Twitter/X has been going state-by-state obtaining money transmitter licenses. The social media platform is now approved in 12 states.

For the last year or so Elon Musk has made clear his intention to build a financial super app to augment the platform’s ad-based revenues. But this move is not going to be easy.

While many major tech companies have been expanding into financial services in recent years, regulators are looking more closely today than ever before at these arrangements.

We have already seen the Financial Stability Oversight Council (part of the Treasury Department) approve a new framework for regulating non-bank financial companies and the CFPB is also looking to expand its oversight powers here.

Given what a lightning rod Elon Musk is, it will be a harder road for X than it could have been. Finance is built on stability and trust and few people would associate those two words with X right now.

Featured

X’s Money Movement Push Comes as Regulators Warn of Risks

X/Twitter now has money transmitter licenses in a dozen states as it gears up for super app status, but can it build enough trust to gain users?

From Fintech Nexus

> Brazil’s QI Tech raises $200M in one of Latam’s largest fintech rounds in 2023

By David Feliba

Brazilian QI tech tapped $200 million in a landmark Series-B investment deal, one of the largest rounds in Latin America this year.

> Artificial Intelligence: Mistral $2B valuation and Open Source strategy

By Laurence Smith

Founded by former DeepMind and Meta employees, Mistral AI secured $487M from Andreessen Horowitz, Nvidia, and Salesforce…

Podcast

Jason Bates has co-founded two of the most successful digital banks in the UK. And his deep experience in financial innovation…

> Listen Now

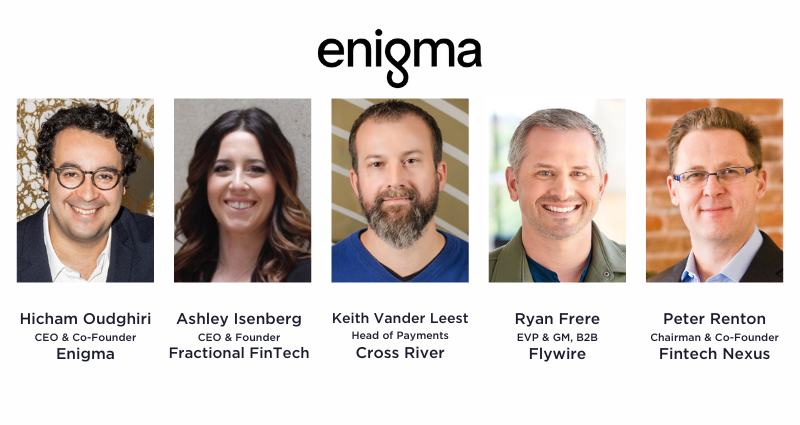

Webinar

Payments Innovation is Hot: What to Expect in 2024

Dec 14, 12pm EST

Global payments revenue grew double digits in 2023 – wondering what the near future of the burgeoning payments space might… Learn More

Also Making News

- USA: Apex Fintech Solutions will try to go public again

The custody and clearing firm has confidentially filed its draft registration statement with the SEC. - USA: How banks can boost customer savings

Mobile banking features that encourage customers to set savings goals can supercharge customer loyalty and attract new primary banking customers. A renewed focus on consumer savings may also help banks offset the decline in deposits reported at many banks in 2023. - USA: Signature bid results add fuel, ‘B’ plot in FDIC’s woes

Real estate investor Brookfield accused the agency of cherry-picking a winning bid that was not the highest price for a portfolio of loans from the failed Signature Bank. - LatAm: Citi leads investment round in Colombian B2B fintech Supra

Citi has led an investment round in Colombian B2B payments startup Supra. - USA: BlackRock’s Bitcoin ETF Now Invites Participation From Wall Street Banks

A change to the structure of proposed spot bitcoin ETFs would enable authorized participants (APs) to create new shares in the fund with cash, rather than only with cryptocurrency, essentially opening the door to banks who cannot hold crypto directly. - India: Omidyar Network pulls out of India

Omidyar Network, backed by eBay founder Pierre Omidyar, is shutting down its India operations, two sources familiar with the matter told TechCrunch, in a stunning development for the impact venture firm that has backed over 120 startups in the South Asian market over the last 13 years.

To sponsor our newsletters and reach 220,000 fintech enthusiasts with your message, contact us here.