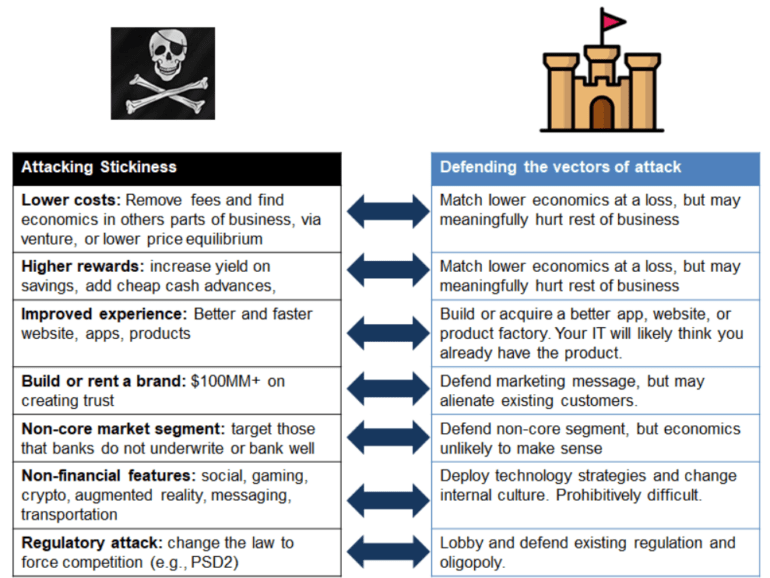

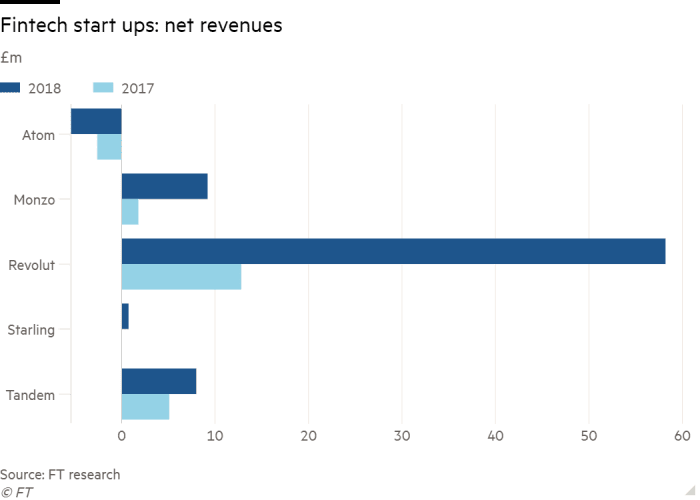

JP Morgan just shut down its neobank competitor Finn, targeted at Millennials in a smartphone app wrapper. Several other traditional banking incumbents have similar efforts, from Wells Fargo's Greenhouse, Citizens Bank's Citizens Access, MUFG's PurePoint and Midwest BankCentre's Rising Bank, as well as most of the Europeans (e.g., RBS competition to Starling called Mettle). These banks have every advantage -- from product infrastructure, to balance sheet, to regulatory licenses, to physical footprint, to relationships with the older generation. So how is it that players like Chime, MoneyLion, Revolut, and N26 are all able to get millions of happy users and the incumbents are failing?

The web of investment bank technology, there are 20 or more core vendors on which systems run. Adding Blockchain to the mix merely adds a 21st system, which is by design incompatible with everything else. Thus enterprise chain projects have been focusing on integration and proofs of concepts, not re-engineering the core. But we know how this plays out -- as it has over and over again across Fintech. Digitizing "unimportant" channels and hoping for them to succeed simply doesn't work. See JP Morgan giving up on Finn, or Northern Trust capitulating its pioneering idea into Broadridge, or any other number of examples from Bloomberg to LPL Financial. Even the struggles of Digital Asset could be used as an example of the danger of working oneself into an existing web of solutions, and trying to preserve their dependencies.

Today's corporations and governments are in the business of defining the balance of these aspects of our participation in society and the economy. Beliefs about the immutability of different attributes about what makes a person (or an employee) and how economies are built (cutting the pie, vs. growing the pie) determine the policy decisions you make, top down. As the core example this week, let's take Deutsche Bank. Facing pricing pressure and headwinds in several of its businesses, Deutsche is responding with a plan to fire 18,000 employees by 2022 and an announced investment of €13 Billion in technology and innovation by 2022. They even spun up a hipster-colored neobank as a proof point. Wall Street ain't buying it.

Robocop vs. Terminator in Fintech; Comparing DeFi originations to Digital Lenders in the early years

I've got a gentle, data-backed story this week inspired by a great distinction made in this Techonomy article by the Chief Digital Officer at Schneider Electric. The thesis tracks three key lessons from attempting to bring large companies into the 21st century: (1) transform the core of your business instead of fumbling around at the edges, (2) digitize your processes and separately figure out a distinct digital model, and (3) catalyze a digital ecosystem from the new model. You can think about the distinction as either taking the existing business and slowly swapping out parts from human to machine (e.g., like RoboCop), or building the robot from scratch utilizing the latest platforms, markets, and artificial intelligence (e.g., like Terminator).

