The following is a guest post from Gary Malhotra, Vice President of Marketing, Paystand.

Amid the crypto downturn, SEC threats, and a 98% drop in BTC value since Nov. 8, 2021, business and financial media are painting everything related to crypto with the same brush.

Besides tanking crypto exchanges, stablecoins have taken a hit, NFT-based art values are plunging, and even DeFi has been called into question.

Negative attitudes may even be seeping into the tech market, where CEO confidence has continued to sink this year, according to the Conference Board.

Yet we have to refrain from throwing out the blockchain baby with the crypto bathwater.

Blockchain is the underlying technology and is not dependent on crypto. DeFi and the blockchain are positioned to offer our economy a significant boost by reducing our reliance on an antiquated and expensive jumble of legacy payment systems that prevent companies from receiving cash in a timely, efficient and secure manner.

Drawbacks of current systems

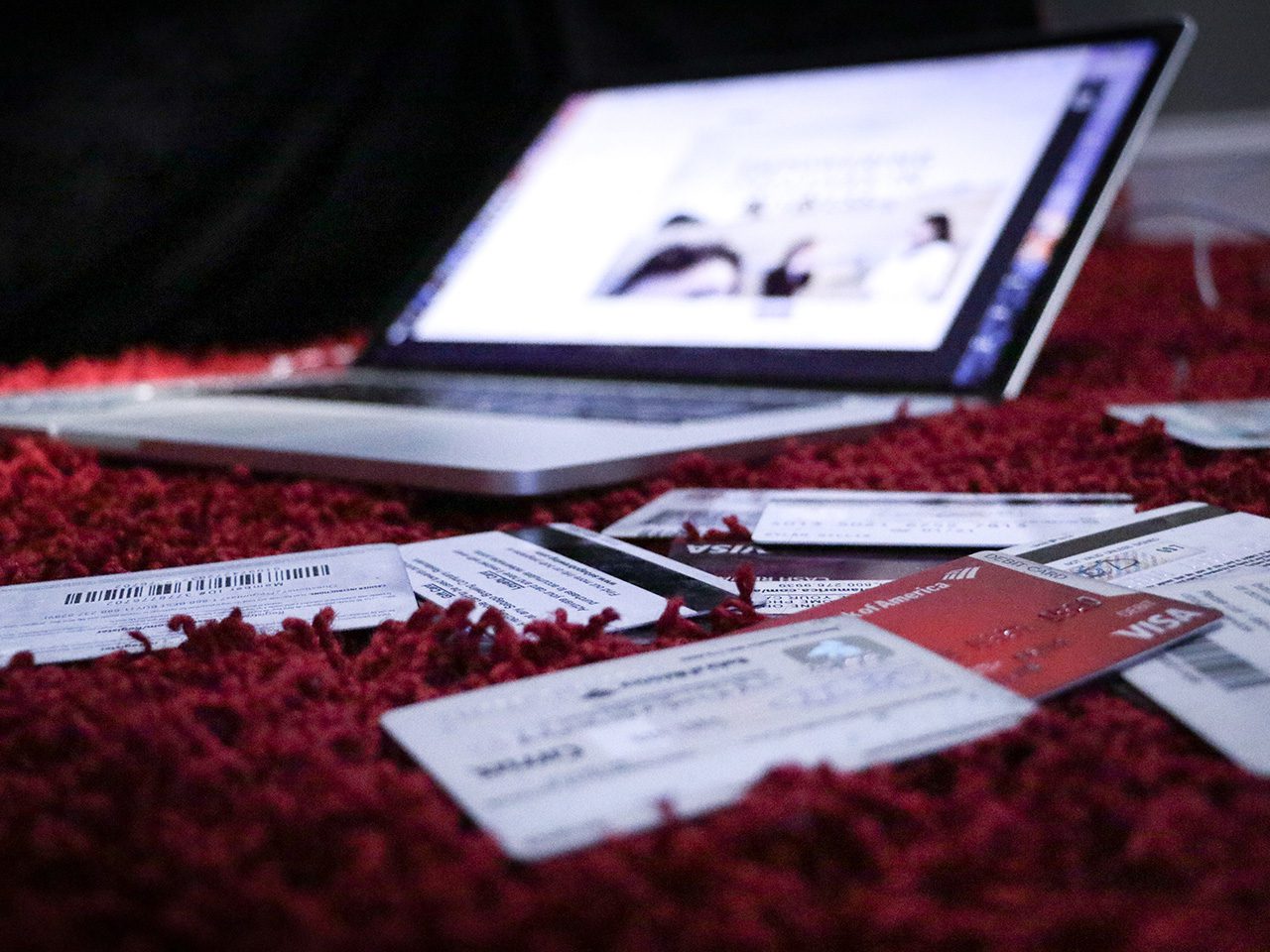

Consider the alternative. Credit card-based payment systems are expensive and inefficient for everyone, keeping cash from getting directly to A/R departments.

Card-based payments go through intermediaries, who get a cut, raising fees and posing a security risk. Visa/MC recently raised swipe fees, and Congress took note.

It’s gotten to the point where the banks are seriously considering replacing credit cards with the Zelle system for consumer-to-merchant payments. That’s a sea change in attitudes towards the card industry.

At the same time, paper checks are costly, delay the cash cycle, and are prone to fraud. ACH is not reliable, as it can be executed without good funds and can be reversed. Wire transfers take a long time, are opaque, and cost a lot of time. This means the reconciliation of payments can be slow going.

Advantages of blockchain

We must create a modern network to replace the outdated legacy payment system. Blockchain is well positioned to help our economy recover and grow.

With blockchain, we have a secure, end-to-end, immutable transaction record, better protecting payments and enabling near-instant reconciliation.

Besides reducing fees and payment times, the system offers the ability to provide more transaction security and visibility, something the industry could call assurety-as-a-service, where you are creating a digitally notarized record trail that is secure, certified, and fully auditable. It can be used across industries, from agriculture to gaming, to healthcare, to document transactions and records.

