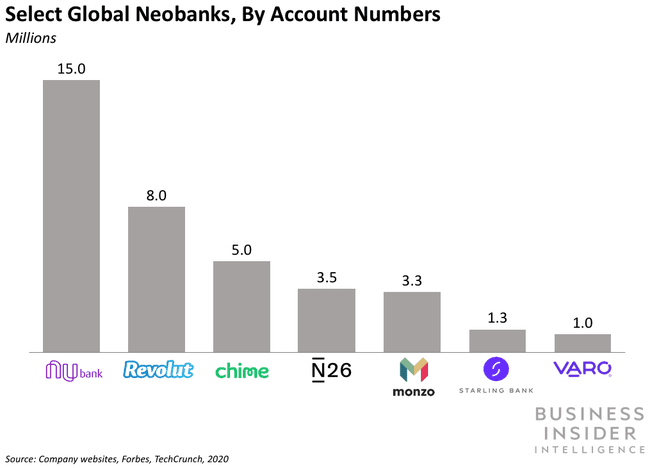

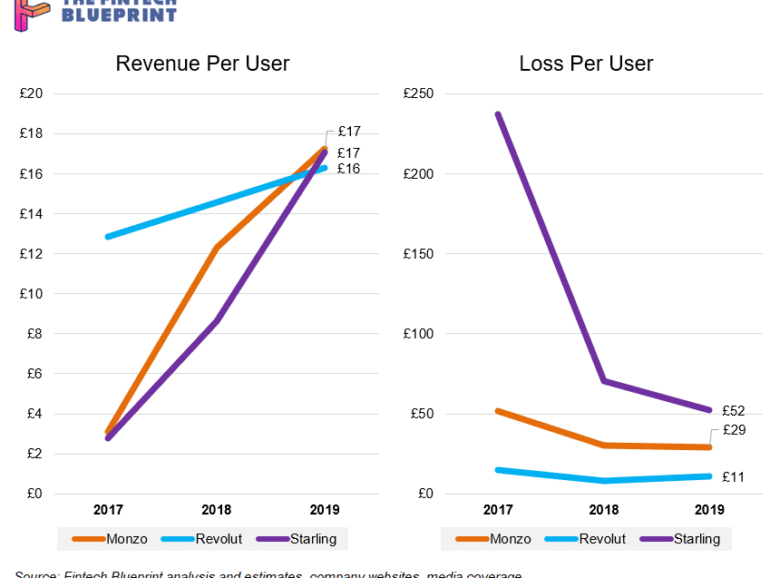

In this conversation, we break down recently published annual reports from Revolut, Starling and Monzo, three of the leading European digital banks. There are some fascinating insights to be drawn from the documents, especially in the context of the broader global fintech market. This is rich subject matter, and we surely didn’t cover everything.

This week, we look at:

The financial model behind Monzo, and comparisons to Revolut and Starling

How the Eastern super apps inspired the marketplace model, and why that success is hard for neobanks to replicate

Paths from losing $100 million per year to break-even and enabling digital assets and other financial products

Facebook Financial forming to take over payments and commerce

big techcentral bank / CBDCdecentralized financedigital lendingdigital securities / STOenterprise blockchainexchanges / cap mkts

·This week, we look at:

How the music industry needed The Pirate Bay and Napster

Why J.P.Morgan is paying $1B in fines for allegedly manipulating the precious metals market

Whether DeFi is flirting with self-dealing and veering towards apathy

Why QAnon and 8chan are a bad example for global governance

And how the European Commission’s proposed crypto-market rules are highly productive for blockchain-based capital markets infrastructure

This week, we look at:

