According to a report by Bloomberg, four bonds comprised of online consumer lending loans have reached or are approaching trigger levels; the four bonds include three securitizations by Avant and one by CircleBack Lending; according to one source, two of Avant's securities breached triggers this month for the first time; the four offerings total over $500 million in size. Source

Sharestates is raising capital for a Series A funding round on SeedInvest; planning for potential investment of $3 million in preferred equity; Sharestates provides real estate investment opportunities and access to capital on its platform; has total loan originations of $178 million. Source

While fintech companies have focused on speeding up the lending process to small businesses, the IRS's continued use of fax machines continues to slow down the lending process when borrowing from traditional institutions; in an article from American Banker, the cumbersome process of getting a tax transcript from the IRS is outlined; when customers need capital on short notice they are often left with higher financing costs; Representative Patrick McHenry recently introduced the IRS Data Verification Modernization Act that aims to provide near-real-time communication of information which may level the playing field across lenders. Source

SmartBiz has been ranked the number one provider for non-Express, SBA 7(a) loans under $350,000 and fifth among providers for traditional SBA 7(a) and Express 7(a) loans under $350,000; SmartBiz is the first SBA marketplace and bank-enabling technology platform; it facilitates small business lending from banks; in the government's 2016 fiscal year, SmartBiz generated $200 million in funded SBA 7(a) loans. Source

Increased challenges have buffeted an already unstable SME lanscape - Is B2B BNPL a saving grace or could it ultimately worsen conditions?

SoFi has received preliminary ratings from Kroll Bond Rating Agency for a securitization portfolio including prime jumbo residential mortgage loans; the securitization includes 36 classes with 270 mortgage loans; 31 classes are rated AAA; the remaining classes are rated AA to B with one unrated class accounting for $1 million of the portfolio; the portfolio includes high quality mortgage loans with a comprehensive weighted average credit score of 777; the total principal balance of the portfolio is $168,790,946. Source

As part of their SoFi ReFi program, SoFi will now offer a six-month grace period for new graduates; typically refinancing student debt has meant that graduates must give up their grace period on loans. Source

With controversy around ESG investing coming to a head, solar loans could offer respite, doing good and doing well as an asset class.

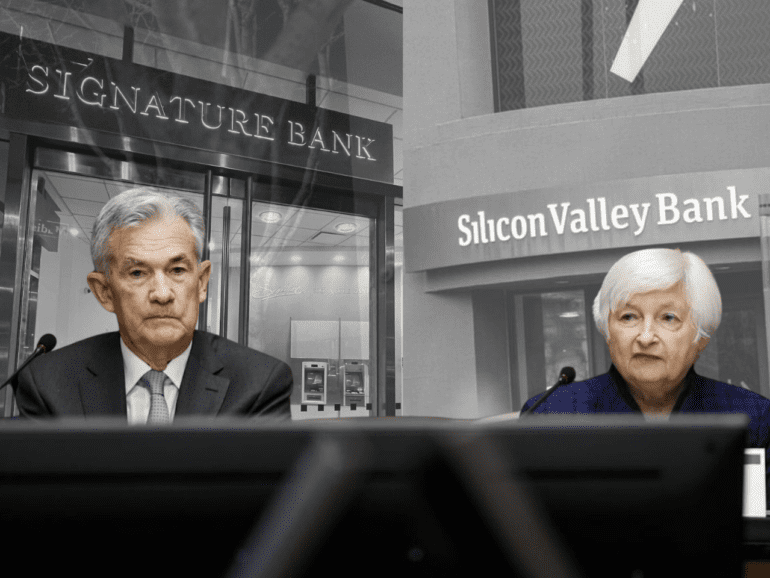

Over the weekend regulators raced to find a resolution for the waves made by SVB's demise. Failure of the financial system may be adverted.

Days after the chaos, newly appointed CEO of the SVB bridge bank urges customers to hold deposits. Meanwhile regulators investigate the fall.