Despite a stay, 1071 is expected to be implemented. Banks may need to rethink their approach to data processing.

In this episode, we connect with serial founder Ohad Samet, CEO of TrueAccord. Ohad has been working in fintech machine learning for a decade and a half, applying multi-dimensional mathematics to consumer finance. The result? A more empathetic approach to the traditionally gnarly problem of debt collection.

Chinadigital lendingeCommerceMetaverse / xRneobanksmall businessSocial / Communitysuper appsupply chain / trade

·This week, we cover these ideas:

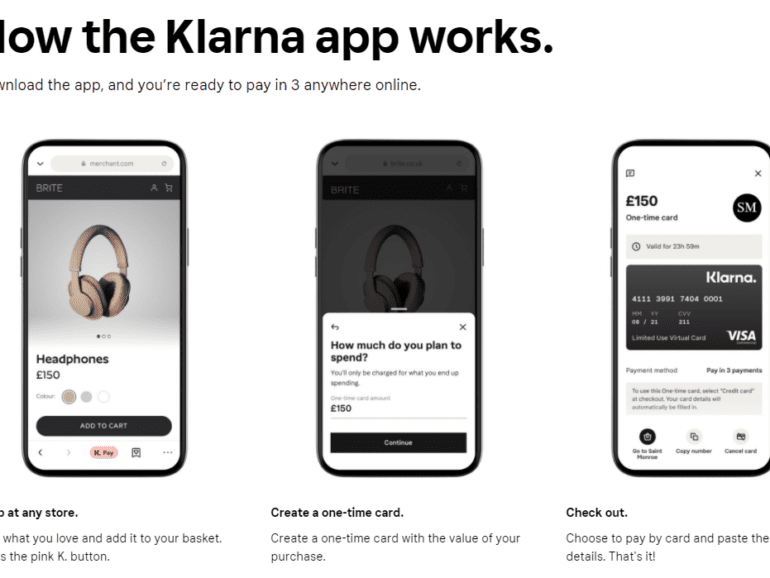

Klarna’s $640 million raise and its $45 billion valuation, and how its business model arbitrages the payments revenue pool to build a lending business

Pinduoduo’s growth path to a $150B marketcap, and the links between shopping, media, and financial mechanisms that help it compete with Alibaba

A comparison of approaches to growth and economics

Implications for crypto assets for capturing “the real economy”

Klarna is raising $640 million on a $45 billion private valuation, with over $1 billion in net operating income. The buy-now-pay-later company has over 90 million active customers and 250,000 merchants. It was founded in Sweden in 2005.

On the other side of the ocean, Chinese ecommerce company Pinduoduo is beating Alibaba with 820 million active buyers, generates over $3 billion in revenue per quarter, connects buyers to 12 million farmers, and has a market capitalization of $150 billion. It was founded in China in 2015.

TruVision Consumer Property Insights for Portfolio Management protects borrowers and lenders through a holistic view of property value fluctuation risks.

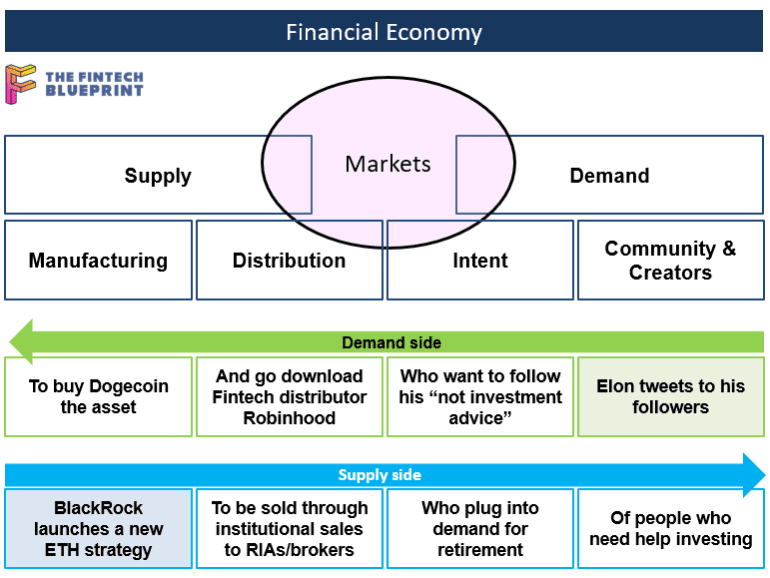

Square upgrades Cash App into a payment processing powerhouse, completing the loop between the consumer and merchant side of the house. Goldman Sachs acquires GreenSky, adding a lending business at the point of intent. This analysis connects these symptoms into a framework explaining the increasing integration between commerce and finance, and the increasing role that demand generation plays. That in turn explains how the attention and creator economies interconnect with financial services.