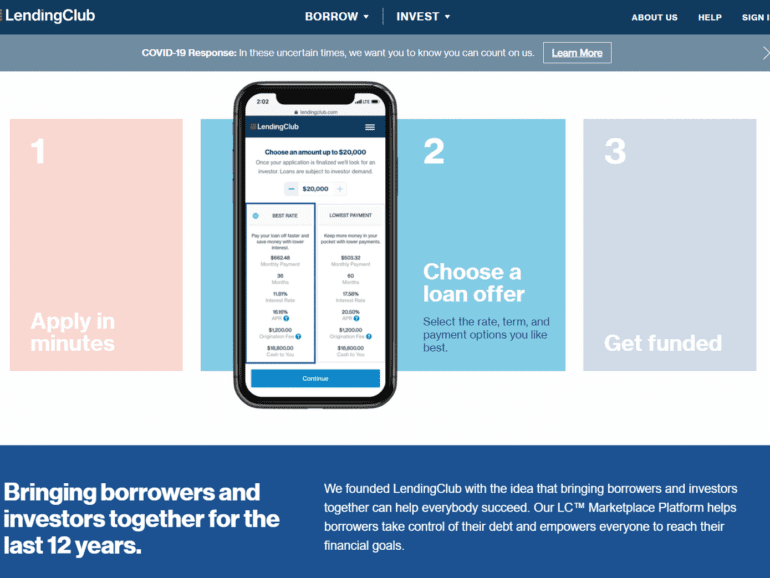

Lending Club, the peer-to-peer lending innovator, turning off peer-to-peer lending after having a bank in its pocket

Consolidation of the UK's largest crowdfunders, CrowdCube and Seedrs, and their limited economics

The scale of the Morgan Stanley and Eaton Vance deal, creating a $1.2 trillion asset manager

The struggle of peer-to-peer models more generally, and whether the blockchain movement can overcome the Prisoner's Dilemma

big techdigital lendingdigital transformationInvestingmega banksOpen Bankingpaytechroboadvisorsuper app

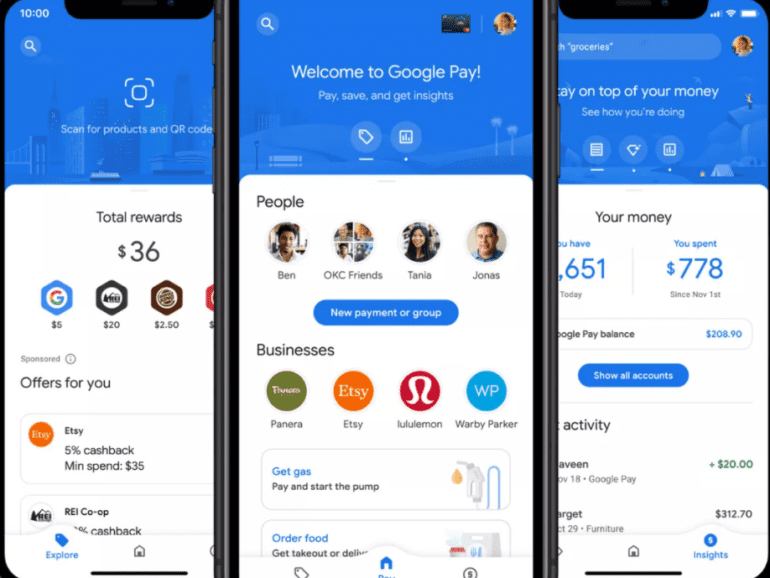

·Google has done it. In a massive update to Google Pay, the company highlighted exactly the direction of travel for high tech, fintech, and the global banks. It has articulated a vision for competing with Apple Pay and Ant Financial. Let's walk through the features.

This week, we look at:

