Last week the Federal Reserve of Cleveland released a report titled Three Myths About Peer-to-Peer Loans that had some pretty damning things to say about the P2P lending industry. They analyzed 90,000 P2P loans issued between 2007 and 2012 and compared these borrowers to similar people who did not take out a P2P loan. The biggest issues I had with the study was that I don’t trust the data set they used and they then made an inflammatory claim that P2P lending has predatory practices without backing up that claim with rigorous analysis.

[Side note: This report seems to be using P2P lending to mean the broader online lending industry beyond just Lending Club and Prosper so keep that in mind when you see me using the P2P lending term in this article].

I was surprised by the outcomes of this report because it contradicted a report from July by researchers at the Philadelphia and Chicago Federal Reserve Banks. That report was based on an analysis of Lending Club data and found that borrowers were getting lower priced credit and that Lending Club was expanding access to credit in underserved areas. The Cleveland Fed report said the opposite.

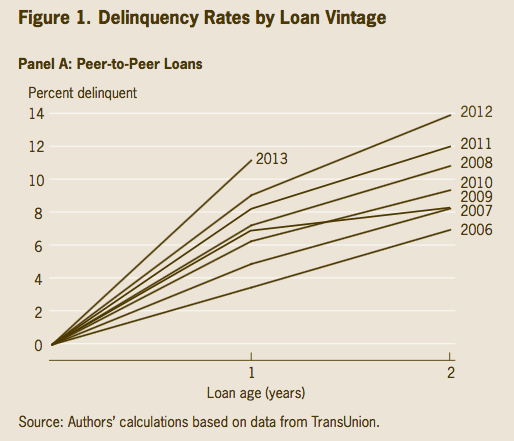

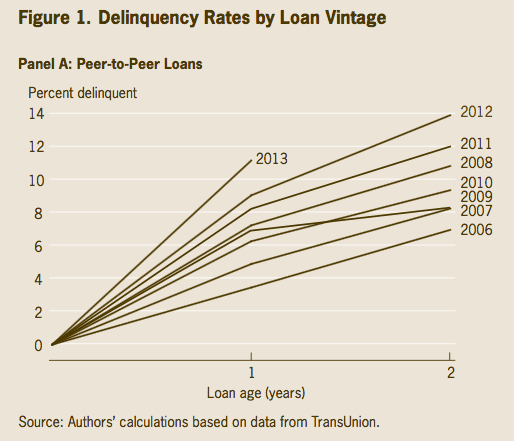

One of the things I disliked most about this new report was the how opaque their analysis was. They just said they used data provided by TransUnion “in which we observe about 90,000 distinct individuals who received their first P2P loan between 2007 and 2012.”. They provide no indication as to which platforms this data is based upon and then we see this very strange chart below showing supposed delinquency rates by year. This is where they lost me.

This chart shows that the lowest delinquencies from P2P loans occurred in 2006. Really? I am sorry but this is just plain wrong and I challenge the authors to show me the actual data this is based upon. In 2006, the only consumer P2P lending (or any significant online lending) platform in existence in this country was Prosper and their 2006 vintage was terrible. Several years ago I wrote about Prosper 1.0 (the period from 2006-2008 where Prosper allowed borrowers with FICO scores down to 520). This data was all publicly available at one point and I reported that of the 28,936 loans issued during those initial two and a half years 10,456 loans defaulted, a 36% default rate. Subsequent vintages at Prosper performed much better. When I see the table above showing those numbers I have to question the entire data set of the report because obviously their 2006 data is wrong.

Another area I was concerned about was their statements on regulation. Here is a paragraph in the report related to regulation of P2P lending:

On the borrower side, there is no specific regulatory body dedicated to overseeing P2P marketplace lending practices. Arguably, many of the major consumer protection laws, such as the Truth-in-Lending Act or the Equal Credit Opportunity Act, still apply to both P2P lenders and investors. Enforcement is delegated to local attorney general offices and is triggered by repeat violations, leaving P2P borrowers potentially vulnerable to predatory lending practices.

Much has been written about the regulation of P2P lending. Law firm Chapman and Cutler have produced a white paper every year for several years providing the state of regulation for P2P (now marketplace) lending. Here they go into detail on the various consumer protection laws that P2P lending platforms must adhere to and they specifically mention the Truth in Lending Act and the Equal Credit Opportunity Act.

The reality is that most P2P lending platforms partner with an issuing bank such as WebBank or Cross River Bank and these banks ensure that platforms are in compliance with all fair lending laws. I have never heard of any platform receiving repeat violations by any state attorney general so I am not sure where the authors of this report make the jump to predatory lending practices.

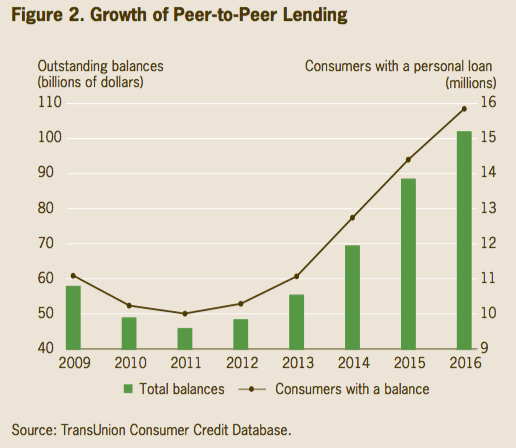

[Update: It was pointed out to me after I published this that there was one other chart that makes it even more clear that this report had nothing directly to do with P2P lending. The chart below shows the supposed growth of P2P lending. In 2009 they are saying the industry had outstanding balances of just under $60 billion. At the end of 2009, Lending Club and Prosper had issued less than $300 million in total loans in their history. Clearly, the Cleveland Fed is talking about something other than P2P lending here.]

To be fair the report does bring up some valid concerns. Here are the three questions the report is referring to that they consider as industry myths.

- Are P2P loans used to refinance previous loans?

They claim that a typical P2P lending borrower does not in reality pay down their credit card balances, but the opposite is actually true – they show an increase of 47% of these balances after taking out a P2P loan. This is something many of us have wondered about and it would be useful for platforms to share these statistics to dispel or confirm this myth.

- Do P2P loans help in building a better credit history?

The industry has often claimed that P2P borrowers typically see a bump in their credit score because they are paying down high interest credit card balances with a lower interest rate thereby freeing up cash flow and leading to better financial health. Again, this may or may not be true but the platforms should all have excellent aggregate data they could share in this area.

- Do P2P lenders serve individuals or markets underserved by the traditional banking system??

I have always felt that this point was not central to the whole online lending revolution. The industry, for the most part, has not focused on the underserved. While access to credit has expanded somewhat due to the easy ability to apply for a loan from any geographic location most borrowers have other options. Of course, in the subprime space this would not be as true but again most online lenders are focused on the prime and near prime space.

In reality I am not necessarily disputing their points on the three myths. I think they are very interesting topics for discussion and I would like to see some more exploration around all three topics. What I am disputing is the entire methodology used to produce this report and the authors’ grasp of their subject matter. It is a shame because a rigorous analysis of this data would have been very useful.