In time, value will migrate to currencies built on quantum-resistant algorithms. But right now it might be well worth spending a few billion to build a quantum submarine to dive down dredge up a hundred billion or so in lost cryptocurrency.

StepChange partnered with Barclays to urge the government to proceed at pace with regulating Buy Now Pay Later (BNPL).

Dow Jones Venturesource has released its first quarter Europe Venture Capital Report; venture capital funding for the quarter was EUR2.23 billion ($2.42 billion); Atomico's Atomico Ventures IV Fund led fundraising with EUR723.30 million ($786.02 million) representing 32% of total fundraising for the quarter; business and financial services was the top funding sector with EUR877.92 million ($954.05 million) across 163 transactions; Funding Circle reported one of the top five deals in the first quarter with its funding round of EUR94.43 million ($102.62 million); by geography, the UK led fundraising with EUR970.28 million ($1.05 billion) from 150 deals and France was second with EUR398.02 million ($432.53 million) from 78 deals; the full report is available here. Source

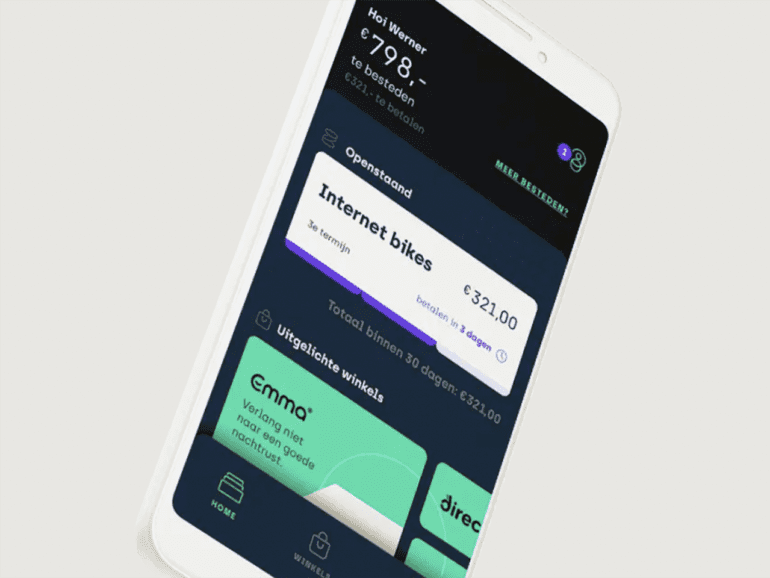

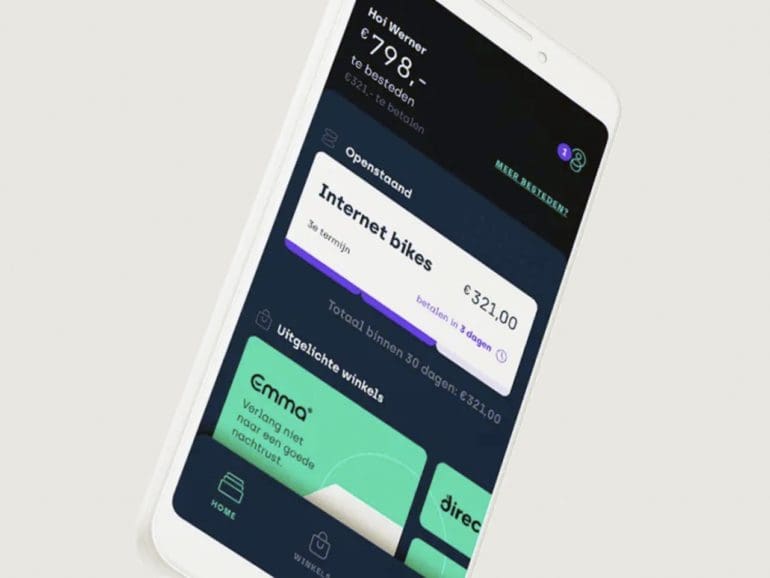

Dutch buy now, pay later platform in3 has landed an $85.3 million Series B debt and equity funding round, and announces partnership with Mollie.

In the Netherlands, BNPL company In3 has been a part of this growth and is now set to expand into other markets.

In the Netherlands, BNPL company In3 has been a part of this growth and is now set to expand into other markets.

Dutch challenger Bunq has become the second largest neobank in the EU after acquiring Belgian fintech Tricount, taking on an extra 5.4 million users.

Bunq has become one of the first European digital banks to enter the mortgage market with an announcement that they...

Three years ago Monzo raised money from individuals via crowdfunding; the round funded £1m in just 96 seconds according to...

CB Insights reports on two of Europe's top markets for fintech investment, the UK and Germany; the UK is reporting significant early-stage investment in personal banking platforms and insurtech with insurtech also a top investment in Germany; year-to-date, European fintech companies have raised approximately $2.6 billion with early stage fintech financing in the UK at $202 million and Germany reporting financing of $83 million. Source