On September 15, 2022, the ethereum blockchain was a major milestone, which saw the current ethereum Mainnet integrated with the Beacon Chain proof-of-stake (PoS) system.

This marks the end of proof of work and a transition to proof of stake, which promises significantly reduced energy consumption, future scaling, and many more updates.

In any case, the industry’s decision-makers, influencers, and traders continue to play an essential role in the future of ethereum and the industry overall. Speaking to three individuals in Europe, they said:

Lenka Hudakova – ethereum Web3 Community Builder and Project Lead at MakerDAO SES

Lenka Hudakova, ethereum Web3 Community Builder and Project Lead at MakerDAO SES, talks about the excitement of this milestone.

“The Merge is one of the most anticipated milestones for the ethereum blockchain and its global community. I am sure that it will be the top highlight of 2022 for many. As part of the community, I was very excited about the first ethereum Proof of Stake (PoS) moment despite delays and timeline uncertainties. In my opinion, these challenges to set the exact date in advance were expected when coordinating a first-of-its-kind decentralized open source development on such a global scale. Secondly, with blockchain, unlike traditional software development, you cannot risk deploying a code that can have errors – as there are assets at risk, and you cannot just fix them in production. The ethereum community has been very cautious in taking incremental steps towards the PoS transition, including several testnet ‘shadow’ forks on its clients. How smoothly the Merge hard fork was executed proves the preparation and professionalism that led to this ultimate success.

“We were, just like the rest of the global community, very excited about this anticipated milestone and (with the support of the ethereum Foundation) held a meetup with our local group I”n Copenhagen. Our goal was to set the awareness, expectations, and excitement levels around the merge for new and seasoned members just a couple of days before the event.”

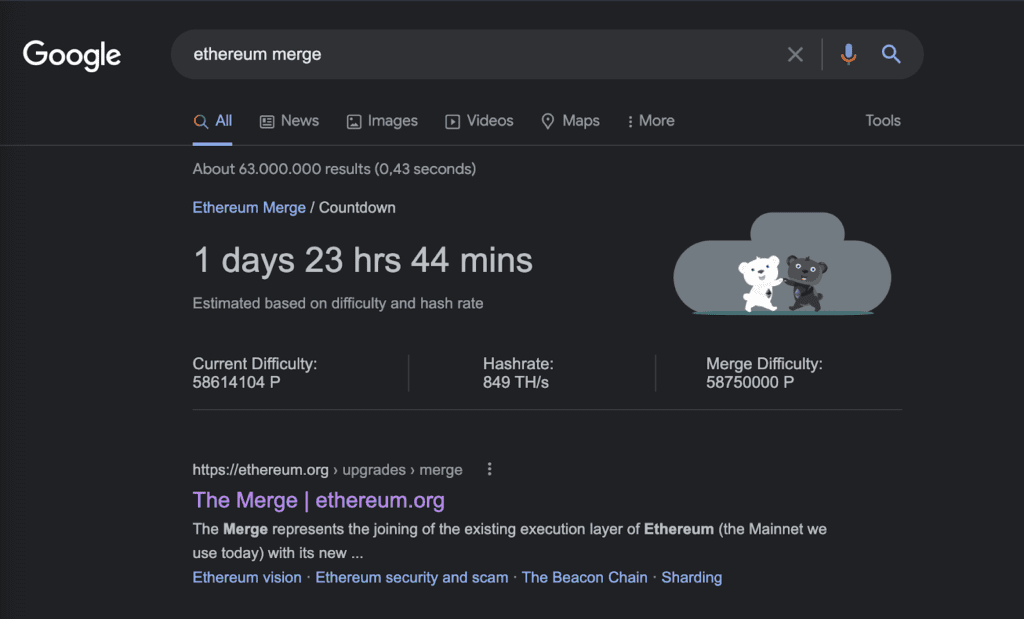

Hudakova also mentions how exciting it was that even Google helped spread awareness and celebrated this historic moment.

Nonetheless, out of all aspects of the transition, Hudakova mentions energy consumption as the most exciting element.

“Comparison to other industries aside, this argument holds no more against ethereum (sorry, bitcoin). Ethereum’s energy consumption/carbon footprint is reduced by 99%, and its transition to PoS also helped reduce worldwide electricity consumption by 0.2%. This makes it immune to critique and much more attractive for newcomers.

James Van Straten: Research and On Chain Analyst at Saidler & Co

James Van Straten, Research and On Chain Analyst at Saidler & Co, takes a less optimistic view, particularly regarding the long-term ramifications.

“Moving from proof of work to proof of stake was technically amazing to see executed but a long-term blunder. They have given up decentralization and security for scalability. Plus, the narrative for ethereum being ‘green and eco-friendly is incorrect.”

The centralization issues PoS opponents warned about are evident on-chain. The total amount of ETH transferred to the ETH2 deposit contract via staking providers currently stands at around 13.8 million ETH. Approximately 70% of that amount, or roughly 10 million ETH, is concentrated with just four staking service providers—Lido, Coinbase, Kraken, and Binance.”

Related:

From a price perspective, Van Straten also mentions the merge was a buy the rumor sell the news event due to options open interest soaring with bearish divergence.

Timo Lehes – Co-founder of Swarm Markets

Talking to Timo Lehes, co-founder of Swarm Markets, he talks about the moment’s significance. “At this juncture, it cannot be understated. Although it’s hard to say precisely what will happen once the merge completes, what is clear is that we are truly breaking new ground in crypto for the first time in a while.”

“The merge is an important milestone to pass through. It allows for future upgrades to ethereum that will kickstart the network on a path to greater scalability. For example, ‘The Surge,’ due to take place in 2023, will address sharding, enabling higher transaction volume that institutional investment brings. One of the key concerns preventing institutions from putting meaningful volume onto the blockchain has been finding a layer one network that can support its level of trade flow.”

Lehes also talks about the need to manage expectations because the problems that merge try to solve won’t be remedied immediately. If anything, he sees it as an act as a kick starter to future improvements.

“Moving to proof-of-stake is estimated to reduce ethereum’s energy consumption by more than 99.9%. Whether institutions now classify ethereum as an ESG asset depends on criteria. The reduction in consumption is a vast improvement. However, it is still not an energy capture asset, and there are other ways to invest in emission-cutting instruments. For example, powering bitcoin using flare gas reduces the amount of CO2 emitted into the atmosphere.”

When it comes to the question of energy, Lehes is slightly more optimistic than Van Straten about the impact. “If energy efficiency is part of a company’s ESG criteria, arguably, ethereum 2.0 would fit the bill. All electronic trading requires the use of power. If future financial markets were built on the blockchain, which we think they will, it would be better to make these on proof-of-stake networks over their proof-of-work counterparts, which are far less energy efficient.”

“The successful transition to a proof-of-stake consensus model will be a more attractive investment opportunity for institutional investors for ESG, scalability, and operational reasons,” he concludes.