Argentina’s biggest private bank decided to add crypto trading, but the central bank bans digital assets’ transactions in the banking system.

UK based Arrowgrass will offer investors fintech exposure through a new vehicle listed on the AIM Market; the $97mn IPO named TruFin, is the first time investors will have access to one of the country’s p2p platforms in Zopa; “Listing on AIM will allow us to provide further capital to our subsidiaries and scale faster, and take advantage of any developments in the current financial services market,” said Henry Kenner, chief executive officer of TruFin plc, to AltFi. Source.

Machine learning and predictive analytics have started to make a real difference in the VC world when it comes to finding investments; VC’s typically traveled a lot and met with thousands of companies to find a few investments; by using machine learning to break down troves of data, like job postings or performance in the App Store, investors can find potential gems without the same laborious effort; VC firms are investing in tools to help them refine searches and comb through thousands of companies quickly; increased computing power and cheaper ways to rent server capacity has really helped VC’s, even the small firms, use these techniques every day. Source.

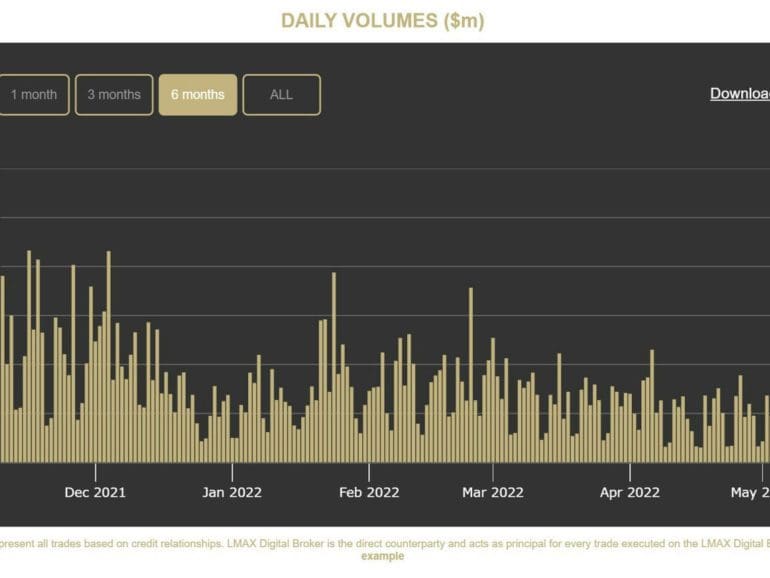

LMAX Digital, an institutional spot cryptocurrency exchange and part of UK-headquartered LMAX Group, hit its peak volume so far in 2022 on Thursday.

Cash usage is declining and the ECB is showing an ongoing commitment to a digital euro. Will cash eventually disappear?

COVID-19 has brought challenging years for SMEs. With inflation rates at an all-time high, alternative lenders become key to their survival.

The Affirm CEO discusses his own experience as a Ukrainian immigrant and what he thinks the market is getting wrong about Affirm....

Major banks are building out teams dedicated to cryptocurrencies and the future of finance. ...

Assetz Capital has originated over 200 million British pounds ($247.02 million) in loans since its inception with 108 million British pounds ($133.39 million) originated in 2016; firm is primarily focused on secured lending for small businesses and property developers; monthly originations have been reaching 26 million British pounds ($32.11 million) and in the fourth quarter total lending for the platform was 45 million British pounds ($55.58 million). Source

After turning a profit in 2016 Assetz Capital has continue that trend in the first half of 2017 by posting a seven figure pre tax profit; “We have reported considerable growth and stability over the past four years, and now that profitably has been consistently achieved in parallel to that strong growth, we continue to go from strength to strength,” said Stuart Law, CEO of Assetz Capital, to AltFi; this shows a trend in the UK of secured P2P lenders having a better track record to profit. Source.