Afterpay (ASX:APT), a provider of Buy-Now-Pay-Later (BNPL) payments, has announced that its in-store payments solution is currently available at major retailers 'just in time for the busy holiday shopping season - including Nordstrom and Nordstrom Rack, J.Crew, Madewell, American Eagle, Aerie, Tilly's, Morphe, Alo Yoga,

Financial technology leader FIS® (NYSE: FIS) announces that its Worldpay from FIS® business will be the first global merchant acquirer to offer merchants the ability to receive settlement directly in USD...

MarketInvoice has appointed Shaun Alexander to head of risk; Alexander joins MarketInvoice from Santander and will be the firm's first head of risk directly overseeing the underwriting unit of the business; the new hire is another example of a fintech firm adding traditional banking risk oversight experience; MarketInvoice expects Alexander will help improve risk management for the firm by providing broader insight on sector risks and market risk factors. Source

Fresh off their €56 million funding round in February Swedish fintech platform, Tink, is partnering with British bank NatWest; the...

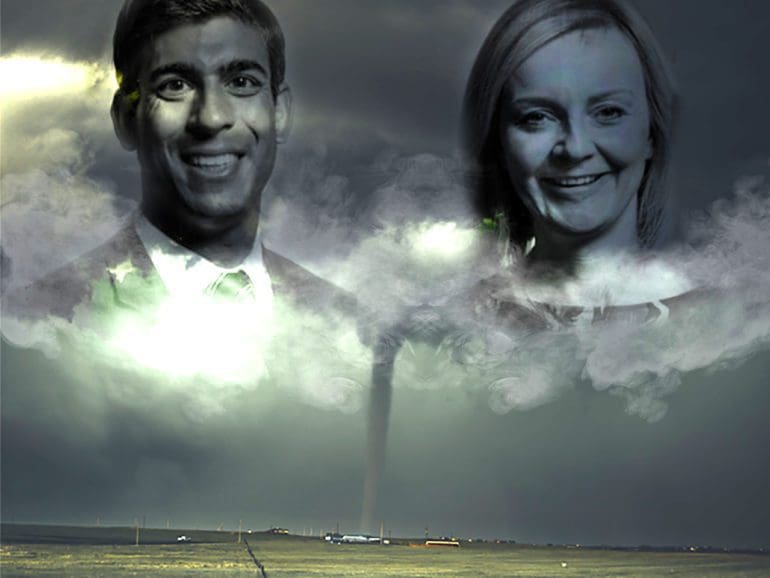

SMEs have been buffeted by the winds of COVID-19 and heightened inflation, and now comes the storm of political instability.

Innovate Finance is out with numbers on UK fintech investments in the first quarter sourced from Pitchbook; overall investments totaled...

UK-based digital bank Revolut has rolled out its new “financial super app” that it says will “reimagine and redefine” its...

A second regulatory reform focused on crowdfunding has gone into effect in France; the reform will broaden the offerings available for crowdfunded investing and lending; on crowdfund platforms, companies can now raise 2.5 million euros in equity funding through simple shares, plain vanilla bonds, preferred shares, participatory notes and convertible bonds; on crowdlending platforms, borrower limits were increased for qualified lenders to 2,000 euros individual lending per project; the reform also introduces new minibon debt securities. Source

LendInvest Co-Founder & CEO Christian Faes challenged the UK government to put more support behind small scale developers at the Conservative Party Conference; “There is a clear monopoly in the sector,” says Mr. Faes; to even the playing field LendInvest and others say more regulatory action can help to tip the scales in favor of property entrepreneurs. Source

P2P commercial real estate lender Relendex has received authorization from the Financial Conduct Authority; the platform provides secured commercial property loans through its P2P marketplace lending platform and now plans to seek the offering of innovative finance individual savings accounts for its investors; in comments regarding the authorization, Michael Lynn, the firm's founder and chief executive officer said, "FCA full authorization marks a fantastic start to 2017 for the Relendex team and platform which will further encourage and facilitate investment in commercial property from both our UK and foreign investors." Source