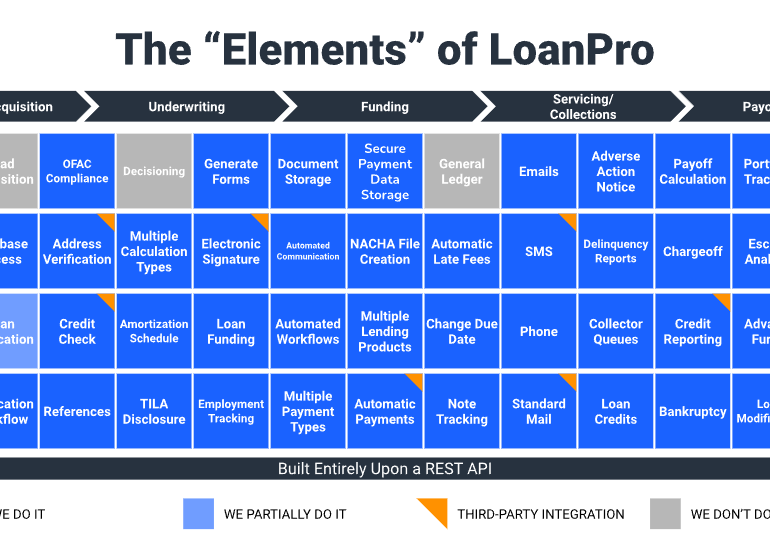

In this conversation, we chat with Rhett Roberts, the Co-Founder and CEO of LoanPro – a new breed of software company that is API-driven, cloud-native and easily scalable. Rhett and his co-founders created the company out of necessity when they ran an auto lending business as they could not find anything flexible enough to suit their own needs.

More specifically, we touch on all things around the lending industry, the auto lending industry and how everything there works, and of course, why LoanPro is such an awesome company, and so much more!