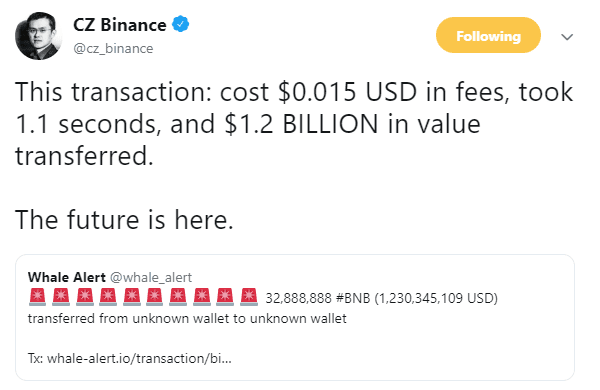

We are like the hungry at the all-you-can-eat buffet. In the beginning, there is not enough! Let's democratize access to food; to music; to transportation; to healthcare; to finance; to payments; to banking; to lending; to investing. The billions in institutional capital across universities, pensions, and sovereigns are delegated to smart portfolio managers. The day before yesterday, it was allocated by small cap stock pickers (hi Warren!). Yesterday, it was the alternative managers of hedge funds and private equity. Today, it is the trading machine and the venture capitalist. Tomorrow, it is the cryptographic artificial intelligence.

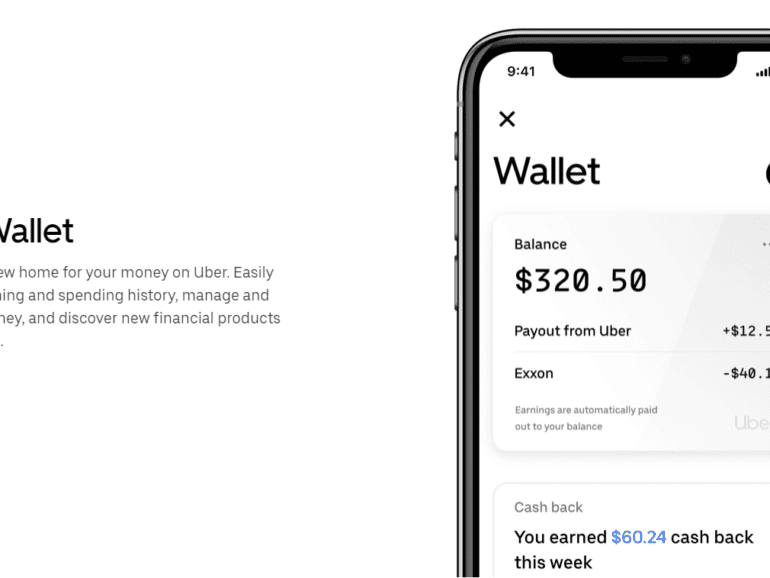

Uber has entered finance! The end is nigh! The boogeyman is here!

Oh. So what's involved? There's a debit card and a "debit account" powered by Green Dot, the same bank that's behind Apple Pay's person to person service. That means that Uber isn't a bank, but is renting shelf space on one. There's a wallet that will be integrated into the Uber app, within the driver's experience. So tracking your earnings and spending will be a feature that is part of the app -- not unlike what Amazon has had for years for merchants. There is a credit component, letting drivers withdraw money against their payckeck. And there's a Barclays credit card, private labeled for Uber, riding on the VISA rails.

Hear ye, hear ye, beware the disruption and tremble under its glory!

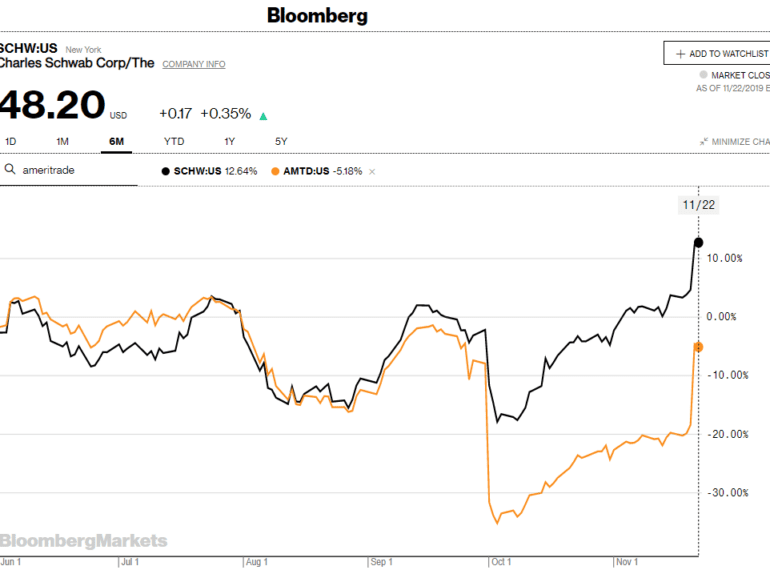

Well this morning started out as a bit of a bummer! See -- Charles Schwab to buy TD Ameritrade in a $26 billion all-stock deal. The $55 billion market cap Schwab is gobbling up the $22 billion TD Ameritrade at a slight premium. Matt Levine of Bloomberg has a great, cynical take on the question: Schwab lowering its trading commissions to zero is actually what wiped out $4 billion off TD's marketcap a few months ago. For Schwab, the revenue loss from trading was 7% of total, while for TD it was over 20%. Once Schwab dropped prices, TD started trading at a discount and became an acquisition target. You can see the share price drops reflected below in the beginning of October.

