Moody's has released a report commenting on the new FDIC guidelines for bank lending through third-party lenders; guidance from the FDIC is proposed and seeks to potentially improve controls on bank lending through marketplace loans; the new FDIC guidance will help to improve the overall quality of loans on marketplace lending platforms, according to Moody's; the new controls focus on greater analysis and oversight by banks of marketplace lenders' credit underwriting models to ensure that they align with the bank's lending terms. Source

Challenging conditions have companies cutting funding from product development and workforces - some believe innovation is a better answer.

How is Generative AI being used in financial services? Spoiler: it's not. But, once perfect, it could have significant impact.

The partnership with Sino Guarantee will provide lending capital of RMB 500 million to China Rapid Finance also helping the marketplace lender to develop and offer lending products on wealth management platforms; Bank of Shanghai will also provide capital support as well as payment channels and fund custody services. Source

The Economist magazine's intelligence unit (EIU) has published a report on regulatory support for financial inclusion in developing countries and it is now gaining traction with press and analysts; the report scores countries on having an inclusiveness strategy and building governmental and private sector expertise, then provides in-depth details in areas including credit markets, non-regulated lenders, payments and insurance; Colombia ties Peru this year for the most progressive country; India has shown the most improvement; Latin America and East/South Asia are leaders regionally while Africa and the Middle East remain behind; the EIU performed the research in conjunction with the Center for Financial Inclusion at Accion and the Multilateral Investment Fund at the Inter-American Development Bank. Source

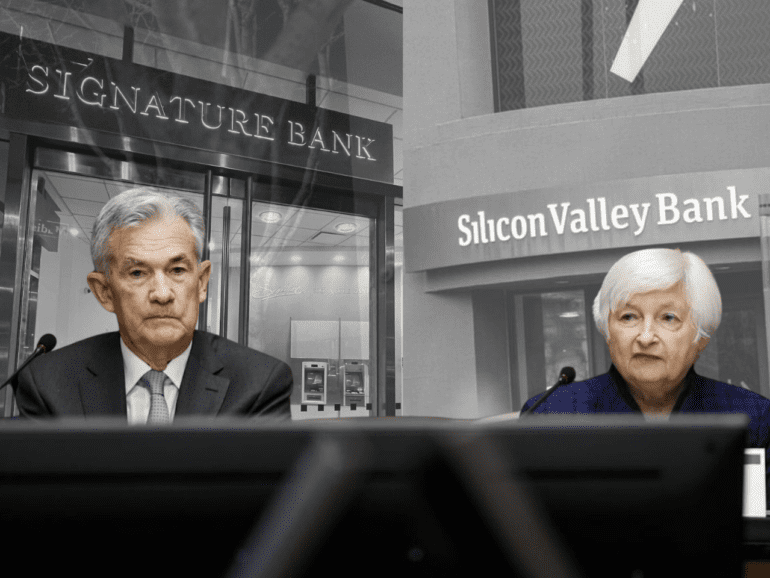

Over the weekend regulators raced to find a resolution for the waves made by SVB's demise. Failure of the financial system may be adverted.

As more and more fintechs disrupt the traditional banking sector, Citi is looking to embrace the new technological advances to ensure they stay relevant; the bank formed a Citi fintech division in November 2015 and stocked it with former employees of Amazon and PayPal; Citi is looking to launch a new version of their mobile app that will include voice and facial recognition to eliminate password entry; Stephen Bird, Citigroup's CEO of global consumer banking, recently told Fortune magazine, "what happens in an extinction phase is that you either rapidly adapt and new means of competition are created, or you go extinct."; the bank is looking to continue making advancements to keep up with industry tech trends. Source

Days after the chaos, newly appointed CEO of the SVB bridge bank urges customers to hold deposits. Meanwhile regulators investigate the fall.

Earlier this week, the UK launched its bank referral scheme to help extend credit to small businesses not funded by nine of the UK's largest banks; it seems that UK banks outside of the UK consortium are also increasing their efforts to provide alternative options for business borrowers; this week NatWest announced it has added iwoca to its alternative lending panel, Capital Connections. Source

State Street and the Alternative Investment Management Association have released a report on decreased liquidity in the investment market; approximately half of respondents see less market liquidity as a long-term factor and three-fifths of respondents are considering less trading liquidity in their investment strategies; report cites new market entrants, electronic platforms and peer-to-peer lending as reasons for increased illiquidity in the market overall; report says investors are focusing on three areas to adapt to the shift in market liquidity including rationalizing risk, optimizing for liquidity, and implementing new rules and tools. Source