Embedded finance has been caught in the convergence of instant payments and open banking. It could be its time to shine.

Theres no size fits all in scalable innovation for legacy structures but new strategies are being developed to help.

Steps are being made to close the gender divide in fintech, but lack of access to funding can be crippling to female-led firms.

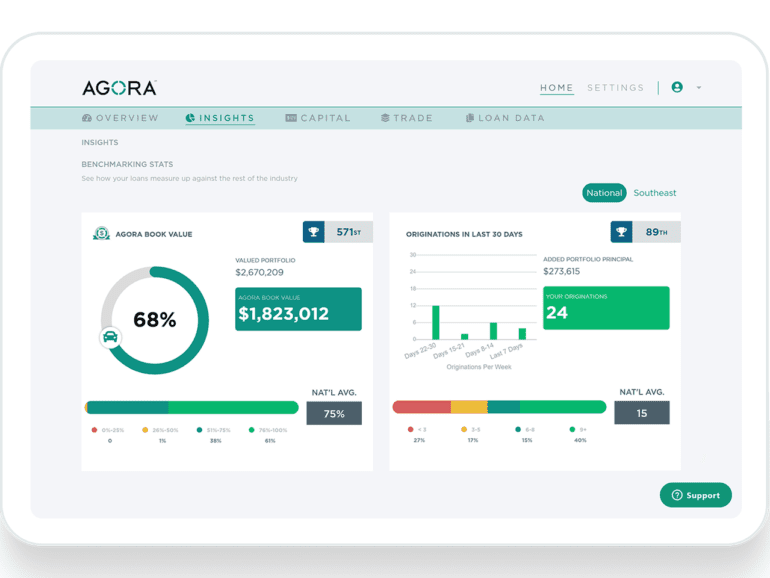

Agora Data helps any size of auto dealer compete with the big corporations by providing affordable financing at more reasonable rates.

A Lendit Fintech and Amount white paper came back with results from 1,000-plus international banks, fintechs, and fin service providers building BNPL.

- OnDeck Adds Former GE Capital and Sun Trust Executives to Finance Team

- Elastic Line of Credit Surpasses $1 Billion in Total Funding

- SenseTime Raises US$410M Series B Financing

- BitGo Raises $42.5M in Series B Funding

- Creditas Raises $50M in Series C Funding

- CAN Capital Makes Three Strategic Hires to Strengthen Sales and Technology Teams

- How asset managers like FinEx Asia are using AI to disrupt traditional bank lending

- Digital challenger Starling to hit profit in 2019 says founder Anne Boden as European expansion takes crucial step

- Compass gets $450M from SoftBank; real estate portal now valued at $2.2B

- Finance teams are ‘bottlenecking’ banks’ digital transformations

- Prosper Appoints Claire Huang to Board of Directors

Alibaba-backed Ant Financial sold $578 million worth of securities backed against small loans granted to consumers on "Double 11" day, the festival to celebrate singlehood and the world's largest online shopping day; Chongqing Alibaba Small Loan provided the underlying loans for the asset-backed security through an online consumer credit portal, Ant Check Later ("Huabei" in Chinese); the Shanghai Stock Exchange approved the offering and allowed it to be privately placed last Monday to qualified institutional investors. Source

The Bank of England kept its central bank borrowing rate at 0.25% and decided to continue with its $86 billion asset purchase program; while no changes were made to monetary policy, the BOE changed its guidance; with an increased focus on inflation in the region, the BOE said it would be prepared to raise rates in order to keep inflation at its 2% target rate. Source

Payday lender, Advance America, and its representative association, the Community Financial Services Association of America (CFSA), have filed a motion with the court to halt regulatory pressure on banks to end relationships with payday lenders; the motion follows the decision by U.S. Bancorp and four other banks to end their relationship with Advance America citing regulatory pressure as a factor; regulators say they have done nothing to pressure banks to end relationships with payday lenders; the court motion is part of an ongoing litigation process involved with a court case filed by Advance America and the CFSA in 2014. Source

BBVA Compass and the Opportunity Finance Network are teaming up to identify and increase training for 25 leaders in community lending through an Opportunity Fellows Program; BBVA Compass is a leading banking franchise with 668 branches mainly in the US sunbelt; Opportunity Finance Network is an association of community development financial institutions (CDFIs); the chosen Fellows will receive six days of training through early 2017 on themes including financial innovation and financial inclusion; applications open mid-November 2016; cost is not specified but appears to be complimentary or highly-subsidized for the leaders given the opportunity to participate. Source