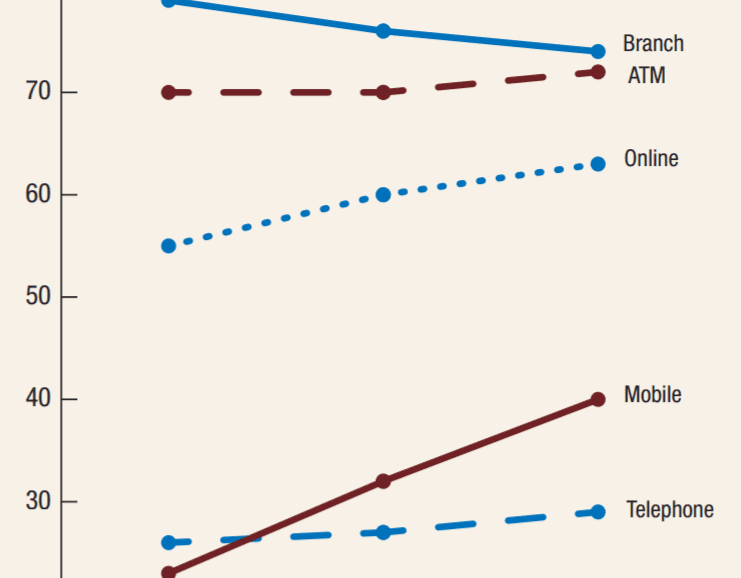

Let's make a collective decision to see the glass as half-full. While physical banking (7,000 US branches gone during 2012-2017) and employment in the sector (425,000 jobs lost since 2013) has been contracting, digital commerce, banking, and investment management have been growing. Even DFA is finally giving in and lowering fees on their $600 billion institutional mutual fund family. Of course, Fintech has been a slow and gradual transformation, not a rapid disruption. We can make a choice to bemoan the loss of the past, or a choice to express an excitement for the future and participate in its making. Which side are you on?

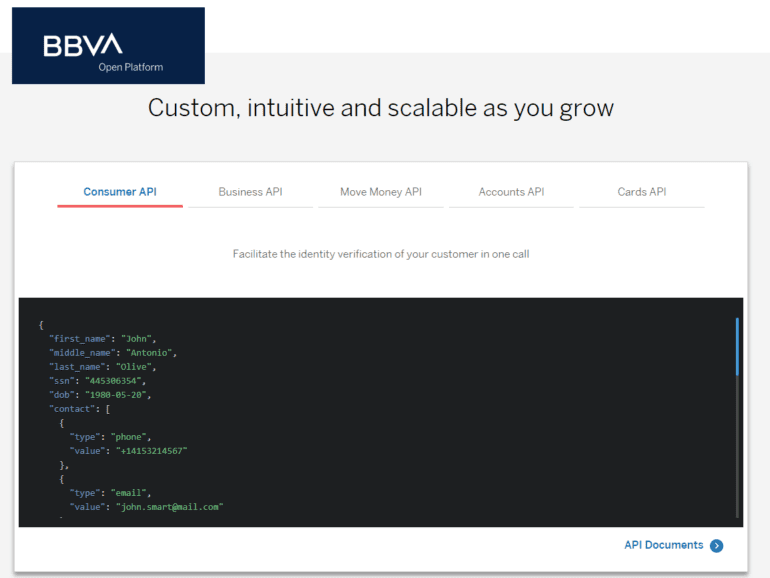

Anyone watching Fintech over the last decade has recognized an increasing shift of power from product manufacturers to the platforms where those products are sold. In the case of Amazon, Google, and Facebook -- finance is just a feature among thousands of others. I've made this point since 2017, when Amazon launched lending into its platform. Brett King has been a bit more generous in the categorization, calling the shift "embedded banking". This means that banking products are built into you life's journey, not accessed in a separate customer center location. The financial API trend is a tangible symptom of this vector.

I discuss Citi's roboadvisor launch and why it took the firm 12 years to get to the party. We break down the difference between financial services ingredients and the organizations that combine those ingredients to manufacture and distribute financial products. We also look at how that consumer prerogative is defining the asset management industry, and the consolidation towards monolithic passive indexing providers. Last, we talk about how people prefer mass produced Twinkies to expensive artisanal desserts. Yummy!