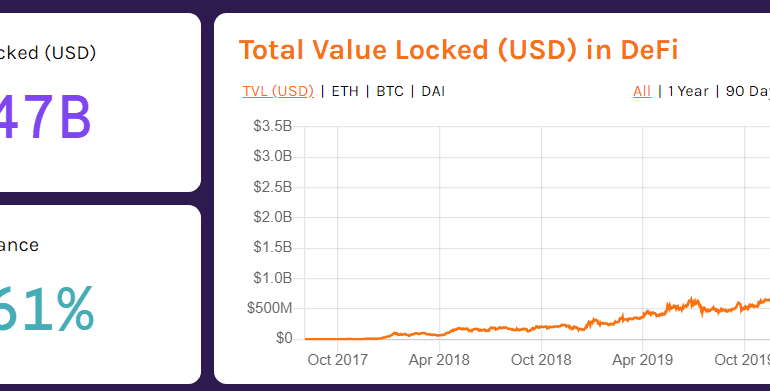

This week, we consider the impact of financial infrastructure collapse and who really gets hurt through the lens of Wirecard, Enron, and Lehman Brothers. Yes, there are investors in the entity that will lose value. But there are also clients and counterparties of Wirecard, like Curve, Revolut, and Crypto.com. In the case of Lehman, there was a $40 trillion derivatives notional amount that took twenty years to wind down. We also consider the most recent $500,000 hacking in DeFi of an automated market maker to see if there are common threads to be drawn between the two worlds.

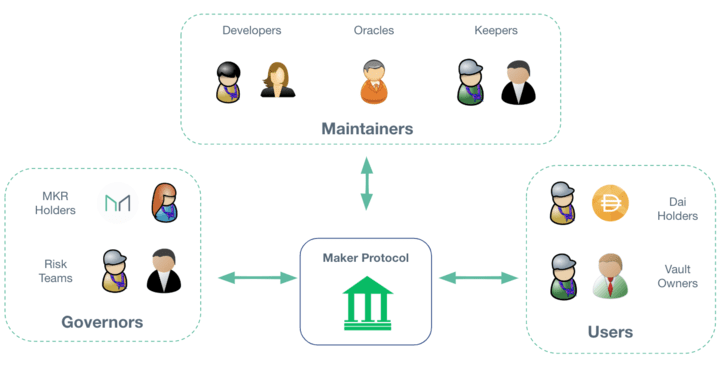

Welcome back to the Fintech Blueprint podcast. Today we share a panel recording that Lex moderated with Steven Becker, President and COO of MakerDAO, and Lucas Vogelsang, CEO and Co-Founder of Centrifuge.

The session was hosted at LendIt Fintech Digital, a vibrant community of Fintech and banking leaders.

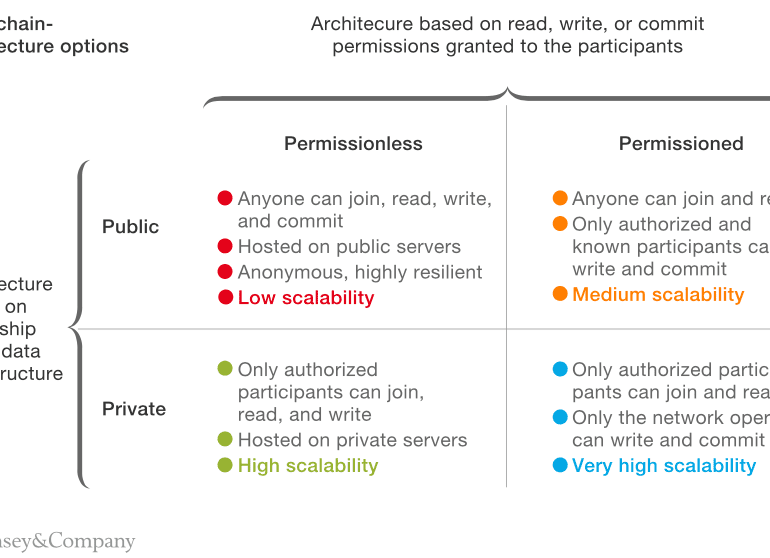

Feelings and emotions at industry events matter. The narrative at the more traditional conferences is that Fintech innovation is just incremental improvement, and that blockchain has struggled to bring production-level quality software and stand up new networks. This isn't strictly true -- see komgo, SIX, or any of the public chains themselves -- but the overall observation does stand. Much of Fintech has been channeled into corporate venture arms, and much of blockchain has been trapped in the proof-of-concept stage, disallowed from causing economic damage to existing business.