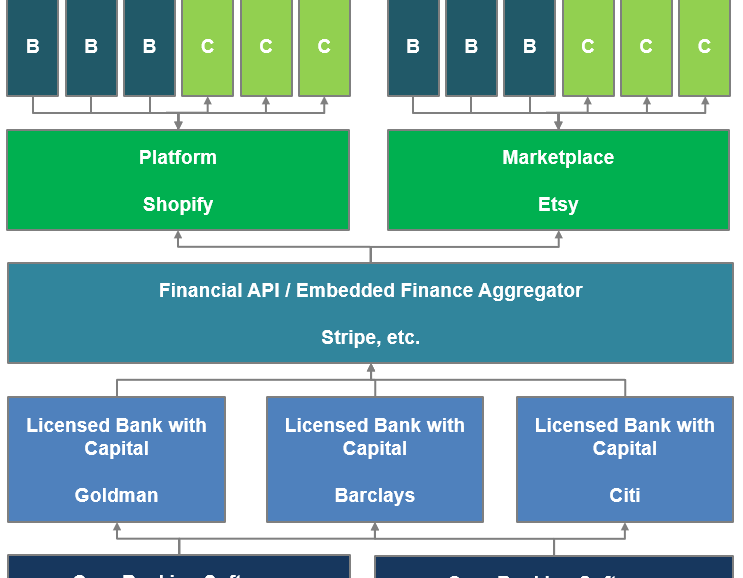

Embedded finance as a growing theme with the $10B Affirm IPO and Stripe's launch of Treasury

The customer types that each of these firms is attempting to convert into their product, and what this tells us about economic growth

A framework for understanding the emerging value chain of digital finance, and the role of platforms and marketplaces

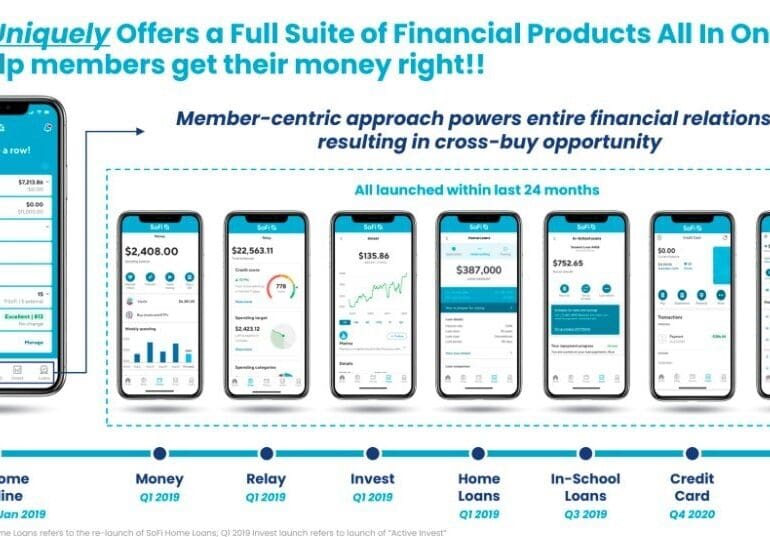

In this conversation, Will Beeson and I break down a few important pieces of recent news — the SPACs for SoFi and Bakkt, and Plaid/Visa falling apart.

SoFi is going public with a SPAC deal worth over $8 billion. A few things we touch on in detail: (1) this is still largely a lender, (2) there is a gem of an embedded finance play called Galileo that SoFi owns, and (3) the multiple is a little over 10x T12 revenues, which is not crazy expensive, but not cheap.

Speaking of Galileo and finance APIs, we transition to Plaid, and how it is is not going to be one of the networks in Visa’s network of networks. Who wins and who loses in the equation? And last, we cover the Bakkt SPAC of over $2 billion and our view on its future.

This week, we look at:

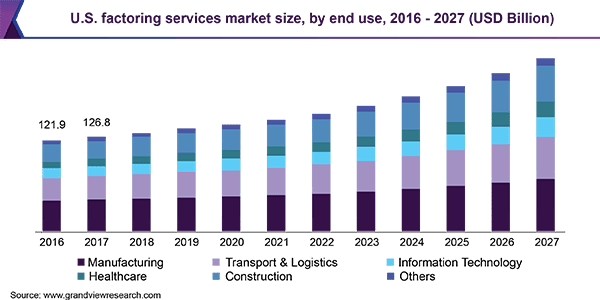

Pipe’s $150 million raise at a $2 billion valuation to turn annualized revenue run-rate into a new peer-to-peer asset class

BitClout’s $200 million of Bitcoin contributions and its mechanisms to turn social media profiles into digital assets

How both projects trade future performance for current monetization

This week, we cover these ideas:

The nature of digital identity, and the difference between a representation at some moment of time vs. a record of your being

