Lenders’ delinquency strategy must be rooted in an “empathy-first” model to support customers in experiencing hardship. Customers in distress need support and resources, not shame.

A new Financial Health Network study shows a circular relationship between financial health and mental health.

There are new ways for Americans to build their emergency savings today from a new government program offered through retirement plans to new fintech offerings.

Fintechs are learning that college campuses are valuable markets for their unique ecosystems and the students they serve.

Digital bank G10 is the first of its kind in a Brazilian favela, low-income areas which together account for roughly 17 million citizens.

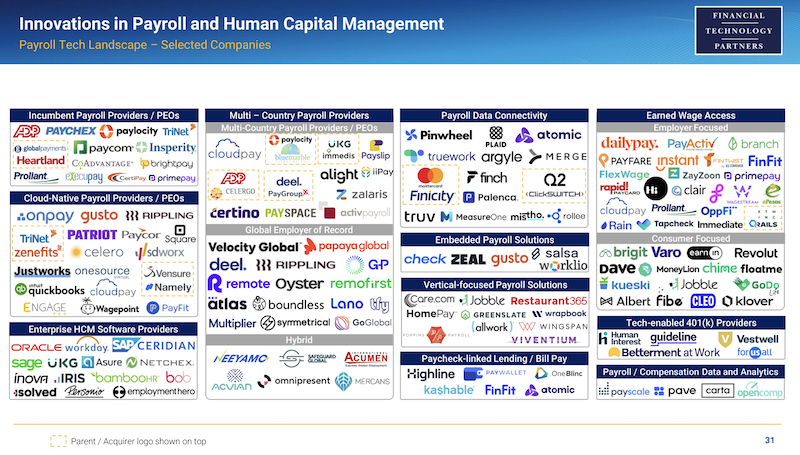

The co-founder of DailyPay shares his views on earned wage access, why it is so important, why it is obviously not a loan, and what is next.

In the west we take it for granted that the vast majority of people have internet access. But that is not true in the developing world. For digital payments to take off there we need to develop robust offline payments infrastructure.

StashWorks is the new B2B offering from Stash, allowing any employer to add savings and investing as a benefit to employees.

Advances in embedded lending provide better options for consumers and higher sales with more certainty for merchants. It's a win-win.

Beem is partnering with U.S. insurance, investment and technology provider TruStage to offer the latter’s Payment Guard Insurance as an additional layer of financial security for its members.