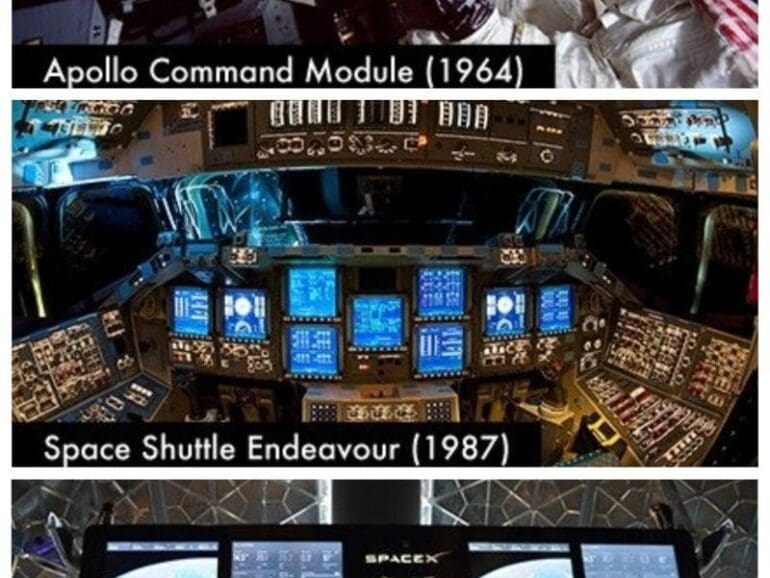

This week I discuss SpaceX, and its Dragon rocket carrying American astronauts to the International Space Station for the first time in 9 years. The 20 year old company is a testament to the incredible iron will and absolute insanity of the most visionary capitalist alive -- Elon Musk. We walk through various attributes of the company and recent launch to derive lessons for the financial industry and the entrepreneurs rebuilding it.

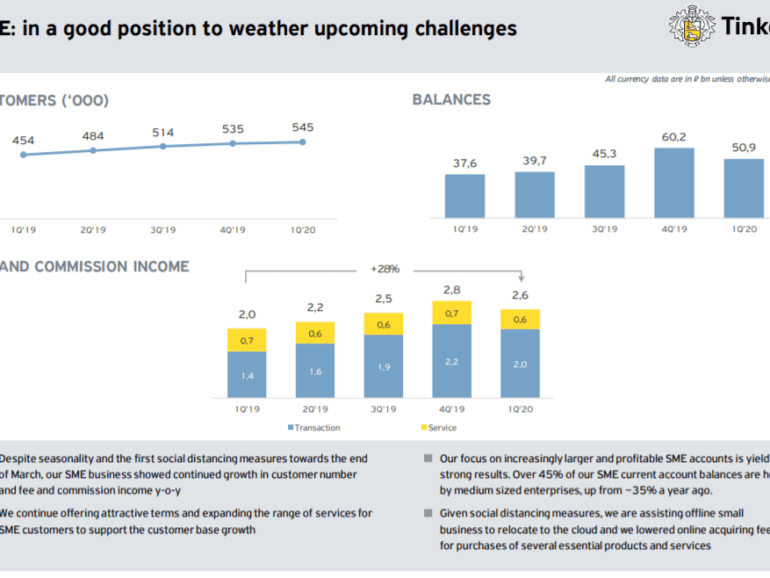

Oliver Hughes is the CEO of Tinkoff Group, one of the world’s most successful digital banking groups with over 10 million customers. This is one our most interesting conversation to date, full of fantastic operating advice.

Tinkoff is publicly listed with a $3.8 billion market capitalization, which brings clarity to its operating model in a time when many noteworthy consumer digital banks are pursuing customer acquisition at the expense of profitability.

Oliver has led Tinkoff through three financial crises, and brings experience and perspective to the current COVID crisis. This is a fascinating discussion about unit economics in digital banking and winning business models with a CEO with thirteen years of experience in this space.

Cryptodecentralized financedigital lendingenterprise blockchainentrepreneurshipfixed incomeneobankroboadvisor

