TruVision Consumer Property Insights for Portfolio Management protects borrowers and lenders through a holistic view of property value fluctuation risks.

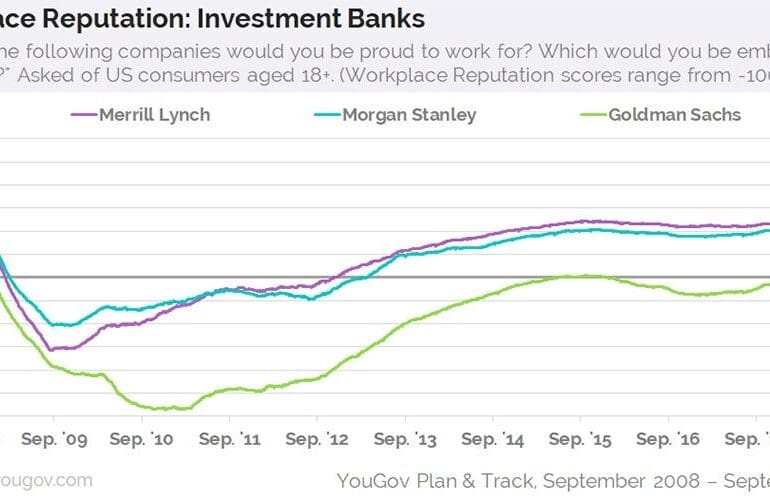

Two things are on my mind: (1) the acquisition of United Capital by Goldman Sachs, and (2) Mike Cagney's Figure securing a $1 billion funding line from Jefferies and WSFS for blockchain-tracked home equity loans. Both are outcomes of complex, interesting, somewhat unexpected processes -- and both are examples of demand-driven market expansion. Let me highlight that again. Both of these are consumer-centric developments, and not product-driven developments, which goes to the core of the problem in the financial services industry.

big techdigital lendingdigital transformationInvestingmega banksOpen Bankingpaytechroboadvisorsuper app

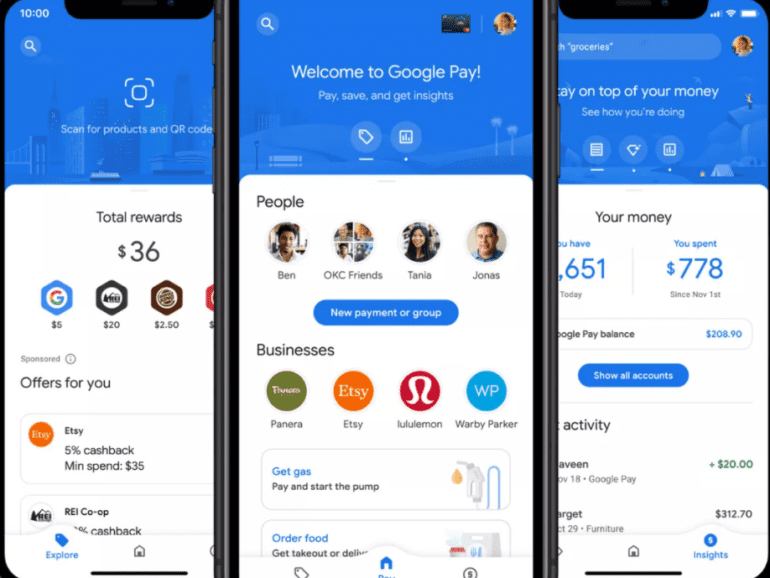

·Google has done it. In a massive update to Google Pay, the company highlighted exactly the direction of travel for high tech, fintech, and the global banks. It has articulated a vision for competing with Apple Pay and Ant Financial. Let's walk through the features.

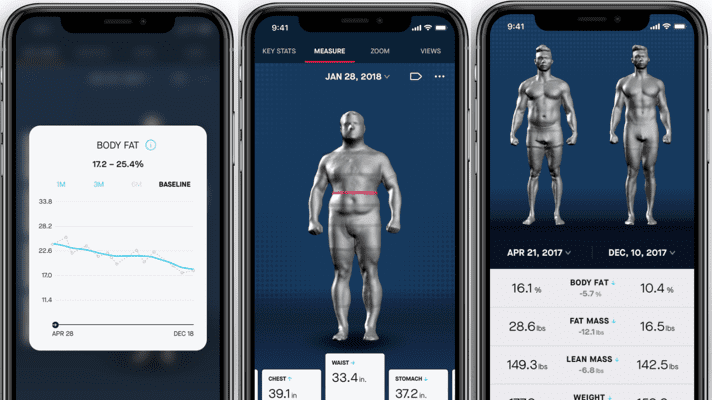

We look at some of the recent Fintech bundling news that boggle the mind. Neobank Chime just raised a mammoth round from DST Global, valuing it at $6 billion. Figure raised another $60 million round. Goldman is launching a retail roboadvisor. Revolut is offering pensions. Wealthfront is offering mortgages. The world is upside down. We cool down with pictures showing augmented reality implementations in commerce and finance, and finish with an elevated thought about the future.

