Embedded consumer lending offers many benefits over BNPL. Working with a BaaS provider like Finastra allows banks to control their roadmap.

Findings from AI-powered tax-filing product april’s 2023 customer impact study suggest customers are receptive to a self-guided, mobile-first process.

Jifiti is quietly shaping the future of embedded finance by working strategically with banks to deliver personalized solutions.

A report from Viola Fintech shows why companies must go beyond embedded to contextual finance if they want their share of a $588 billion pie.

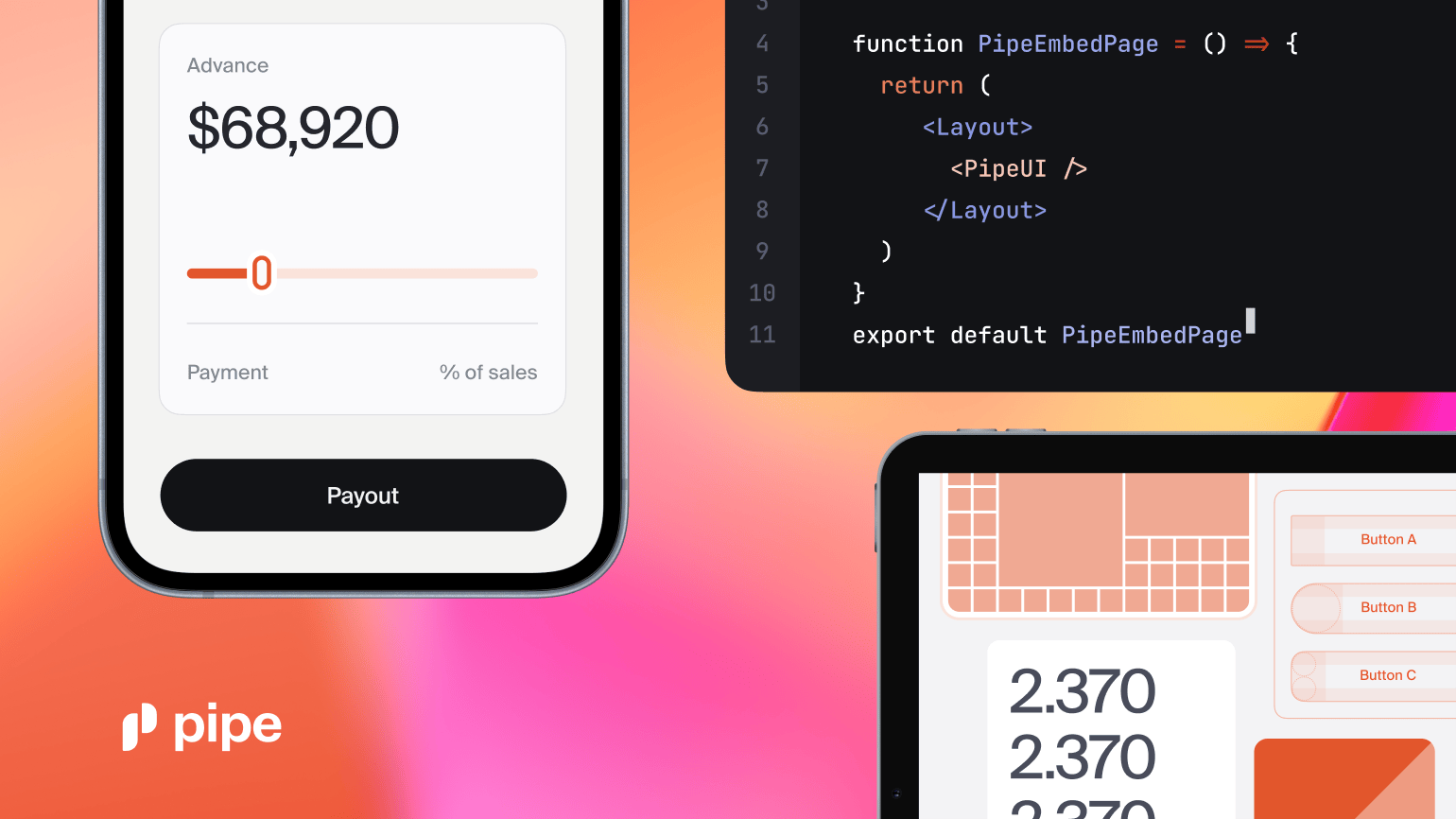

Pipe is launching a new embedded finance product to help small businesses. Their Capital-as-a-Service product has three launch partners.

Embedded finance can help small businesses manage their money end-to-end, but not all companies are equipped to offer it properly.

Digital bank G10 is the first of its kind in a Brazilian favela, low-income areas which together account for roughly 17 million citizens.

Consumers have enjoyed the fruits of the embedded finance revolution but not so small businesses. It is time to rectify that.

Bank lending is often the least expensive form of financing but it is not often a consideration at the point of sale. Advances in embedded lending now makes this possible.

Embedded finance and buy now, pay later (BNPL) are hotbeds of innovation, and Marqeta is in the middle of the action, CEO Simon Khalaf said.