The launch of the DeFi Passport by Arcx and how it can be useful for underwriting

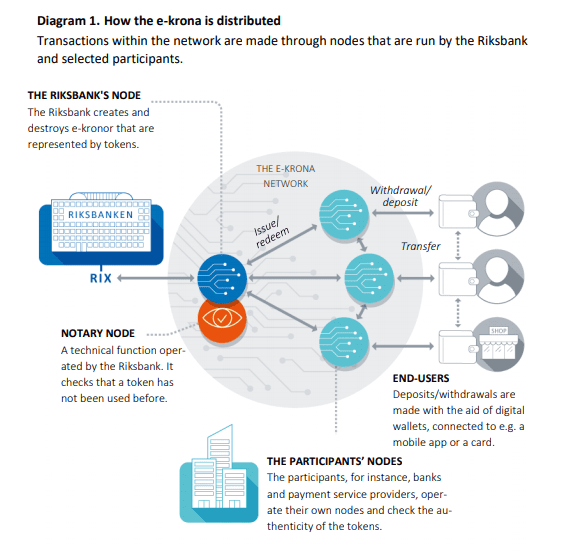

The European Digital Wallet, and the implication of such a development for CBDCs and government services

China’s CBDC, Sweden’s BankID, and other existential crises

If you want to go deeper on this topic, we strongly recommend our conversation with Michael Cena of the Ceramic Network here. Whereas Michael started working on the identity problem by trying to add labels to people, where he ended up is creating a protocol that tracks historic software activity and interactions between actors. In thinking about the Ship of Theseus, this is the solution that says — your identity is your journey through the river of time itself, and not any particular stop you make along the way.

Chinadigital lendingeCommerceMetaverse / xRneobanksmall businessSocial / Communitysuper appsupply chain / trade

·This week, we cover these ideas:

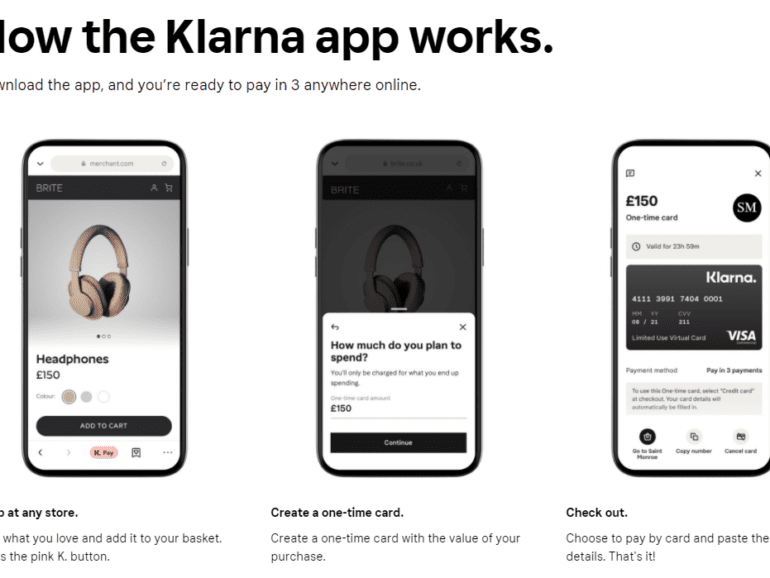

Klarna’s $640 million raise and its $45 billion valuation, and how its business model arbitrages the payments revenue pool to build a lending business

Pinduoduo’s growth path to a $150B marketcap, and the links between shopping, media, and financial mechanisms that help it compete with Alibaba

A comparison of approaches to growth and economics

Implications for crypto assets for capturing “the real economy”

Klarna is raising $640 million on a $45 billion private valuation, with over $1 billion in net operating income. The buy-now-pay-later company has over 90 million active customers and 250,000 merchants. It was founded in Sweden in 2005.

On the other side of the ocean, Chinese ecommerce company Pinduoduo is beating Alibaba with 820 million active buyers, generates over $3 billion in revenue per quarter, connects buyers to 12 million farmers, and has a market capitalization of $150 billion. It was founded in China in 2015.