This week, we cover these ideas:

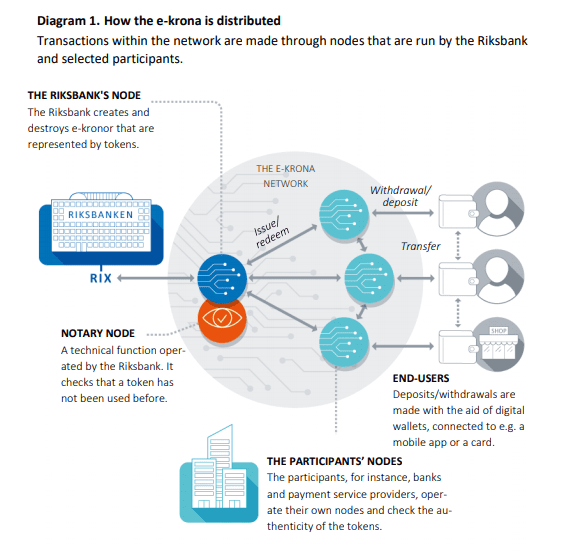

The nature of digital identity, and the difference between a representation at some moment of time vs. a record of your being

The launch of the DeFi Passport by Arcx and how it can be useful for underwriting

The European Digital Wallet, and the implication of such a development for CBDCs and government services

China’s CBDC, Sweden’s BankID, and other existential crises

If you want to go deeper on this topic, we strongly recommend our conversation with Michael Cena of the Ceramic Network here. Whereas Michael started working on the identity problem by trying to add labels to people, where he ended up is creating a protocol that tracks historic software activity and interactions between actors. In thinking about the Ship of Theseus, this is the solution that says — your identity is your journey through the river of time itself, and not any particular stop you make along the way.

InformedIQ helps lenders find opportunities in today’s challenging environment while others pull back. The main difference is who embraces AI.

In this conversation, Will Beeson and I break down a few important pieces of recent news — the SPACs for SoFi and Bakkt, and Plaid/Visa falling apart.

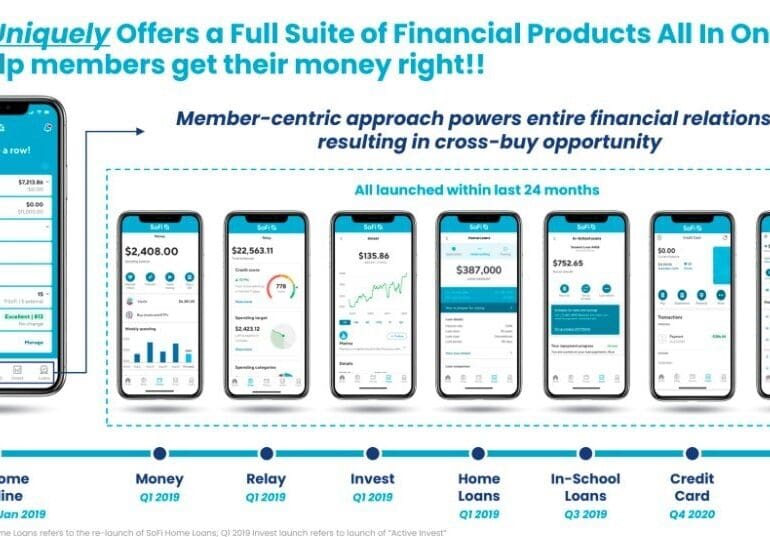

SoFi is going public with a SPAC deal worth over $8 billion. A few things we touch on in detail: (1) this is still largely a lender, (2) there is a gem of an embedded finance play called Galileo that SoFi owns, and (3) the multiple is a little over 10x T12 revenues, which is not crazy expensive, but not cheap.

Speaking of Galileo and finance APIs, we transition to Plaid, and how it is is not going to be one of the networks in Visa’s network of networks. Who wins and who loses in the equation? And last, we cover the Bakkt SPAC of over $2 billion and our view on its future.

·

Lendbuzz blends its founders’ early experiences with AI to disrupt traditional assessment methods and widen the pool of credit-worthy individuals.

Financial institutions struggle to meet consumer demand for more payment types, mainly because they lack the proper data science capabilities. This drives suboptimal strategies like layering multiple payment types.

This week, we put on the Goldman hat and go shopping for companies. We buy a little bit of Folio and sell some Motif. We look at Personal Capital and the $1 billion it wants for its $12 billion of assets. We examine the private markets with Addepar / iCapital and SharesPost / Forge, and then move over to the banking sector. Should we buy Wells Fargo, as rumored, or some digital wallet apps? Read on for how to acquire a best-in-class Fintech.