Christmas shopping put on BNPL rose by £1billion in 2021, as banks, retailers & others continue to jump on the increasing popularity.

Buy now pay later (BNPL) startups are proliferating around the world and the Philippines is no exception. Today, one of the country’s biggest BNPL providers, BillEase, announced it has raised an $11 million Series B. The round was led by BurdaPrincipal Investments, growth capital arm of Hubert Burda Media. Other participants included Centauri, a joint...

Today marks the fourth anniversary of the Payments Services Directive 2 (PSD2) * making open banking a regulatory requirement in the UK

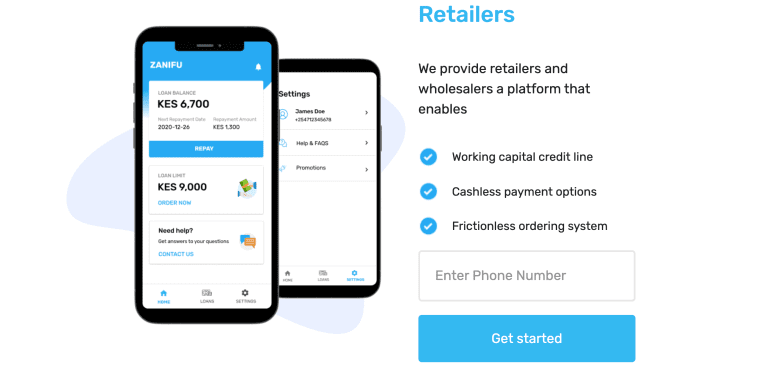

Kenyan fintech Zanifu is set to upgrade its platform and grow the number of micro, small and medium enterprises (MSMEs) it extends stock-financing to after securing $1 million in Seed funding. Saviu Ventures, which invested in the startup’s pre-seed round early 2020, Launch Africa Ventures, Sayani Investments and a number of angel investors from Kenya...

The expected?change regarding?the use of Visa credit?cards?on Amazon?will no longer take place on January 19. Read the full article at:...

Citigroup added 5,500 technology workers and increased its tech spend 10% to about $10 billion in 2021. The $2.9 trillion bank reported $3.3 billion in net income for the fourth quarter of 2021, down from $4.3 billion in Q4 2020. Tech and communications spending reached $2.1 billion in Q4, a 3% year-over-year increase and 4%...

Allfunds Blockchain, the arm of Allfunds specialising in the creation of digital solutions for the funds industry supported by blockchain technology, and Renta 4 Banco (‘Renta 4’), a leading Spanish Bank, have successfully executed the first orders of Renta 4’s new tokenised Spanish fund within the framework of Spain’s Regulatory Sandbox initiative.

Experian sees growing demand for its services in the booming buy-now-pay-later (BNPL) sector as it adds more clients to the unit, the world's largest credit data firm said on Friday after a strong third quarter.

Paysend, the international payments platform, has announced the appointment of Jairo Riveros, as MD of the United States and Latin America.

The Central Bank of Ireland (CBI) has introduced a new crowdfunding regulatory regime, following a years-long campaign for regulatory recognition by Irish peer-to-peer lenders. The new regime requires all crowdfunding service providers to be authorised and subject to operational requirements and investor protection measures. They will also be required to incorporate appropriate warnings in their...