Additionally, the blockchain enables greater automation and digitization of the cash cycle. Here, smart contracts can make additional savings available to A/R teams via dynamic discounting, that is, the ability to automatically adjust payment discounts based on time or other factors to get the money faster from the customer.

Taking it a step further, blockchain-based Oracle services can quickly verify merchants’ and partners’ trust and credit worthiness. And the long term, blockchain holds out the promise of being the new internet, with business data being stored on the blockchain rather than in Amazon cloud storage (AWS).

Cut out intermediaries

Since blockchain is a peer-to-peer network, it cuts out the intermediaries who have typically verified the transactions.

With blockchain, all the verification is completed via code, which is the same for everyone. This means that if you have access to the internet, you can transact on the blockchain without anyone’s permission, including that of your bank or other financial providers.

Businesses are seeing the benefits of blockchain-based digital payments. Cotopaxi is an outdoor clothing and gear provider in San Francisco.

A few years ago, it transacted only 20-25% of its digital payments via noncard methods using the blockchain. Now, that number has jumped to 38%, and it continues to grow, which cuts down on the transaction fees they pay as a merchant.

My company, Paystand, is also seeing a surge of interest in converting to blockchain-based digital payments to speed the cash cycle. Customer and partner engagement has increased by 100% in the last 12 months, and hiring has doubled yearly over the previous three years. And as the crypto downturn causes layoffs, we are reaching out to laid-off crypto and Web3 workers as potential hires. These individuals have valuable industry knowledge based on their experience and on which business models work and which do not.

Wild West? Not so much

In the current turbulence around crypto, we need to think of crypto as one application that sits on top of a secure high-speed operating system, the blockchain.

The crypto fallout has been caused by a Wild West atmosphere characterized by unbridled growth with few guardrails, where an unregulated atmosphere still prevails.

But the blockchain-based financial system, as an underlying operating system, is solid, rapidly expanding, and offering unprecedented speed and security. It provides a new digital economic infrastructure that can streamline the payment process, enable immediate payment, cut out the intermediaries through peer-to-peer transactions, and reduce costs.

The dot com era shake-out led to a universal shift in the production and consumption of information, and winning companies emerged over time. Blockchain companies will weather this current crypto storm as they transform every aspect of how we do business, including the realm of B2B payments.