In this conversation, we talk with Rune Christensen of Maker Foundation about how he became one of the most influential builders in the DeFi ecosystem. Additionally, we explore the creation, experiences, and evolution of Decentralized Autonomous Organizations (DAOs), the nuances of stablecoins, the interaction between Maker and DeFi with traditional finance and traditional economies, and Maker’s approach to leveraging layer 2 solutions to aiding scalability and transaction throughput.

This week, we look at:

How the medical reality is accelerating remote work and digital commerce, including the success of buy-now-pay-later companies like Affirm and Klarna

The emergence of virtual worlds and video game environments that generate $ billions in revenue and have millions of participants, with examples of Zwift, Fortnite, Tomorrowland, Roblox, Genshin Impact

How to connect digital environments to digital communities and their economic activity, including through mechanisms like non-fungible-tokens in Rarible and Async Art

Advice for shifting thinking from manufacturing financial product, to starting with the customer, to leveraging the community

In this conversation, we talk with Patrick Berarducci of ConsenSys, about the valuations and multiples of capital markets protocols in Decentralized Finance on Ethereum, now making up over $60B in token value. Additionally, we explore the nuances of scaling Ethereum and its solutions, such as Metamask and the emerging Layer 2 protocols.

We also discuss law and regulation, including a fascinating story about Bernie Madoff from when Pat was a practicing attorney. This leads into a conversation about the embedded compliance nature of blockchain and crypto technology, the early days of ConsenSys, the path of crypto brokerages like Coinbase, and Metamask exhibiting emerging qualities of a neobank.

central bank / CBDCCryptodecentralized financeopen sourcephilosophyregulation & compliancestablecoins

·This week, we look at:

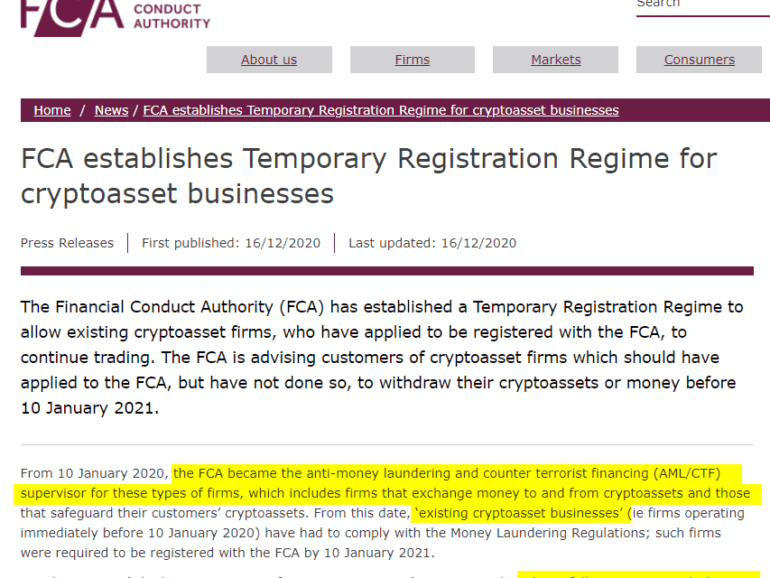

Proposed US regulation from FinCEN, legislation from the House of Representatives, and UK FCA registration requirements that would impact the crypto industry

The difference between competition for share within an established market, and competition between market paradigms (think MSFT vs. open source, finance vs. DeFi)

The crypto custodian moves from BBVA, Standard Charters, and Northern Trust

The bank license moves from Paxos and BitPay, as well as the planned launch of a new chain by Compound, in the context of the framework above

Permissionless finance is a paradigm breach. It pays no regard for the very nature of the incumbent financial market. Without banking, it creates its own banks. Without a sovereign, it bestows law on mathematics and consensus. Without broker/dealers, it creates decentralized robots. And so on. It tilts the world in such a way as to render the economic power of the incumbent financial market less important. Not powerless -- the allure of institutional capital is a constant glimmer of greedy, opportunistic hope. But the hierarchy of traditional finance does not extend to DeFi, and thus has to be re-battled for the incumbent. This is cost, and annoying.