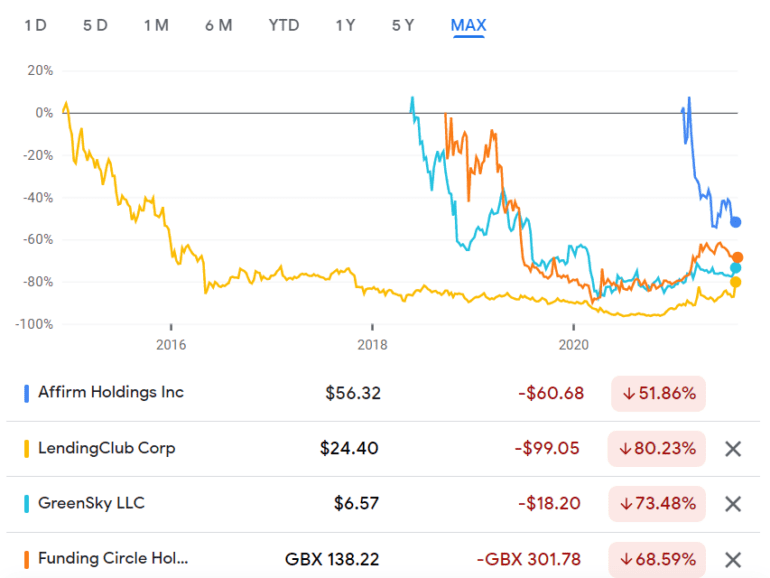

We look in detail at the state of marking recently-private-fintechs to the public market in mid-2021. Multiple industry segments have seen IPOs, direct listings, and SPACs transition fintech darlings into traditional stocks. How is performance doing? Is everything as magnificent and rich as we expected? Have multiples and valuations fallen or held steady? The analysis explores the answers and provides an explanatory framework.

This week, we look at:

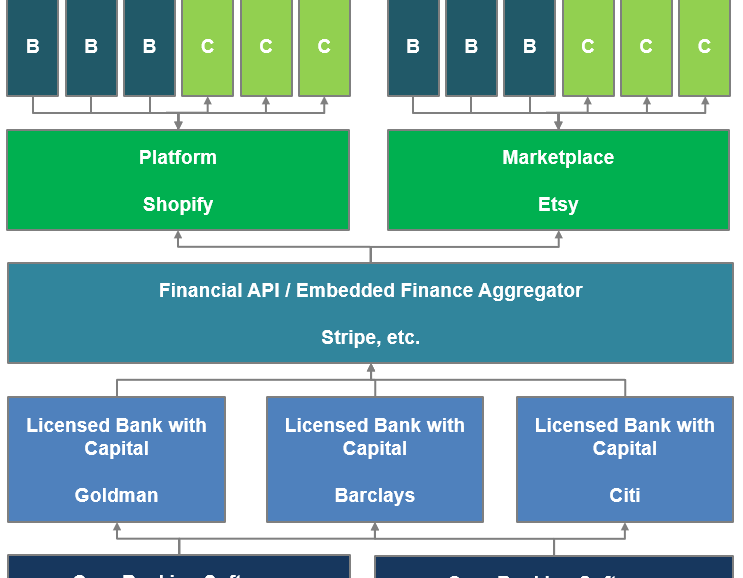

Embedded finance as a growing theme with the $10B Affirm IPO and Stripe's launch of Treasury

The customer types that each of these firms is attempting to convert into their product, and what this tells us about economic growth

A framework for understanding the emerging value chain of digital finance, and the role of platforms and marketplaces

In this conversation, Will Beeson and I break down a few important pieces of recent news — the SPACs for SoFi and Bakkt, and Plaid/Visa falling apart.

SoFi is going public with a SPAC deal worth over $8 billion. A few things we touch on in detail: (1) this is still largely a lender, (2) there is a gem of an embedded finance play called Galileo that SoFi owns, and (3) the multiple is a little over 10x T12 revenues, which is not crazy expensive, but not cheap.

Speaking of Galileo and finance APIs, we transition to Plaid, and how it is is not going to be one of the networks in Visa’s network of networks. Who wins and who loses in the equation? And last, we cover the Bakkt SPAC of over $2 billion and our view on its future.

This week, we look at:

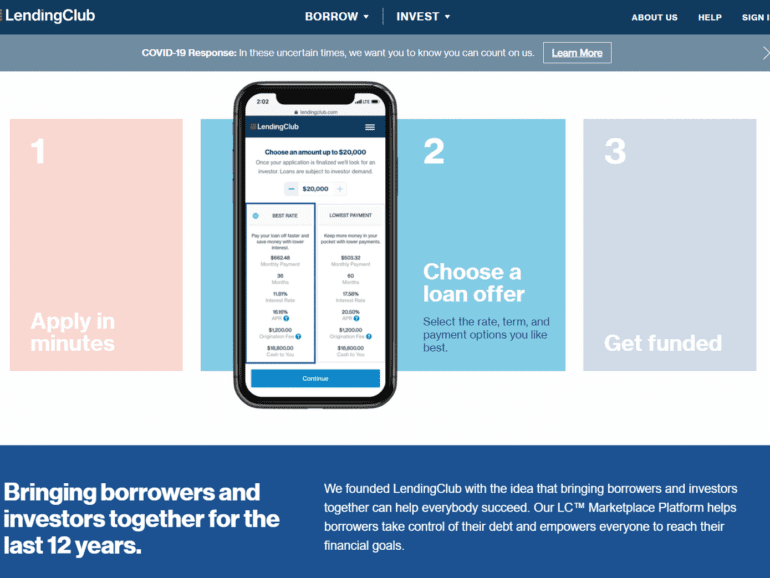

Lending Club, the peer-to-peer lending innovator, turning off peer-to-peer lending after having a bank in its pocket

Consolidation of the UK's largest crowdfunders, CrowdCube and Seedrs, and their limited economics

The scale of the Morgan Stanley and Eaton Vance deal, creating a $1.2 trillion asset manager

The struggle of peer-to-peer models more generally, and whether the blockchain movement can overcome the Prisoner's Dilemma

Alternative data helps lenders score previously difficult-to-serve groups like thin- and no-file customers. Lenders seeking to serve those client groups need the right technology in place, Provenir’s executive vice president for North America Kathy Stares said.

No More Content