We focus on the law of unintended consequences, and how making rules often creates the opposite outcome from the desired results. The analysis starts with the Cobra effect, and then extends to a discussion of the Wells Fargo account scandal, dYdX trading farming, Divergence Ventures executing Sybil attacks, and Federal Reserve insider trading. We touch on the concepts of credit underwriting and token economies, and leave the reader with a question about rules vs. principles.

In this conversation, we chat with Paul Rowady is the Founder and Director of Research for Alphacution Research Conservatory and a 30-year veteran of proprietary, hedge fund and capital markets research, trading and risk advisory initiatives. Alphacution is a digitally-oriented research and strategic advisory platform focused on modeling and benchmarking the impacts of technology on global financial markets and the businesses of trading, asset management and banking. This data-driven approach allows Alphacution to reverse-engineer the operational dynamics of these market actors to showcase the most vivid and impactful themes among the field of available research providers and platforms.

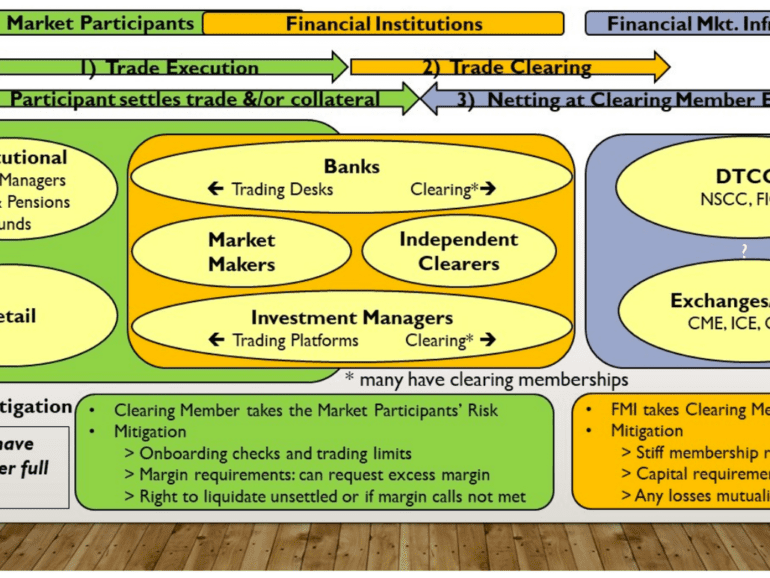

In this conversation, we geek out with Horacio Barakat, who serves as the Head of Digital Innovation for Capital Markets and the Head of DLT for the Repo Platform of Broadridge, about digital transformation, capital markets, and the role of blockchain in the institutional part of the financial industry.

Additionally, we explore the embedded complexities of capital markets and how fundamental they are to the smooth functioning of our economy, determining the growth of companies, and funding expansion. Touching on everything from the engine that powers capital markets, how that engine has evolved to becoming computational, and lastly how companies like Broadridge are leading the deep work going on in making that engine better.

This week, we look at:

Deep Fakes behind South Park creators' new parody, Sassy Justice

The AI-created author of the fake Hunter Biden intelligence report

GPT-3 winning the love and attention of people on Hacker News

How should we react to these robots and their desire to mess with our minds

Unlike equities, the crypto markets were born from machines, and are constructed from code. Hold dear the tokens in which you believe, and stay away from the stories of easy money. Nothing is easy. To win Russian roulette is not good fortune. It is, instead, a grave mistake to play a lethal game. Have you nothing to lose?

And then Brexit. And then Taiwan and China. And then Covid, again. And then, who knows.

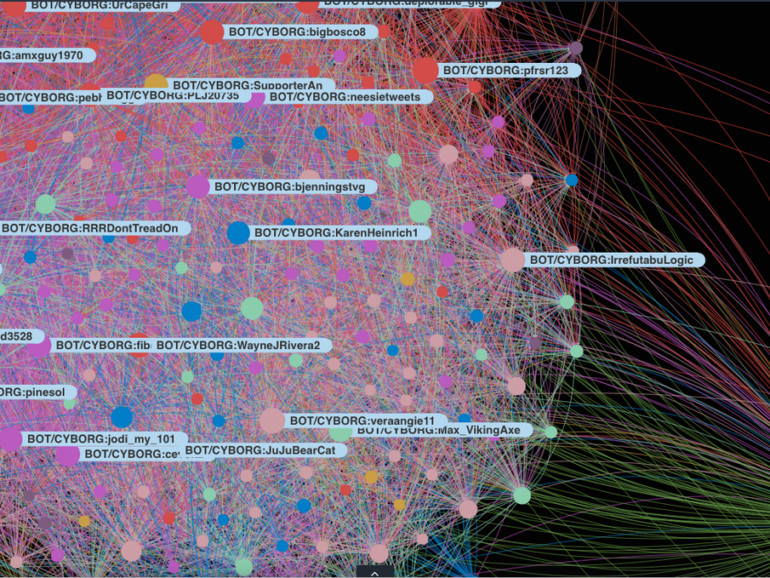

From now on and forever, your counterparty is the data center running an AI cluster on top of the Internet. The data center that has already profiled you and knows everything about you. Bring the tinfoil hat.

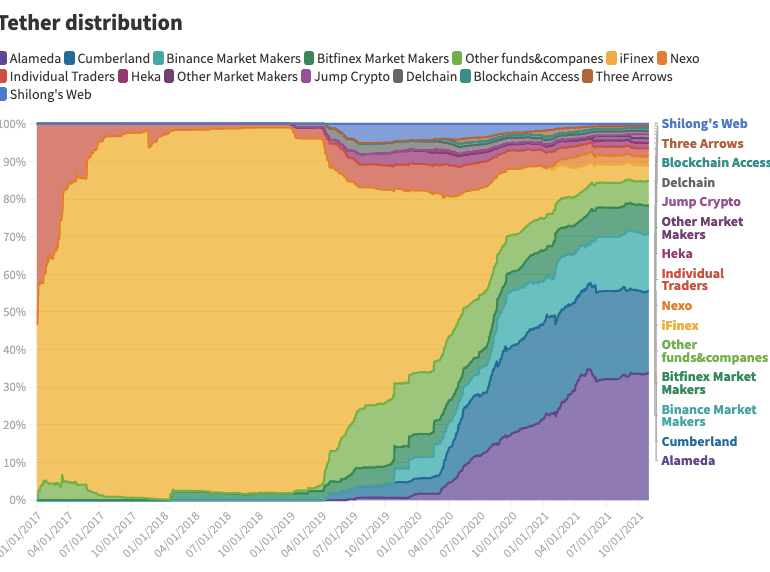

We look at a recent report from Protos that traces the issuance of USDT to the institutional players in the centralized crypto capital markets. The data reveals the market share of players like Alameda, Cumberland, Jump, and others in powering trading in exchanges. We try to contextualize this market structure with what exists both in (1) investment banking and (2) decentralized finance. The analogies are helpful to de-sensationalize the information and calculate some rough economics.

No More Content