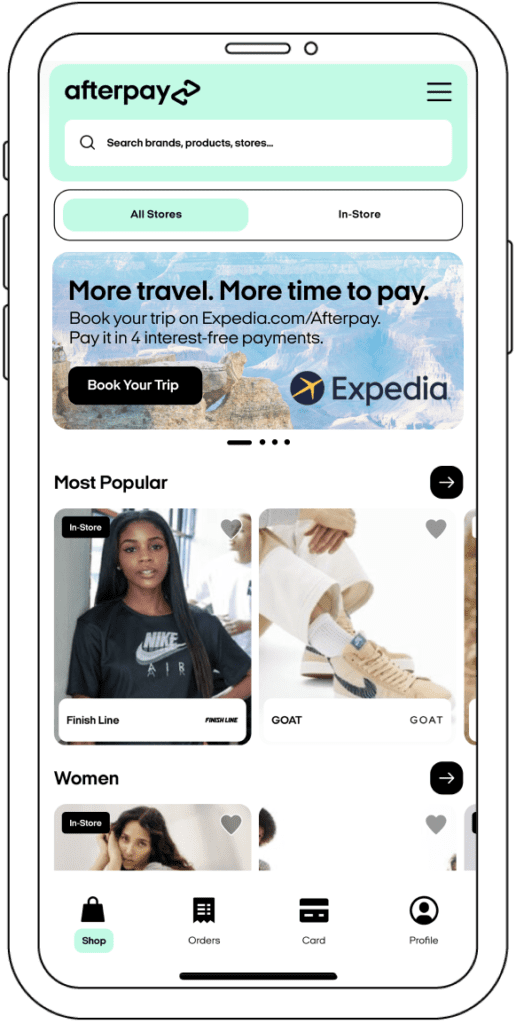

Expedia Group and Afterpay recently launched their partnership on Nov. 21.

For the first time, customers can book travel with Expedia through the Afterpay app. Afterpay is a leader in the Buy Now, Pay Later platform. Now millions of customers based in the U.S. can book flights and hotels with Expedia and have the option to select Pay in 4.

What is the ‘Pay in 4’ option?

More travel with more time to pay. Once travel is booked, you can choose to pay for your trip in four interest-free installments. The payments are spread over six weeks helping consumers manage their finances and budget.

“Our partnership with Expedia Group is a significant step in offering our customers a more responsible payment option for higher-priced items like travel,” said Alex Fisher, Head of Revenue, North America, Afterpay and Cash App.

“As consumers prepare for the peak holiday travel period, we are excited to provide an easy and flexible service that will allow our customers to book and pay in four installments for their preferred flights and accommodations, interest-free and over time.”

Customers can screen-shop and book their trip through Expedia, with a selection of more than three million properties and 500-plus airlines worldwide, exclusively through the Afterpay app.

“Expedia Group is proud to become Afterpay’s first major U.S. travel partner,” said Senior Vice President of Media and Brand Partnerships Christian Gerron, Expedia Group. “This highlights our ongoing growth in developing cutting-edge traveler technologies that provide our partners with new ways to deliver great experiences to their customers, which, in turn, drive customer loyalty.”

What if the customer misses a payment?

Consumer protection is foundational to how their platform works. They cannot fall into revolving debt. Their account is halted from further use, which means they cannot use the BNPL option with any other companies they partner with. If one payment is missed, there is a cap on late fees from $8 or 25% of the total payment, depending on which is less costly to the customer. They do have a hardship strategy with a flexible payment arrangement if needed. One interesting detail is that they never report missed payments to any credit bureaus.

Afterpay could not share the number of customers using the Afterpay app option with Expedia Group. However, they say they are receiving a confident and beneficial response thus far. They also say that Afterpay customers are less likely to be late than credit card users.

Many other large companies have paired up with Afterpay. Rite Aid, PetSmart, Nordstrom, and DICK’s Sporting Goods, just to name.

Expedia Group plans to increase this type of partnership with their additional brands down the road. The Afterpay app has taken off substantially beginning in March of 2022. They have joined with more than 144,000 retailers worldwide, from travel, beauty, home, pets, fashion, and other vendors offering Afterpay.