AltFi takes a look into the future at what the new Payment Services Directive will mean when it takes effect in 2018; companies will learn a great deal by trial and error as this is a new market and new markets need time to grow; client on boarding using KYC and AML requirements will be a key test for global banks who need to comply with the directive; open banking might also allow for banks to come across new customers that they might not have had access to in the past; ultimately client value is the biggest takeaway and open banking has the ability to deliver more to the client. Source

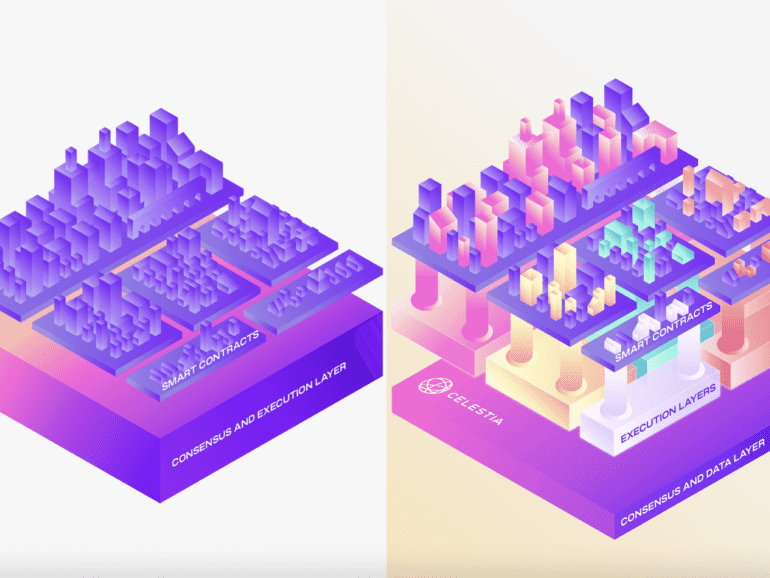

Just when you thought you had got a handle on blockchain, it turns out not all are equal. Modular could solve scalability and more.

Innovate Finance is planning to move from Canary Wharf to a new location in the Square Mile; the industry body also plans to provide space for startups; Mark Boleat, the City of London's policy chairman, also noted they plan to bring broader and faster wireless coverage in order to attract small businesses stating that the Square Mile was a "natural place for fintech to coalesce." Source

Business Insider takes a look at the worldwide regulations surrounding the emerging Cryptocurrency market; in addition to cryptocurrencies they also take a deeper look at the regulatory structure beginning to be built around blockchain technology; regions covered include the US, Europe, China and more. Source.

City A.M. recently visited Funding Circle’s offices and highlights the stark differences from other financial institutions; the company has a relaxed office with various games typical at many startups; as the company has grown they have made sure to maintain a healthy culture which empowers employees to make decisions and be creative; Funding Circle’s co-founder James Meekings discusses workplace culture, the problems they are solving for small businesses and some of the early challenges the company when they lacked data for underwriting. Source

In the last 18 months there has been a wave of consolidation in the payments sector and that trend looks...

Multi-lending platform Alternative Business Funding (ABF) will become the fourth alternative finance business to be involved in the UK's bank referral scheme; the bank referral scheme began in November 2016 and has been reporting success with over 8,000 SMEs being referred to alternative funding sources; the other three businesses in the referral scheme network include Funding Options, Funding Xchange and Bizfitech. Source

Ablrate was recently authorized by the FCA and is now launching their custom Innovative Finance ISA; Ablrate offers a self-select marketplace where investors hand pick the loans they look to invest in; this is one of many products the company will launch in this arena; Ablrate facilitates asset-backed loans with specialization in aircraft and capital equipment; they currently will take cash deposits for their IFISA but no transfers as David Bradley-Ward, CEO of Ablrate, tells AltFi, "We want to be able to get everyone going with their IFISA first and then allow transfers in from other providers after the first week of our launch." Source

The UK online lender was launched with a focus on secured aviation lending and has expanded to other types of transactions including secured capital equipment and property lending; it says the authorization will help it to expand and further concentrate efforts on its technological development; the firm has reported an 850% increase in loan volume in the last year; the firm has plans to launch in Australia and also expand to other regions. Source

Dutch banking giant ABN AMRO Bank has signed a multi-year subscription extension with Temenos (SIX: TEMN) to support customer growth and business...