShift chose decentralization, while Revolut chose decacorn funding.

DAOs are not socialist communes built for the benefit of humankind. Rather, they are techno-fortresses to defend, and make valuable, exclusive online tribes.

Whereas Millennials dream about a VC-funded unicorn startup, permissioned into wealth with capital from traditionally successful investors, Gen Z and crypto natives dream about bottoms-up community syndicates with trillions to spend on the sci-fi future, unshackled from regulatory overhang and the sins of the 2008 quantitative-easing past.