During a panel discussion at LendIt Europe in London representatives from leading incumbent lenders Lloyds Banking Group (LBG), ING, BBVA, HSBC, and Barclays discussed the challenges faces in the new digital world; topics discussed include cultural transformation, more power in the customers hands and trying to stay on top of the latest tech trends. Source.

Abe Smith, founder and CEO of UK based Dealflo tells Banking Technology about the big opportunity for UK fintechs in China; China and the UK have recently formed as closer partnership with Teresa May signing s number of deals and partnerships; three key areas for UK fintechs to focus on include approaching China for the unique market it is, work with a local group or team of advisors and understand the complex data residency programs. Source.

Ireland has become a hub of technological innovation as big tech, fintech and big financial services companies set up shop in country as an alternative to the UK; “Ireland has always been quite an innovative country; it has to be because it is such a small market, you can’t just lean on the Irish market to produce a decent fintech business.” says Sinead Fitzmaurice, co-founder of TransferMate, to the FT; talent from Google and Facebook have not only started their own companies but have also moved into finance giants like Deutsche Bank; low corporate tax rates combined with the tech talent has help the country become an emerging fintech market. Source.

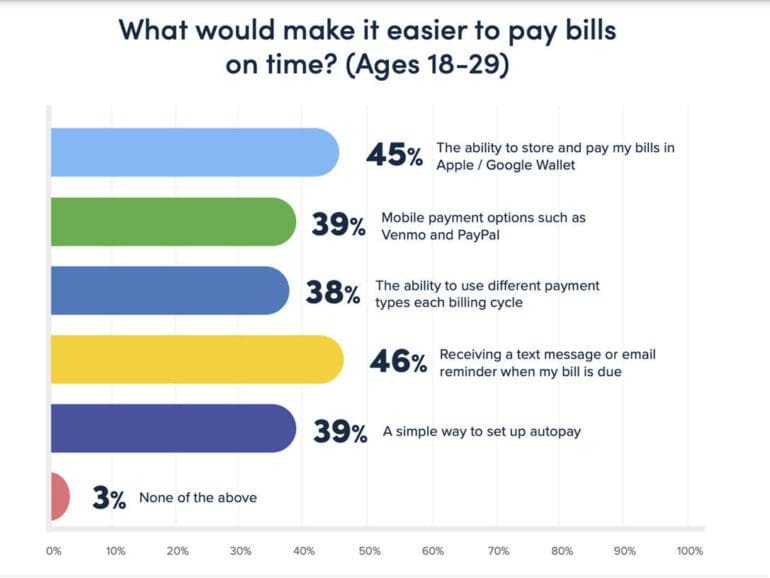

Pay Near Me has found adults aged 18-29 are more likely to pay their bills late. Through asking why, their survey unveiled an opportunity.

Fintech company BillFront today announces it has secured €50 million in a multi-currency asset-backed financing from Fasanara Capital and adopted a new name: Vane.

Invoice financing platform, BillFront, has secured $35 million in financing from a Series A funding round which included 4Finance, NIBC Bank and FinLeap; BillFront offers a working capital solution to media companies; uses advanced technology to evaluate a company's invoices for financing approval; the firm will use the new capital for company expansion and continued development of its technology. Source

Billie is an invoice finance platform that launched earlier this year; the round was led by Creandum with participation from existing investors Speedinvest and Global Founders Capital; the company focuses on complete automation with no human interaction; It was co-founded by Matthias Knecht and Christian Grobe; Billie also secured a refinancing facility from a major German bank.

Binance, a major cryptocurrency exchange, has announced on Wednesday that Binance France had been granted a Digital Asset Service Provider (DASP) registration by the Autorité des marchés financiers (AMF).

Binance, a major cryptocurrency exchange, announced on Friday that its branch in Italy had received regulatory approval from the country’s watchdog.

Binance Labs Closes $500M Investment Fund to Boost Blockchain, Web3, and Value-Building Technologies

Binance Labs, the venture capital and incubation arm of Binance, announces the closing of a new $500 million investment fund.The fund is supported by leading global institutional...