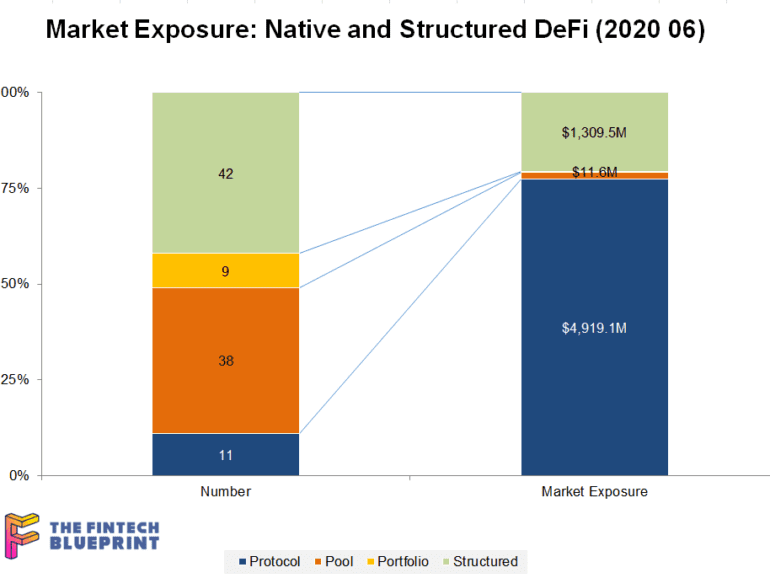

This week, I grapple with the concepts of financial centralization and decentralization, anchoring around custody, staking, and DeFi examples. On the centralized side, we look at BitGo's acquisition of Lumina, Coinbase Custody and its similarity to Schwab and Betterment Institutional. On the decentralized side, we examine the recent $500 million increase in value within the Compound protocol, as well as the recursive loops that could pose a broader financial risk to the ecosystem.

Sometimes more is more, and sometimes less is more.

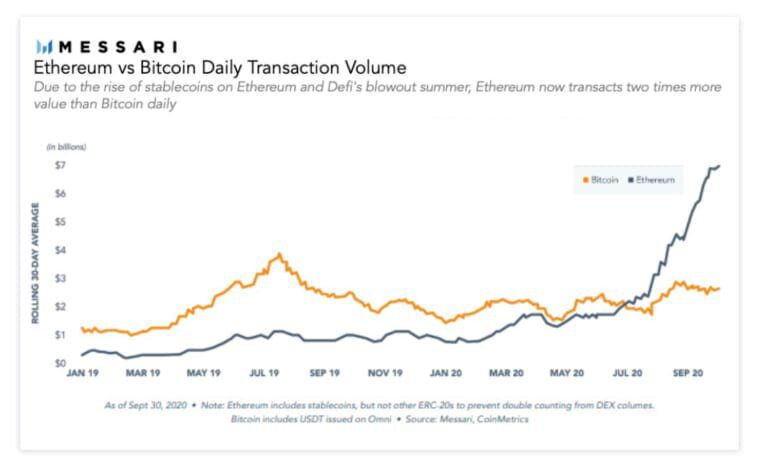

In that spirit, we strongly urge you to check out Messari’s Crypto Theses for 2021. It is a mammoth work of 134 pages, covering each and every development in the ecosystem.

If you don’t want to fuss around with the email gate, the direct link is here.

We are going to pick out five things that are interesting to us substantively and provide a view below. By pick out, we mean screenshot and respond.

In this conversation, we talk with Camila Russo of The Defiant and author of The Infinite Machine, about her journey as a successful financial journalist was derailed by the Crypto boom and subsequent winter of 2017. Additionally, we explore the success behind her first book, the nuances of the NFT craze, and how The Defiant became one of the most popular crypto media brands to date.