Typically, the private commercial debt market has been weighted in the favor of institutional investors, leaving retail investors out.

“Debt investing historically has excluded certain groups, reserving high-quality investment opportunities for the wealthy few,” said Sundip Patel, Co-Founder and CEO of AVANA Companies. He explained that the sector, made up of large investments, had many individual investors unable to participate, unwilling to take on so much risk despite the possibility of large returns.

To this end, today, October 17, 2023, AVANA is launching its EqualSeat platform, aimed at providing individuals access to investment in private commercial loans.

“As the name suggests, EqualSeat was to treat everyone that is coming on to invest on the platform equally,” continued Patel. AVANA, until the launch of EqualSeat, had worked with institutional investors, providing loans and investment into SMBs. “We wanted to open out our platform to other investors that typically don’t have the access, like retail investors, women, underserved communities, enabling them to invest however little they like but still to be able to co-invest with the likes of BlackRock. That’s where they are exposed to better returns than what they’re able to do on their own.”

The platform launch today allows accredited individual investors access to the EqualSeat platform, where they can invest from $5,000 into commercial projects and SMBs.

RELATED: Fintech Nexus Podcast USA 2022: The Shifting State of Fintech Investing

Backed by experience

AVANA’s experience in the lending space has driven much of its approach to the platform. Founded by Patel and his brother, the company was built over 21 years, lending to small businesses with institutional investor involvement.

“First and foremost, we’re a credit shop first,” said Anish Dhanjee, Senior Product Manager of AVANA Companies. “We’re not a technology firm that says, “hey, we’ve got this piece of software. We should learn how to do credit.” We’re a mortgage lender and have been for 21 years, and now we are using technology to try and get this product out to as many people as we can.”

Patel explained that their methodical approach had allowed them to assess the private commercial debt environment and how to adapt it to a wider audience of fractional investing.

“We learned all the mistakes other people make,” he said. “So not only are we good at originating or making loans, but we’re very good at managing other people’s money. We’ve had to. We’ve managed institutional money. Those two skill sets were well ingrained in the development of B2C philosophically and the way the software is designed.”

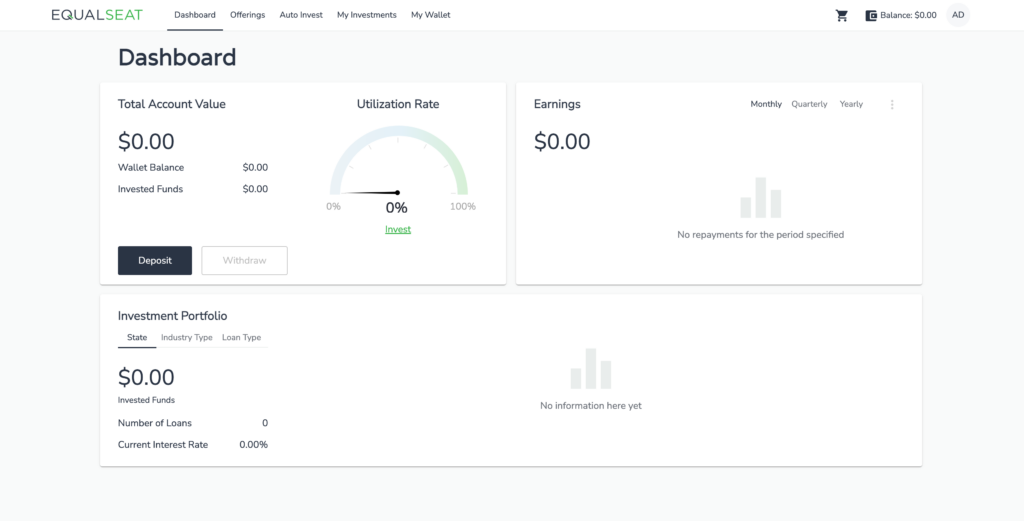

Consisting of a main dashboard, potential investors can look at investment opportunities, assessing each project’s attributes and wider impact. Patel explained that when each investment is introduced, a webinar is set up to present the investment and answer investor questions. Each project then has its own page, including information about the business as well as the investment parameters and a history of loan repayments.

“If you don’t know what these investments are all about, you really should not be selling them to anyone else. And that’s a really simple philosophy, but it’s worked for us for 21 years,” said Patel. “Every time we give any capital to any business, our team will go out and meet with that person and that business. We want to know who we’re giving money to… That was very important to us. It helps us manage risk. Because if you are able to connect with the person that you’re giving money to, if there is a problem, and you’re speaking with them regularly, they’ll call you, they won’t cower, they’ll talk to you because you came up to meet with them.”

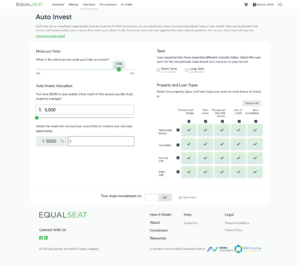

Investors can also diversify investments based on location and sector and view the impact of their investments based on the number of jobs and kilowatts of energy created. The platform also has an auto loan feature that allows investors to set the parameters of their investments and what attributes they are interested in investing in.

An aim to “democratize” private commercial debt investment

Today’s launch focuses on accredited investors, those with a net worth of over $1 million, excluding the value of their primary residence, or who individually earn over $200,000 annually. However, it’s the first step on a long roadmap to democratize the private commercial debt market.

“The first phase is doing accredited, next phase will be a non-accredited, and the third phase will be for anyone with as little as $10, or $100,” said Patel. He explained that the initial idea for the platform had aimed to focus on education in fractional investment.

Patel explained that AVANA’s time managing money for institutional investors had allowed them to identify key conditions for individual investors. Investors are unable to invest all the capital available on their EqualSeat wallet in one project, necessitating portfolio diversity.

“Institutional investors can take large amounts of risks that retail investors cannot,” said Patel. “We were very specific because we knew all the mistakes people could make. You cannot allow retail investors to invest all their wealth into one investment. We want them to diversify.”

“What we want to ultimately encourage is diversification of smaller amounts between different loans because that is a better return than perhaps your money sitting in a bank account in a deposit account.”

In addition, only 30% of each loan is available for individual investment, reducing the amount of risk they are exposed to. This, as well as a restricted time to invest in the loan, allows AVANA to balance the expectations of institutional investors.

The involvement of institutional investors is fundamental to the EqualSeat solution. Patel explained that while risk always exists in investment, individuals’ ability to invest alongside institutional investors could help them manage their risk.

“You’ve got an institutional partner who’s already put out the first dollar of risk. They’ve already funded that loan. You’re simply going in to buy participation in that loan.”