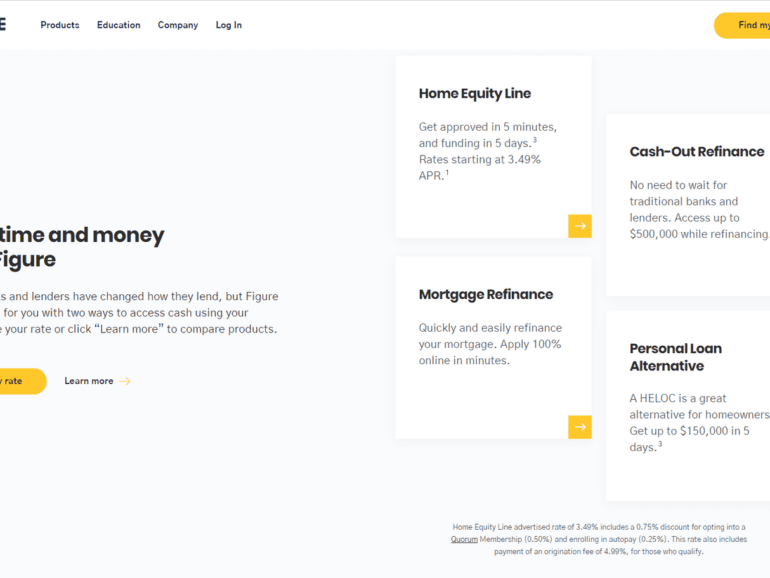

·Mike Cagney is the Co-Founder and CEO of Figure, a full stack financial services blockchain company with consumer offerings in market or on the way in lending, banking and more. In late-2019, Figure raised $103 million at a $1.2 billion valuation and continues to grow.

Prior to starting Figure, Mike co-founded and ran SoFi, one of the most successful consumer fintech companies ever.

In this conversation, we discuss Figure’s routes to asset origination and capital markets disruption, Figure’s previously unannounced consumer banking and payments offering, lessons learned building and scaling multiple billion dollar companies and more.

This week, we cover these ideas:

The difference between building a Fintech company, and building an empire to transform the world

How Warren Buffett is the best in the world at getting leverage through third party capital to grow

How Elon Musk is the best in the world at re-investing capital into his own judgment and view of the future

The $1.2B BitGo acquisition by Galaxy Digital, and the growing footprint of Alameda Research

DAOs as a way for all of us to participate

·

This week, we cover these ideas:

How market structure determines the types of companies and projects that succeed

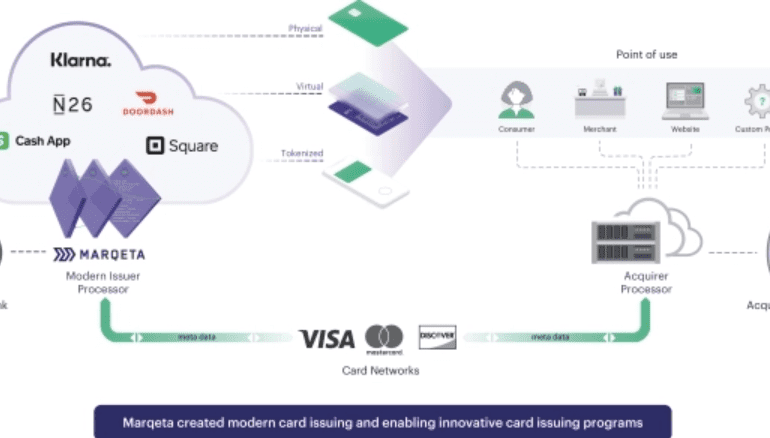

A walk through Marqeta’s economics and business model, and how Square’s Cash App and DoorDash were needed for success

The emerging $10B transaction revenue pool on Ethereum, MEV, and the changes to mining and gas

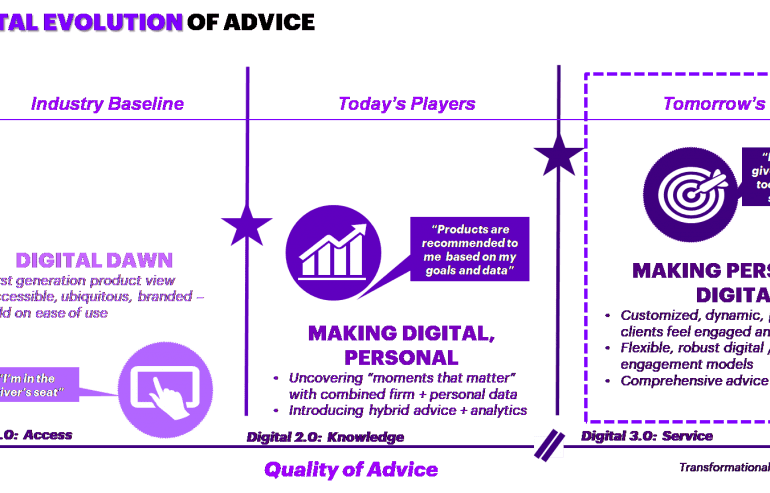

In this conversation, we chat with Jason Wenk, who is the Founder & CEO at Altruist. Apart from this Jason is a writer, self-proclaimed math geek, and investment systems developer. He began his career at Morgan Stanley in NYC at age 20, working on investment research and asset management systems development. After this Jason founded FormulaFolios: quantitative, computer-driven investment models based on academic research to help remove emotion from investing. FormulaFolios would later develop into a standalone asset manager and go on to rank as a fastest-growing private company by Inc. magazine 4 years in a row, reaching as high as #10 in 2017.

More specifically, we discuss all things wealth tech, as well as, serving people with financial planning, financial advice, and generally improving their financial health.

Early stage founders face a challenging climate and many lack the expertise to drive growth.Support from an experienced hand may be critical.